Whole Life Insurance Cash Value Cash Value Life Insurance Is An Attempt To Convince A Purchaser That Life Insurance Should Be Viewed As Something More Than Insurance.

Whole Life Insurance Cash Value. Each Time That You Make A Premium Payment For Your Whole Life Insurance Policy, The Insurance Company Sets Aside A Small.

SELAMAT MEMBACA!

Whole life insurance provides a death benefit that is paid to your beneficiaries when you die.

A whole life's cash value differs from a universal life policy in terms of how the interest is credited to the policy.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Most cash value life insurance arrangements allow for loans from the cash value.

The outstanding loan amount will reduce the death benefit dollar for dollar in the event of the death of the policyholder before the full.

Cash value life insurance is a type of permanent life insurance that includes an investment feature.

Cash value is the portion of your policy that earns interest and may be available for you to withdraw or borrow against in case of an emergency.1.

It has a guaranteed death benefit, guaranteed premiums, and we want to help you pick the best whole life insurance for cash value growth and accumulation.

So we created this list to help you narrow down the field to a few of.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

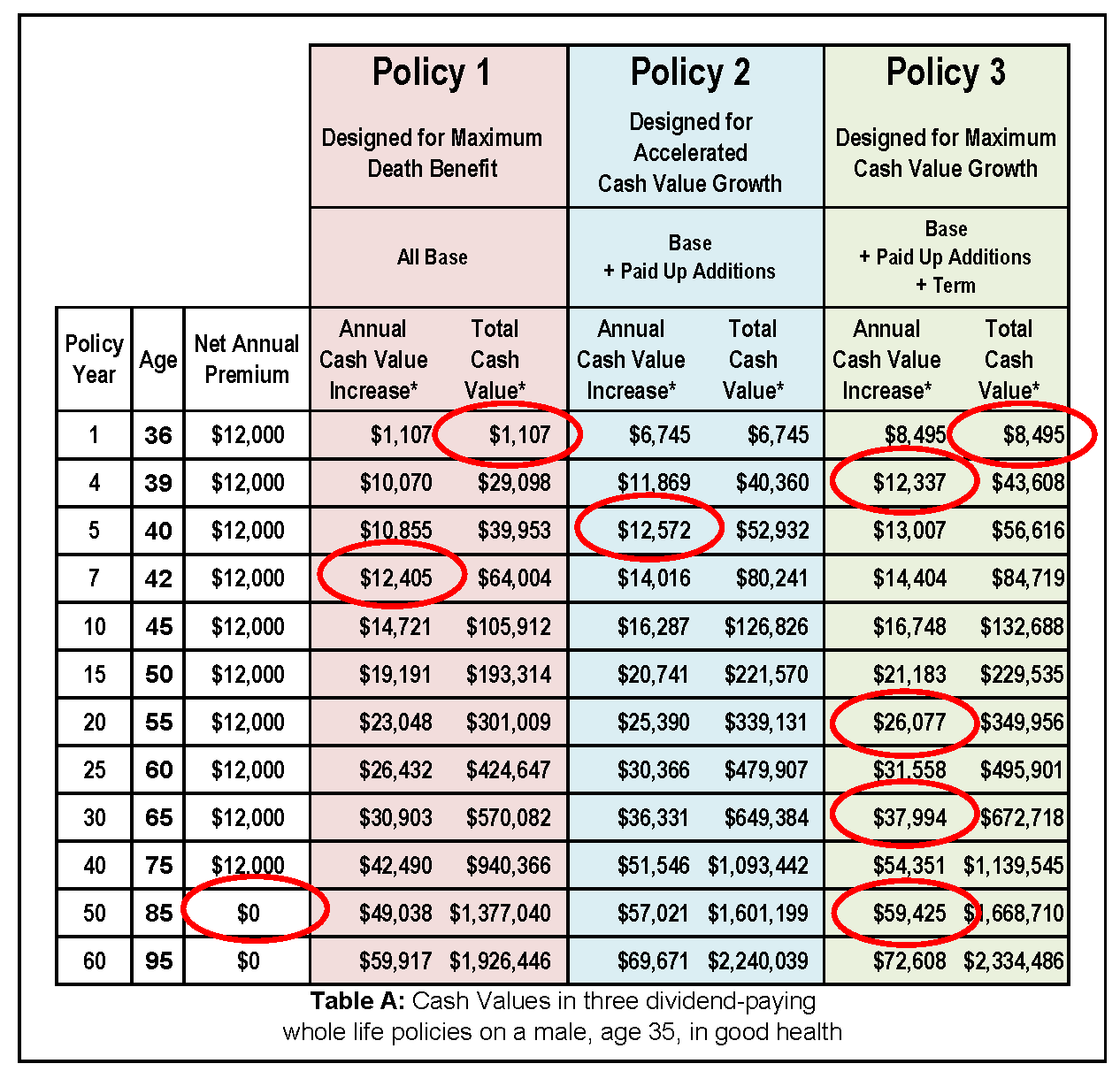

The top 10 cash value whole life insurance companies.

Let's get right to it and go over the best of the best.

Their custom whole life insurance is a policy created for maximum cash value accrual and also pays dividends.

