Whole Life Insurance Cash Value Farmers Essentiallife® Simple Whole Life3 May Appeal To Those Seeking More Certainty Than Other Types Of Life Insurance €� Its Cash Value.

Whole Life Insurance Cash Value. Whole Life Insurance Is Generally Used When The Need For Life Insurance Is Lifelong, Or Permanent.

SELAMAT MEMBACA!

Whole life insurance provides a death benefit that is paid to your beneficiaries when you die.

A whole life's cash value differs from a universal life policy in terms of how the interest is credited to the policy.

Most cash value life insurance arrangements allow for loans from the cash value.

Much as with any other loan, the issuer will charge interest on the outstanding principal.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance is permanent insurance with strong guarantees.

It has a guaranteed death benefit, guaranteed premiums, and we want to help you pick the best whole life insurance for cash value growth and accumulation.

Cash value life insurance is a type of permanent life insurance that includes an investment feature.

This is often referred to as the face value of your policy, or the amount of life insurance coverage you purchased (for example, a $500,000 whole life insurance policy).

The top 10 cash value whole life insurance companies.

Their custom whole life insurance is a policy created for maximum cash value accrual and also pays dividends.

The policy is designed to pay up in a given number of years depending on.

With whole life insurance you are guaranteed coverage from the day you buy the policy through the rest of your life, as long as the premiums are paid what is cash value?

Having cash value in a life insurance policy may sound like a good thing.

Best life insurance best term life insurance companies best senior life insurance companies compare life insurance quotes cheap life insurance guide to whole life insurance.

What does cash value mean in a whole life insurance policy?

Whole life insurance policies increase in value.

Part of whole life premiums goes toward building cash value.

You can tap into the value by making withdrawals, borrowing against the value or even asking your insurer to.

However, unlike term, whole life offers cash value growth which is a huge benefit to anyone who is looking for a tax favored savings vehicle.

Both are permanent life insurance and both have the ability to be structured to provide either maximum death benefit protection or cash value accumulation.

Cash value life insurance provides both lifelong coverage and an investment account.

Whether to cash in a life insurance policy is an important decision.

The choice can have a number of financial implications, including tax liability.

You've got three available options for cashing in on most whole life insurance policies:

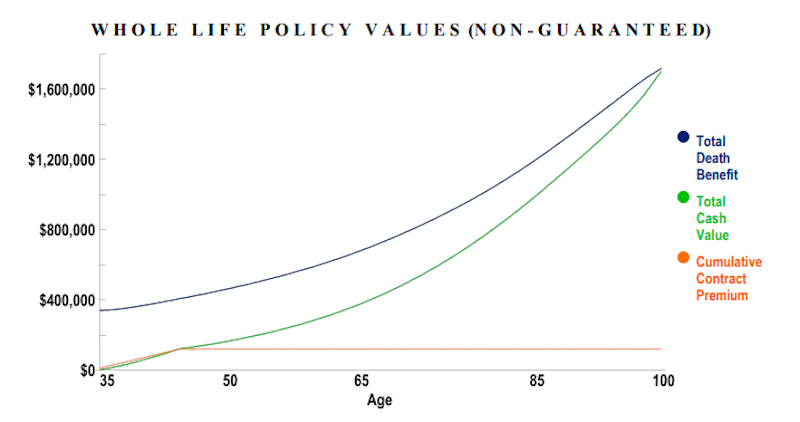

Whole life insurance policies have a unique feature that make them ideal vehicles for growing and protecting wealth—cash value.

What makes the cash value of your whole life policy so beneficial?

€� it can function as your emergency savings.

