Whole Life Insurance The Purpose Of Whole Life Insurance Is To Provide Coverage For The Insured, For Their Entire Lifetime.

Whole Life Insurance. The Average Life Insurance Rates Are Greater On Whole Life Insurance Policies Because They Have Some Type Of Cash Value Buildup, And Traditional Term Life Insurance Policies Do Not.

SELAMAT MEMBACA!

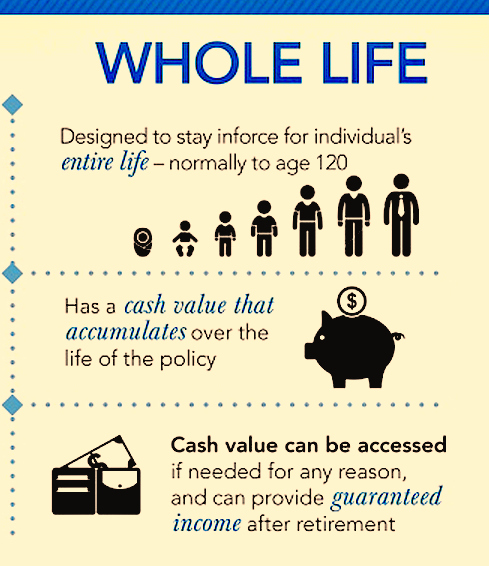

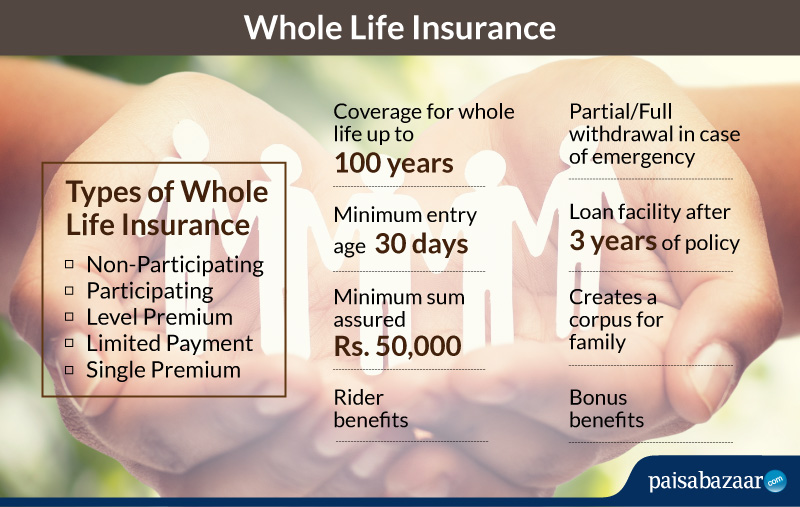

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance is paid out to a beneficiary or beneficiaries upon the policyholder's death, provided that the premium payments were maintained.

Whole life insurance pays a death benefit.

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and consistent premiums these policies include a cash value account, which is the investment component in.

The policy's face value is what your beneficiaries receive when you die.

So if you have a $500,000 policy, they'll receive $500,000 at your.

Whole life insurance is a type of permanent life insurance that helps protect your loved ones in the future and your finances now.

Whole life insurance is a type of insurance designed to provide coverage throughout your life, with a benefit paid at your death to your family (or the beneficiary of your choosing), as long as you maintain.

The policy builds cash value over time and once locked in your.

Whole life insurance is a subtype of permanent life insurance that provides lifelong coverage to the insurer.

Unlike term insurance, whole life does not have a set term;

The insured can keep the insurance whole life insurance differs from term life insurance in its provision of both a death benefit and a.

The purpose of whole life insurance is to provide coverage for your entire lifetime.

Whole life insurance is a permanent life policy designed to last for the insured's lifetime.

Features include level premiums and guaranteed death benefits.

Whole life insurance is the original insurance.

This policy also has an investment.

The purpose of whole life insurance is to provide coverage for the insured, for their entire lifetime.

Traditionally, whole life insurance is a consumer demanded product that offers more than just a.

Whole life policies generally offer fixed premiums, guaranteed death benefits and are designed to build tax deferred cash.

Whole life insurance probably should not be the centerpiece of any financial investment plan.

How much life insurance do i need?

A whole life insurance plan offers the advantage of providing permanent coverage, but it is a much more expensive type of policy than a term life one.

Premiums remain at a stable level as long as the.

Whole life insurance, sometimes called permanent life insurance, provides coverage for your entire lifetime.

Whole life insurance is a term insurance policy that covers you for 99 years.

They are different from ordinary insurance policies which have a defined term of say 10, 20 or 30 years.

Whole life insurance is a type of permanent life insurance that is valid throughout the lifetime of the insured.

Apart from providing a death benefit, it also contains a savings.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

Whole life insurance provides unwavering, permanent coverage that grows in value over time, providing added financial security for you and those you care about.

Whole life insurance is permanent protection that lasts your entire life, at a guaranteed premium rate that will never increase, regardless of your age or health status.

With whole life insurance from new york life, you're guaranteed lifetime protection with savings.

Discover how much it has to offer you and your family today!

Finding the right life insurance plan can feel like an overwhelming process.