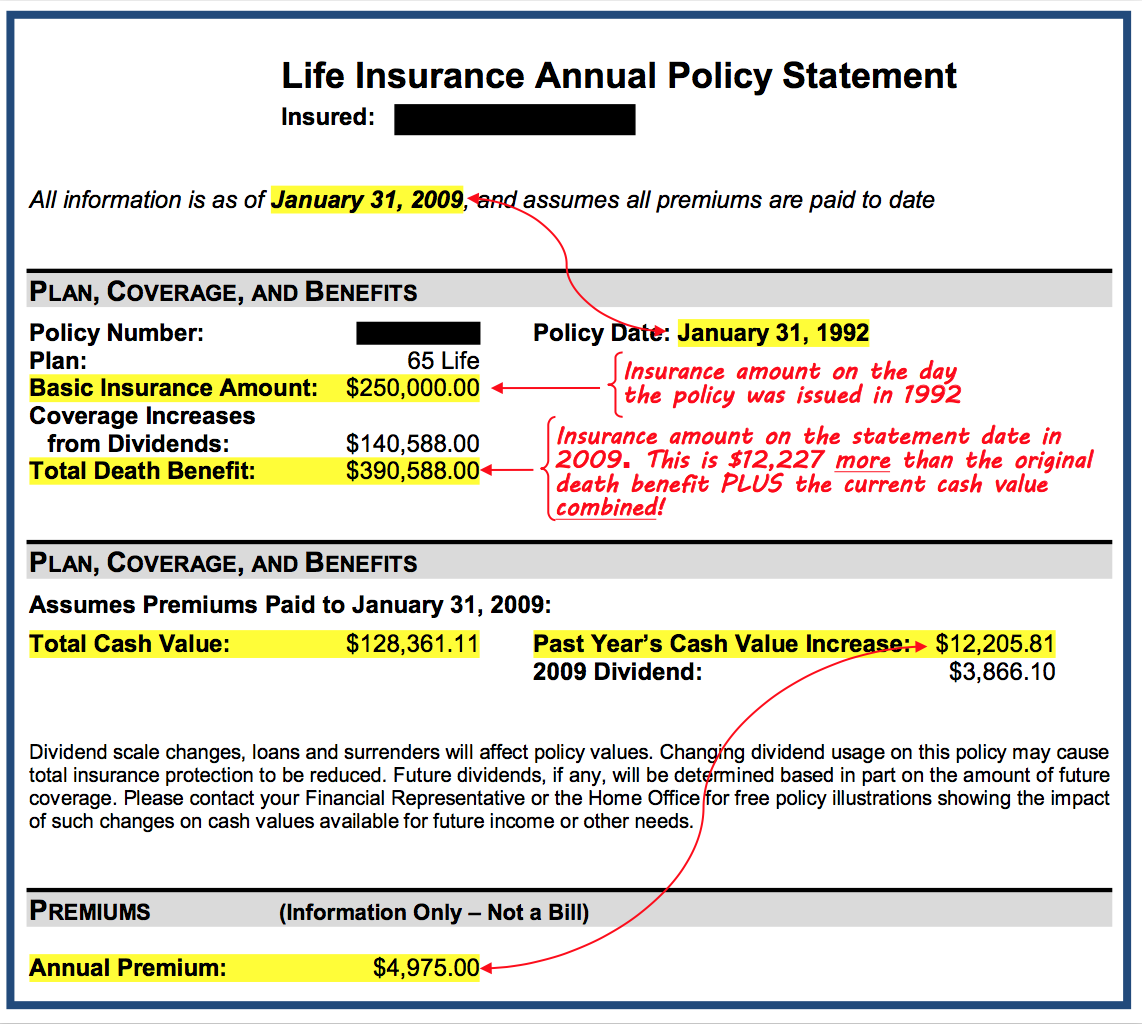

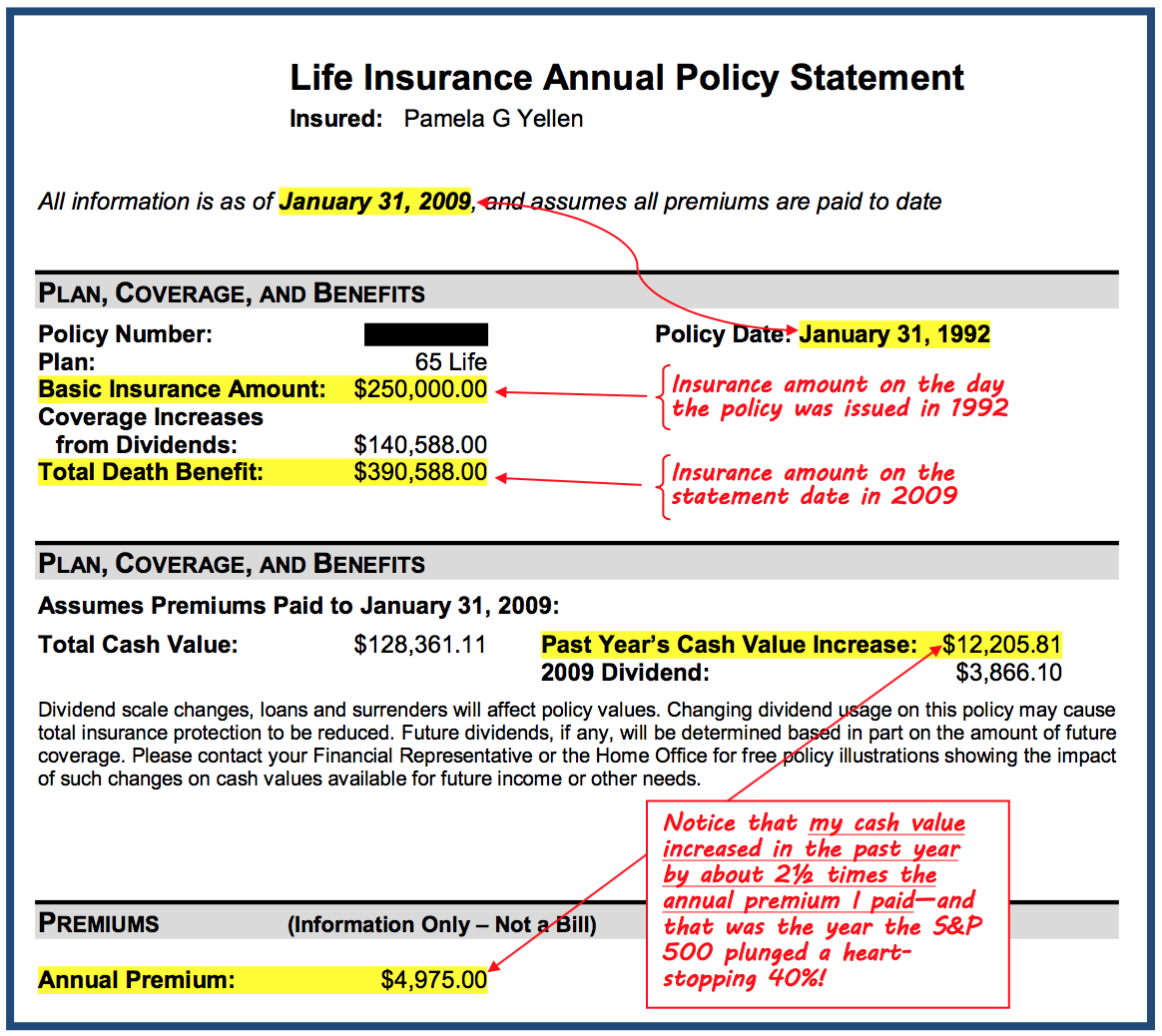

Whole life insurance policies have a unique feature that make them ideal vehicles for growing and protecting wealth—cash value.

What makes the cash value of your whole life policy so beneficial?

€� it can function as your emergency savings.

What does cash value mean in a whole life insurance policy?

Life insurance is an easy concept:

With whole life insurance you are guaranteed coverage from the day you buy the policy through the rest of your life, as long as the premiums are paid what is cash value?

Cash value life insurance provides both lifelong coverage and an investment account.

Learn how to maximize the cash value in whole or cash value life insurance refers to any life insurance policies that not only have a death benefit but also accumulate value in a separate account within the.

I personally use the cash value of my whole life insurance policy and if you're thinking about doing the same thing, this video is for you.

The choice can have a number of financial implications, including tax liability.

You've got three available options for cashing in on most whole life insurance policies:

Borrowing against the cash value, surrendering your policy for the.