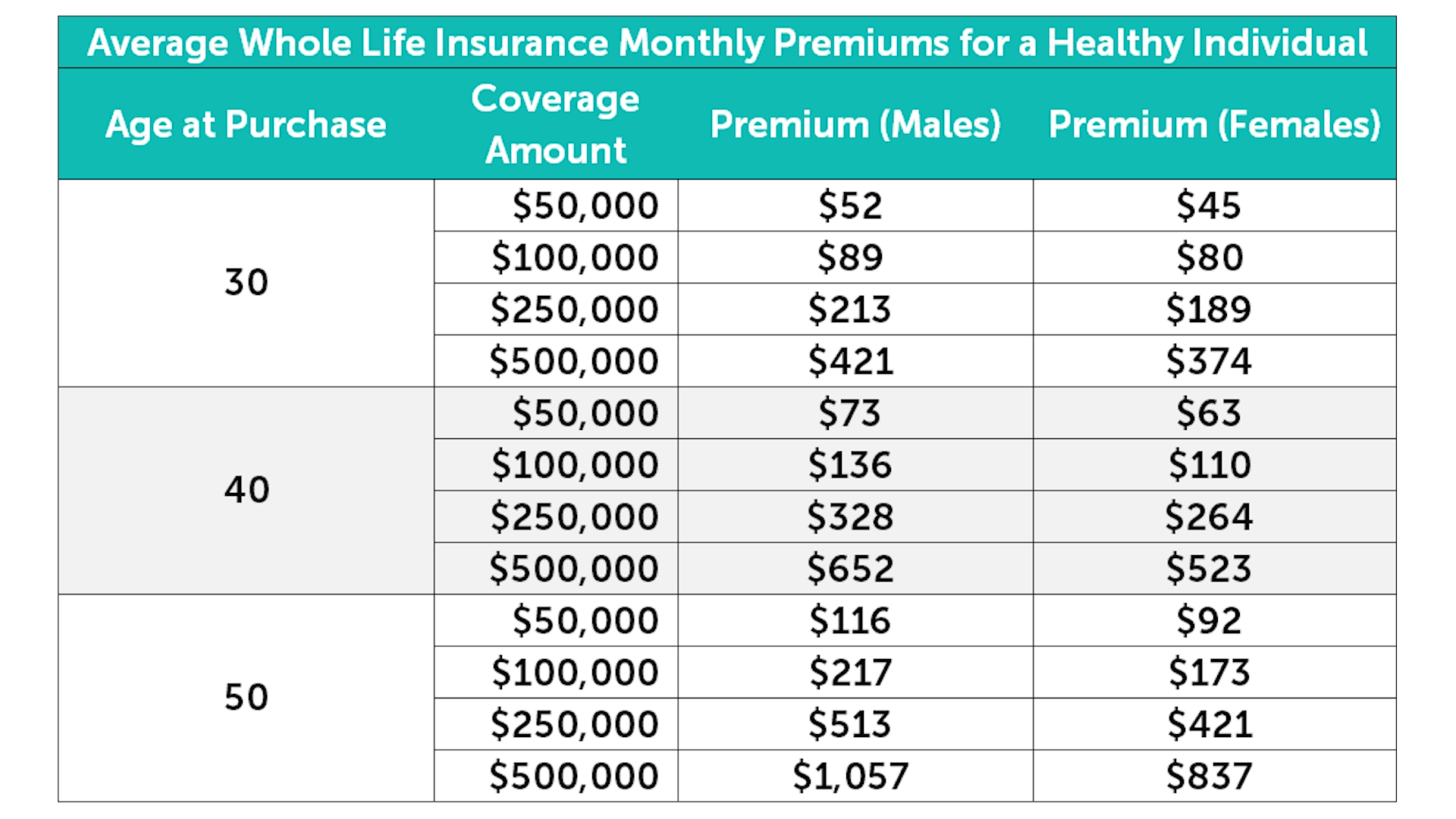

In the past, life insurance companies have made it difficult to find quotes for whole life insurance without first talking to an agent.

However, a lot of people just want an idea as to how much it costs, what sort of cash value will it build, and how much retirement income could it potentially provide.

Cash value life insurance is permanent life insurance coverage that includes a savings like component called cash value.

Whole life insurance is the gold standard of life insurance policies.

This type of permanent life insurance is one of the most misunderstood financial a whole life policy accumulates cash value throughout the life of the policy, which can be borrowed against.

By contrast, a term life policy.

In whole life insurance, the the rider allows the insured to have all premiums returned if they outlive the policy term.

Cash value life insurance can be difficult to understand and even harder to choose.

When calculating the cash value of a life insurance policy, you may find it helpful to review the policy's cash value chart.

Whole life insurance is for those looking for lifetime protection with added benefits.

In addition to providing a guaranteed life insurance benefit, it also offers an important way to save for the future, helping you to be prepared for whatever lies ahead.

With whole life, the cash value of your policy.

Whole life insurance offers lifetime guaranteed coverage with the additional benefit of accumulating cash values.

Cash value life insurance is a type of life insurance policy that's in place for your whole life and comes with a sort of savings account built into it.

A portion of that $100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company.

Features include level premiums and guaranteed death benefits.

Farmers essentiallife® simple whole life3 may appeal to those seeking more certainty than other types of life insurance — its cash value.

As a type of permanent life insurance, whole life insurance lasts for life, as long as the premiums are paid, and beneficiaries are paid out upon the insured's death.

Whole life policies also include a savings component, called cash value, and you can choose to borrow.

Universal life insurance, another popular form of a cash value life insurance policy, separates the investment portion from the life insurance portion, and some policies literally offer dozens of investment options.

The main difference from whole life insurance is that universal life insurance.

Permanent life insurance is synonymous with whole life insurance.

Cash value in a whole life insurance policy.

Ternyata Jangan Sering Mandikan BayiTernyata Ini Beda Basil Dan Kemangi!!Sehat Sekejap Dengan Es BatuUban, Lawan Dengan Kulit KentangJangan Buang Silica Gel!Efek Samping Mengkonsumsi Bawang Merah Yang Sangat Berbahaya Bagi TubuhMulai Sekarang, Minum Kopi Tanpa Gula!!5 Manfaat Habbatussauda Untuk Pria Dan Wanita, Yang Terakhir Wajib Dibaca5 Manfaat Meredam Kaki Di Air Es6 Khasiat Cengkih, Yang Terakhir Bikin HebohWhole life insurance is generally used when the need for life insurance is lifelong, or permanent. Whole Life Insurance Cash Value. Additionally, whole life insurance may be used as a part of your estate planning.