The terminology and amount of plan choices can make it difficult to really narrow down what type of.

Resep Alami Lawan Demam AnakTernyata Inilah Buah Yang Bagus Untuk Menahan LaparSegala Penyakit, Rebusan Ciplukan ObatnyaWajah Mulus Dengan Belimbing WuluhTernyata Tahan Kentut Bikin KeracunanTernyata Kalau Mau Hamil Bayi Kembar Wajib Makan Gorengan IniJam Piket Organ Tubuh (Lambung) Bagian 2Ternyata Merokok + Kopi Menyebabkan KematianMengusir Komedo Membandel - Bagian 2Manfaat Kunyah Makanan 33 KaliWhole life insurance is typically more expensive than term life policies, but the premium amount typically doesn't change throughout the life of the policy. Whole Life Insurance. Over time, this helps make whole life.

Whole life insurance is one type of permanent life insurance that can last for a lifetime.

Whole life is much more expensive than term life insurance, which expires after a certain number of years.

A whole life policy also has a savings.

» is whole life insurance a good investment?

When you start shopping for life insurance, you will come across two different types:

Here is an objective review of whole life insurance as an investment option.

Whole life insurance offers coverage for your entire lifetime, tax benefits and a cash value component which grows over time.

By maxime croll updated april 5, 2021.

Find cheap life insurance quotes in your area.

Whole life insurance is the original permanent life insurance contract.

That's what we intend to discuss today.

Yes, sure life insurance have pros and cons.

It will provide benefits, predictable premiums/returns,various tax advantages.

Spend five minutes researching term life vs.

Whole life and so rather than just accept a blanket pronouncement that whole life insurance is always the bad choice, let's look at the pros and cons so you can.

Here are the pros and cons of whole life insurance.

Depending on your policy, that cash value could grow to a substantial amount in the future.

See our list of pros and cons of whole life insurance along with information about whole life insurance has living benefits, such as the accumulation of cash value which you can access when and how you wish, while term insurance only pays out if the insured dies during the term of the policy.

Here are the whole life insurance pros and cons that you wanted to know.

This flexibility makes it extremely important to make some knowledgeable move with well known consequences.

Whole life insurance, specifically dividend paying whole life insurance, offered through a mutual insurance company, is a great tool for building a solid financial foundation.

You see, whole life insurance has very unique qualities that set it apart as a excellent vehicle for escaping the rat race.

Beyond a need for a death benefit, permanent life insurance can provide many living benefits as well, says stephen stricklin.

The pros and cons of whole life insurance depend on what your financial objectives happen to be at this time.

If the primary purpose for considering this product is to offer a death benefit to your loved ones, then there are cheaper products out there which can serve this need when compared to a.

Navigating the pros and cons.

Now that a baseline has been established, let's look closely at what makes whole life insurance stand out.

Whole life insurance has several pros and cons that make it the right choice for some, and the wrong choice for others.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Life insurance that pays a death benefit to your beneficiaries whenever you die.

There is no term limit.

The cons are that mist term policies never pay out, and must be renewed at new higher.

Instant whole life quotes, who whole life is best suited for, pros and cons, and how whole life insurance works.

To keep costs down, many insurance advisors recommend blending term and whole life insurance for ample coverage in your earlier years, with some additional coverage.

Fixed premiums for life even as you age and your health status changes, you will not pay more for your policy.

Cons of whole life insurance.

High monthly premiums you'll pay.

Whole life insurance, also known as traditional permanent life insurance, is one of the most common and oldest forms of life insurance.

That is being said there are pros and cons of whole life insurance.

Not only does whole life insurance provide for your loved ones when you die, but it also becomes a cash asset over time.

The whole life insurance consists of the death benefit, accelerated rider, and the investments.

This policy has a savings or investment component and is considered as the most popular and whole life insurance advantages.

You can borrow against your policy while still living, living benefits.

With so many life insurance options out there, deciding on a policy can be difficult.

Whole life insurance policies pros and cons [2021 guide].

In truth, there are both pros and cons when it comes to whole life insurance.

That said, whole life insurance can be a huge commitment, so let's go through its pros and cons below.

In summary, they are the most obvious pro of whole life insurance is that it offers practically lifelong coverage.

Most whole life insurance policies will either cover you for the rest of.

Let's take a look at both of these.

The knowledge could help you save lots on money.

Whole life insurance, simply put, is a permanent life insurance policy.

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

Pros and cons of whole life insurance.

Predictable, in most cases premiums are fixed for the life of the insured.

A more complex product than term life insurance.

The beneficiaries receive the death benefit no matter when the insured dies, as long as premiums were paid. Whole Life Insurance. A more complex product than term life insurance.Stop Merendam Teh Celup Terlalu Lama!Ternyata Makanan Ini Hasil NaturalisasiTernyata Bayam Adalah Sahabat WanitaTernyata Fakta Membuktikan Kopi Indonesia Terbaik Di DuniaIni Beda Asinan Betawi & Asinan BogorTernyata Jajanan Pasar Ini Punya Arti RomantisResep Stawberry Cheese Thumbprint CookiesTernyata Kue Apem Bukan Kue Asli IndonesiaBuat Sendiri Minuman Detoxmu!!Amit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!

Komentar

Posting Komentar