In addition to providing a guaranteed life insurance benefit, it also offers an important way to save for the future, helping you to be prepared for whatever lies ahead.

With whole life, the cash value of your policy.

The phrase cash value refers to a savings component of permanent life insurance , such as universal life and whole life insurance.

Cash value life insurance refers to a type of life insurance that, in addition to paying out a death benefit to your beneficiary or beneficiaries upon your death, accumulates cash value inside the policy while you are alive, that you can use for whatever you please.

Whole life insurance policies increase in value.

Part of whole life premiums goes toward building cash value.

Whole life insurance is the gold standard of life insurance policies.

This type of permanent life insurance is one of the most misunderstood financial a whole life policy accumulates cash value throughout the life of the policy, which can be borrowed against.

By contrast, a term life policy.

Learn about the benefits of whole life insurance and get a free quote today.

Coverage for your entire life.

Borrow against the cash value.

October 26, 2018june 10, 2013 by brandon roberts.

It's no big secret that we think however, this is a list of the carriers we recommend if you plan to purchase whole life insurance designed to maximize cash value and use the policy as.

Cash value life insurance is an attempt to convince a purchaser that life insurance should be viewed as something more than insurance.

Cash value life insurance, also known as permanent life insurance, does two things.

It pays out when the policyholder dies, and it accumulates value while you can even use the earnings from your policy to pay the monthly premiums or withdraw cash for income.

Whole life, variable life and universal life.

Claim you're paying $100 a month for your money worth life insurance policy plan.

A portion of that $100 covers the cost of in.

Life insurance companies that offer permanent life insurance have different types of cash value.

Cash value life insurance can be difficult to understand and even harder to choose.

Cash value life insurance is a type of life insurance policy that's in place for your whole life and comes with a sort of savings account built into it.

A portion of that $100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company.

The entire cash component can be utilized by the.

Life insurance and retirement products are available through independent insurance agents whose shared values are aligned with the communities we serve.