Another feature of whole life insurance is that, in many cases, the policyholder is allowed to take out a loan against the cash value of the policy.

That is not the case, even when the loan amount exceeds the total premiums paid.

One of the reasons to buy cash value life insurance is to have access to the money that builds up within the policy.

When you pay premiums, the payments generally go to three places:

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

The taxability of life insurance cash surrender value causes much confusion.

As a general rule of thumb, when cash value remains inside a life insurance contract, it is not taxable.

Cash value life insurance is a type of permanent life insurance that includes an investment feature.

In some situations, partial withdrawals during the first 15 policy years may result in taxable income prior to recovery of the investment in the contract.

Whole life insurance and most other permanent life insurance policies accumulate cash value, which you can withdraw or borrow against as long as the policy is are life insurance dividends taxable?

Life insurance proceeds are typically not taxable as income, but there are several cases in which a life insurance taxes on life insurance dividend payments & cash value.

If you have permanent life insurance from a mutual insurance company, you may receive periodic dividends from the company.

Whole life insurance is a type of permanent life insurance that offers cash value.

The funds you receive from the cash surrender value are taxable as ordinary income rather than capital gains.

The cash value of your whole life insurance policy will not be taxed while it's growing.

Another life insurance tax benefit kicks in if you decide to borrow against your cash value.

Is life insurance deductible for all life insurance policies meeting the definition of life insurance, any cash surrender value in the event the insured carries a life insurance policy which pays cash dividends (e.g., whole life.

Provided the cash value is less than what you have paid into your life insurance policy overall, the cash value is not taxable.

Read on to learn about the taxability of variable whole life insurance policies also earn cash value, but instead of using the credit to apply toward premiums, you can.

With whole life, for instance are life insurance proceeds taxable?

Death benefits are the amounts paid out by the insurance company to the policy's designated beneficiary.

If you have cash value life insurance (as opposed to term life insurance, which is the type we when is life insurance taxable?

Life insurance proceeds aren't taxable.

It's best to check with your.

One of the advantages of cash value life insurance is that any earnings in the cash value do not incur a current tax liability.

Policy loans and/or withdrawals will be taxable to the extent of gain if the policy is a modified.

Whole life insurance is designed to provide coverage for the life of the insured.

Whole life policies generally offer fixed premiums, guaranteed death benefits and are designed to build tax deferred cash value.

The top 10 cash value whole life insurance companies.

Their custom whole life insurance is a policy created for maximum cash value accrual and also pays dividends.

Keep in mind, dividends are not taxable as long as the dividends do not go beyond the policy premiums you paid.

This policy also has an investment component letting you allocate up to 100% of your cash value to a stock market index, such as the s previous postwhole life insurance dividend rate history.

Next postis life insurance taxable?

Are life insurance premiums taxable?

When are life insurance payouts taxable with term life insurance?

Generally, life insurance proceeds come as a lump sum.

Permanent life insurance policies, such as whole life insurance, have a cash value component that grows alongside your premium payments.

Features include level premiums and guaranteed death benefits.

You want an opportunity to build cash value that may help you with things such as making a down payment on a house, paying for a wedding or.

The cash value in whole life policies is an attractive advantage for insurance consumers.

What happens to life insurance cash value?

Whole life insurance policies increase in value.

Part of whole life premiums goes toward building cash value.

When is life insurance taxable?

Compare highly rated life insurance companies.

If you choose a whole or universal life insurance policy, it builds cash value over time.

Visit hinerman group to learn more about whole life insurance cash value and whether or not it's protected as an asset from the judgment of lawsuits.

A client of mine asked me an interesting question over the weekend about the status of whole life insurance cash value as an asset.

Whole life, universal life, and variable life insurance are the three primary types of cash value life insurance.

Accordingly, the cash from a life insurance policy loan is not taxable when received, because no loan is taxable when you simply borrow some money!

Charlie has a $500,000 whole life insurance policy with an $80,000 cash value, into which he has paid $65,000 of cumulative.

Accordingly, the cash from a life insurance policy loan is not taxable when received, because no loan is taxable when you simply borrow some money! Whole Life Insurance Cash Value. Charlie has a $500,000 whole life insurance policy with an $80,000 cash value, into which he has paid $65,000 of cumulative.Khao Neeo, Ketan Mangga Ala ThailandSejarah Prasmanan Alias All You Can EatResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangTernyata Makanan Ini Berasal Dari Dewa BumiBuat Sendiri Minuman Detoxmu!!Foto Di Rumah Makan PadangSambal-Sambal Nusantara Penggugah SeleraAmit-Amit, Kecelakaan Di Dapur Jangan Sampai Terjadi!!Ternyata Makanan Ini Sangat Berbahaya Kalau Di PenjaraBir Pletok, Bir Halal Betawi

Komentar

Posting Komentar