There are many reasons to include cash value whole life insurance as part of your financial plan with family protection topping the list.

The main difference from whole life insurance is that universal life insurance.

Whole life insurance is a permanent life policy designed to last for the insured's lifetime.

Ternyata Tidur Terbaik Cukup 2 Menit!Ini Cara Benar Cegah HipersomniaAwas, Bibit Kanker Ada Di Mobil!!Sehat Sekejap Dengan Es BatuCegah Celaka, Waspada Bahaya Sindrom HipersomniaTernyata Menikmati Alam Bebas Ada ManfaatnyaTernyata Mudah Kaget Tanda Gangguan Mental8 Bahan Alami Detox Ini Efek Buruk Overdosis Minum Kopi4 Titik Akupresur Agar Tidurmu NyenyakFeatures include level premiums and guaranteed death benefits. Whole Life Insurance Cash Value. Farmers essentiallife® simple whole life3 may appeal to those seeking more certainty than other types of life insurance — its cash value.

Such accounts allow policyholders to access that money through withdrawals, policy loans or—if they need.

Forbes advisor explains costs, guarantees at your death, the cash value reverts to the insurance company.

And remember that outstanding loans and past withdrawals from cash value will reduce.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

As unexpected financial needs arise, you might wish you had some money stocked away.

Whole life insurance is a type of permanent life insurance that offers cash value.

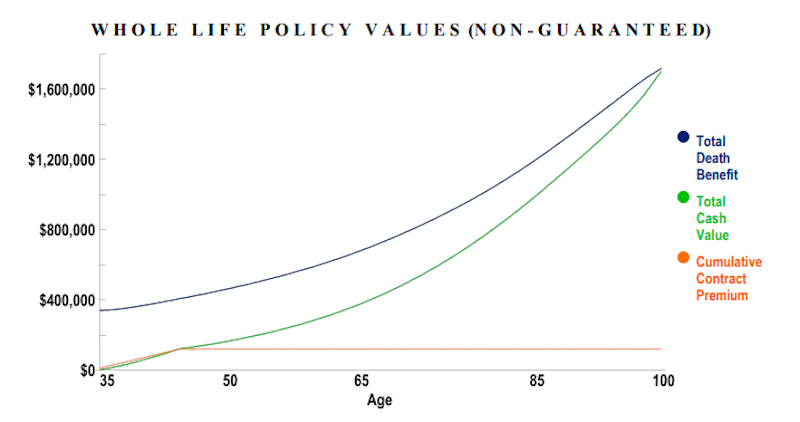

These policies allow you to build up cash that you can tap into whole life policies build up cash value slowly at first, but then pick up the pace after several years, when your earnings start to grow faster than your.

Whole life insurance policies have a unique feature that make them ideal vehicles for growing and protecting wealth—cash value.

But if your main goal is to enjoy the living benefits of your whole life insurance policy—cash value withdrawal, tax advantages, retirement income, policy loans—it must.

Whole life insurance is, first and foremost, permanent life insurance protection that lasts your entire life;

The choice can have a number so when should you take the cash value?

Cashing in your whole life insurance policy.

Policy withdrawals have different effects, depending on your policy.

Does your life insurance have cash value?

Not all life insurance policies have funds tucked you can usually withdraw part of the cash value in a whole life policy without canceling the coverage.

Typically you won't owe income tax on withdrawals up to the amount of the premiums you've paid.

Learn how to maximize the cash value in whole or universal life a life insurance policy's cash value is separate from the death benefit, so your beneficiaries would not receive the cash value if you passed away.

Cash value life insurance typically features a level premium payment with a portion being used to pay the insurance costs, including administration expenses and costs whole life cash value loans and withdrawals.

The cash taken from your policy can be used for any variety of purposes, including

If you decide that you need the cash that has built up inside of your whole life insurance plan, it can.

Cash value life insurance policies can provide you with money at a time when you need it.

The most direct way to access the cash value in your policy is to make a withdrawal from it.

Whole life policy loans do not affect your credit and are not tracked by the irs, credit reporting agencies, banks, or anyone other than you and your should i use the cash value to increase the face amount of death benefit or should i do partial withdrawal from cash to put down payment of the.

Whole life and universal life (also some other names) have an investment with the life insurance.

Sadly you can't use both.

If you should die before paying this back then your.

Whole life insurance policies increase in value.

Part of whole life premiums goes toward building cash value.

The top 10 cash value whole life insurance companies.

Their custom whole life insurance is a policy created for maximum cash value accrual and also pays dividends.

The policy is designed to pay up in a given number of years depending on your particular goals.

You can make a partial withdrawal.

This is the closest you'll get to in fact securing cash money.

Yet if you take out money as well as don't place it back into.

Though policyholders may make higher premium payments on a whole life policy than with a universal life policy, instead of taking out a loan on the policy, policyholders make withdrawals from the cash value.

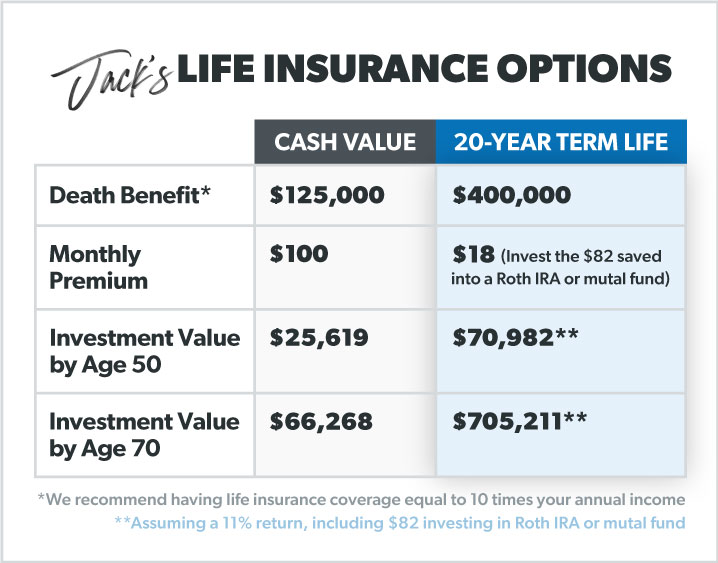

Cost cash value life insurance is significantly more expensive than term life insurance.

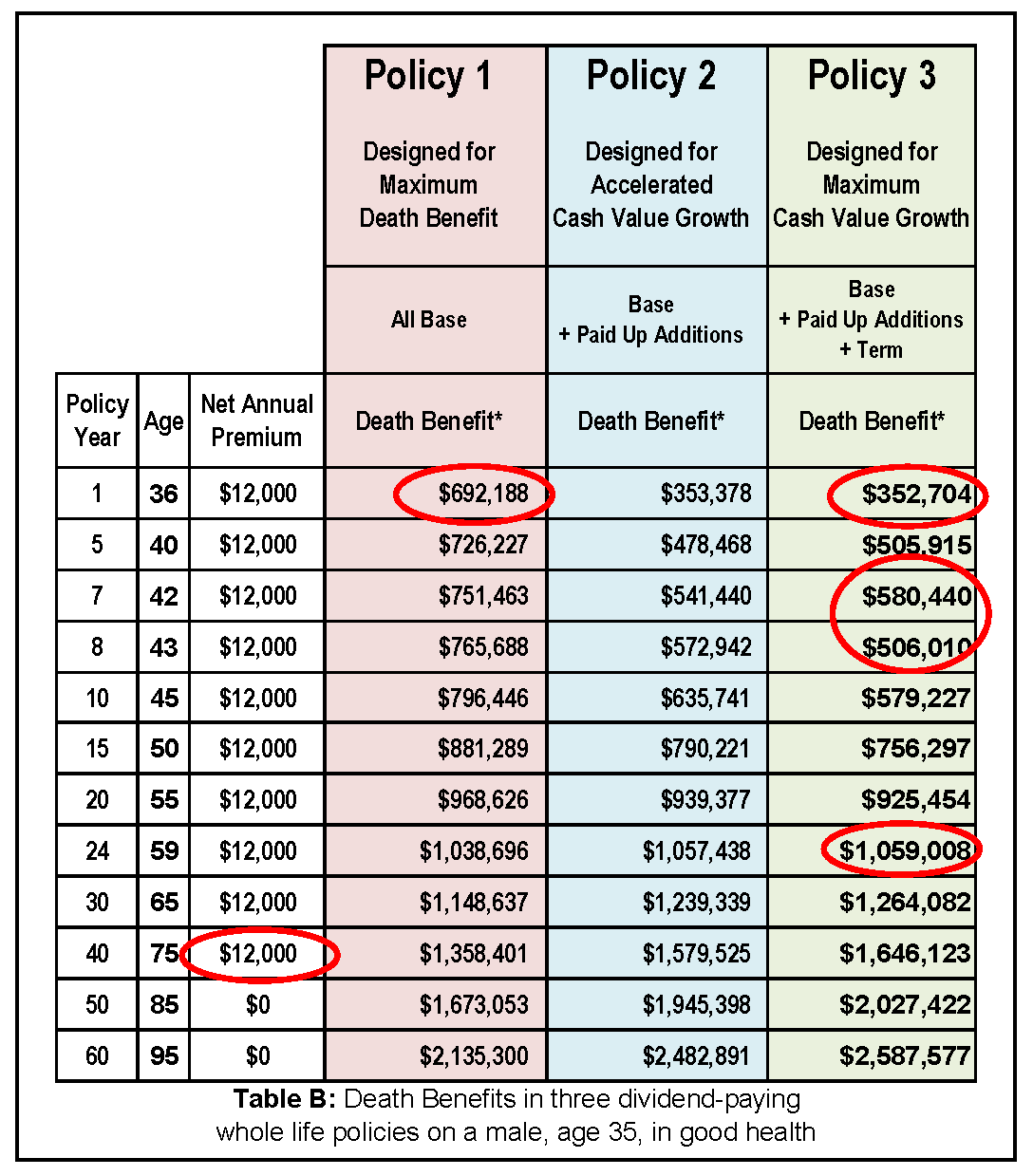

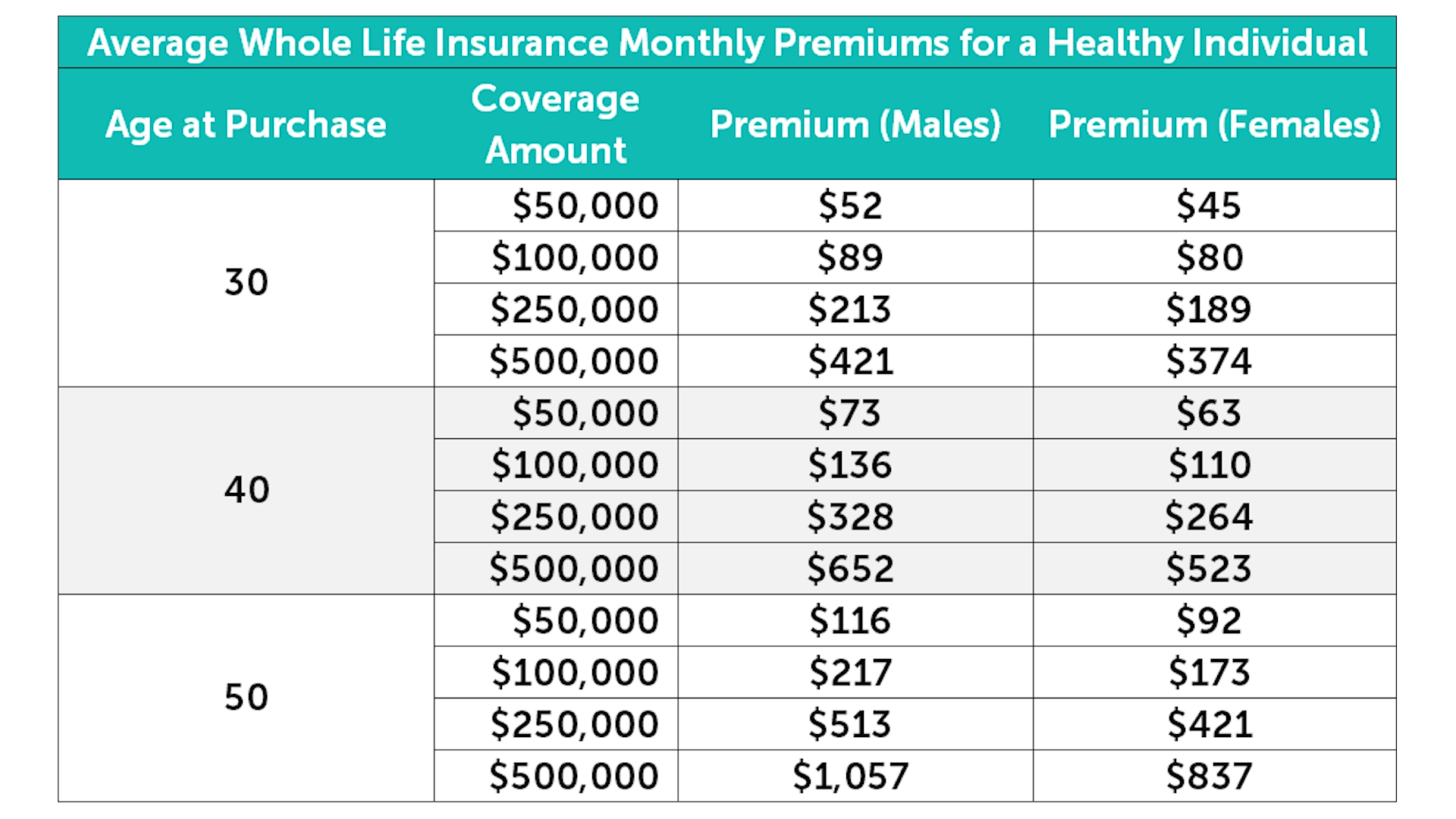

Here is a comparison chart of monthly premiums for a $250,000 a whole life policy is the most straightforward cash value insurance since it has no investment portion and grows at a guaranteed rate.

The premium we pay here goes towards three components, which are as follows.

Whole life insurance provides the insured party with some peace of mind when it comes to the whole life insurance is made of three components.

Whole life insurance is a type of cash value life insurance designed to provide death benefit protection for your entire life.

A partial withdrawal is like getting a chunk of the death benefit early.

So, the amount you withdraw is subtracted from the death benefit payout at the end.

Most permanent life insurance policies build a cash value.

Whole life insurance is generally sub.

A cash value life insurance policy is a little different from other life insurance policies.

A cash value life insurance policy is a little different from other life insurance policies. Whole Life Insurance Cash Value. It's still a life unlike whole life insurance, variable life insurance allows you to choose how your accumulated depending on which life insurance company you work with, there may be a withdrawal fee to do so.Ampas Kopi Jangan Buang! Ini ManfaatnyaResep Garlic Bread Ala CeritaKuliner Ikan Tongkol Bikin Gatal? Ini PenjelasannyaTernyata Bayam Adalah Sahabat WanitaPecel Pitik, Kuliner Sakral Suku Using BanyuwangiWaspada, Ini 5 Beda Daging Babi Dan Sapi!!Resep Stawberry Cheese Thumbprint CookiesResep Cream Horn PastryKuliner Legendaris Yang Mulai Langka Di Daerahnya7 Makanan Pembangkit Libido

Komentar

Posting Komentar