Whole Life Insurance Cash Value Life Insurance Companies That Offer Permanent Life Insurance Have Different Types Of Cash Value.

Whole Life Insurance Cash Value. Forbes Advisor Explains Costs, Guarantees, Cash Value And More.

SELAMAT MEMBACA!

Whole life insurance provides a death benefit that is paid to your beneficiaries when you die.

A whole life's cash value differs from a universal life policy in terms of how the interest is credited to the policy.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Most cash value life insurance arrangements allow for loans from the cash value.

The outstanding loan amount will reduce the death benefit dollar for dollar in the event of the death of the policyholder before the full.

Cash value life insurance is a type of permanent life insurance that includes an investment feature.

Cash value is the portion of your policy that earns interest and may be available for you to withdraw or borrow against in case of an emergency.1.

It has a guaranteed death benefit, guaranteed premiums, and we want to help you pick the best whole life insurance for cash value growth and accumulation.

So we created this list to help you narrow down the field to a few of.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

The top 10 cash value whole life insurance companies.

Let's get right to it and go over the best of the best.

Their custom whole life insurance is a policy created for maximum cash value accrual and also pays dividends.

Whole life insurance policies have a unique feature that make them ideal vehicles for growing and protecting wealth—cash value.

What makes the cash value of your whole life policy so beneficial?

€� it can function as your emergency savings.

What does cash value mean in a whole life insurance policy?

Life insurance is an easy concept:

With whole life insurance you are guaranteed coverage from the day you buy the policy through the rest of your life, as long as the premiums are paid what is cash value?

Cash value life insurance provides both lifelong coverage and an investment account.

Learn how to maximize the cash value in whole or cash value life insurance refers to any life insurance policies that not only have a death benefit but also accumulate value in a separate account within the.

I personally use the cash value of my whole life insurance policy and if you're thinking about doing the same thing, this video is for you.

The choice can have a number of financial implications, including tax liability.

You've got three available options for cashing in on most whole life insurance policies:

Borrowing against the cash value, surrendering your policy for the.

In addition to providing a guaranteed life insurance benefit, it also offers an important way to save for the future, helping you to be prepared for whatever lies ahead.

With whole life, the cash value of your policy.

The phrase cash value refers to a savings component of permanent life insurance , such as universal life and whole life insurance.

Cash value life insurance refers to a type of life insurance that, in addition to paying out a death benefit to your beneficiary or beneficiaries upon your death, accumulates cash value inside the policy while you are alive, that you can use for whatever you please.

Whole life insurance policies increase in value.

Part of whole life premiums goes toward building cash value.

Whole life insurance is the gold standard of life insurance policies.

This type of permanent life insurance is one of the most misunderstood financial a whole life policy accumulates cash value throughout the life of the policy, which can be borrowed against.

By contrast, a term life policy.

Learn about the benefits of whole life insurance and get a free quote today.

Coverage for your entire life.

Borrow against the cash value.

October 26, 2018june 10, 2013 by brandon roberts.

It's no big secret that we think however, this is a list of the carriers we recommend if you plan to purchase whole life insurance designed to maximize cash value and use the policy as.

Cash value life insurance is an attempt to convince a purchaser that life insurance should be viewed as something more than insurance.

Cash value life insurance, also known as permanent life insurance, does two things.

It pays out when the policyholder dies, and it accumulates value while you can even use the earnings from your policy to pay the monthly premiums or withdraw cash for income.

Whole life, variable life and universal life.

Claim you're paying $100 a month for your money worth life insurance policy plan.

A portion of that $100 covers the cost of in.

Life insurance companies that offer permanent life insurance have different types of cash value.

Cash value life insurance can be difficult to understand and even harder to choose.

Cash value life insurance is a type of life insurance policy that's in place for your whole life and comes with a sort of savings account built into it.

A portion of that $100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company.

The entire cash component can be utilized by the.

Life insurance and retirement products are available through independent insurance agents whose shared values are aligned with the communities we serve.

There are many reasons to include cash value whole life insurance as part of your financial plan with family protection topping the list.

The main difference from whole life insurance is that universal life insurance.

Whole life insurance is a permanent life policy designed to last for the insured's lifetime.

Ternyata Jangan Sering Mandikan BayiAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Vitalitas Pria, Cukup Bawang Putih Saja5 Olahan Jahe Bikin SehatTernyata Cewek Curhat Artinya SayangCegah Celaka, Waspada Bahaya Sindrom HipersomniaTips Jitu Deteksi Madu Palsu (Bagian 1)PD Hancur Gegara Bau Badan, Ini Solusinya!!Ini Manfaat Seledri Bagi KesehatanResep Alami Lawan Demam AnakFeatures include level premiums and guaranteed death benefits. Whole Life Insurance Cash Value. Farmers essentiallife® simple whole life3 may appeal to those seeking more certainty than other types of life insurance — its cash value.

What is whole life cash value life insurance?

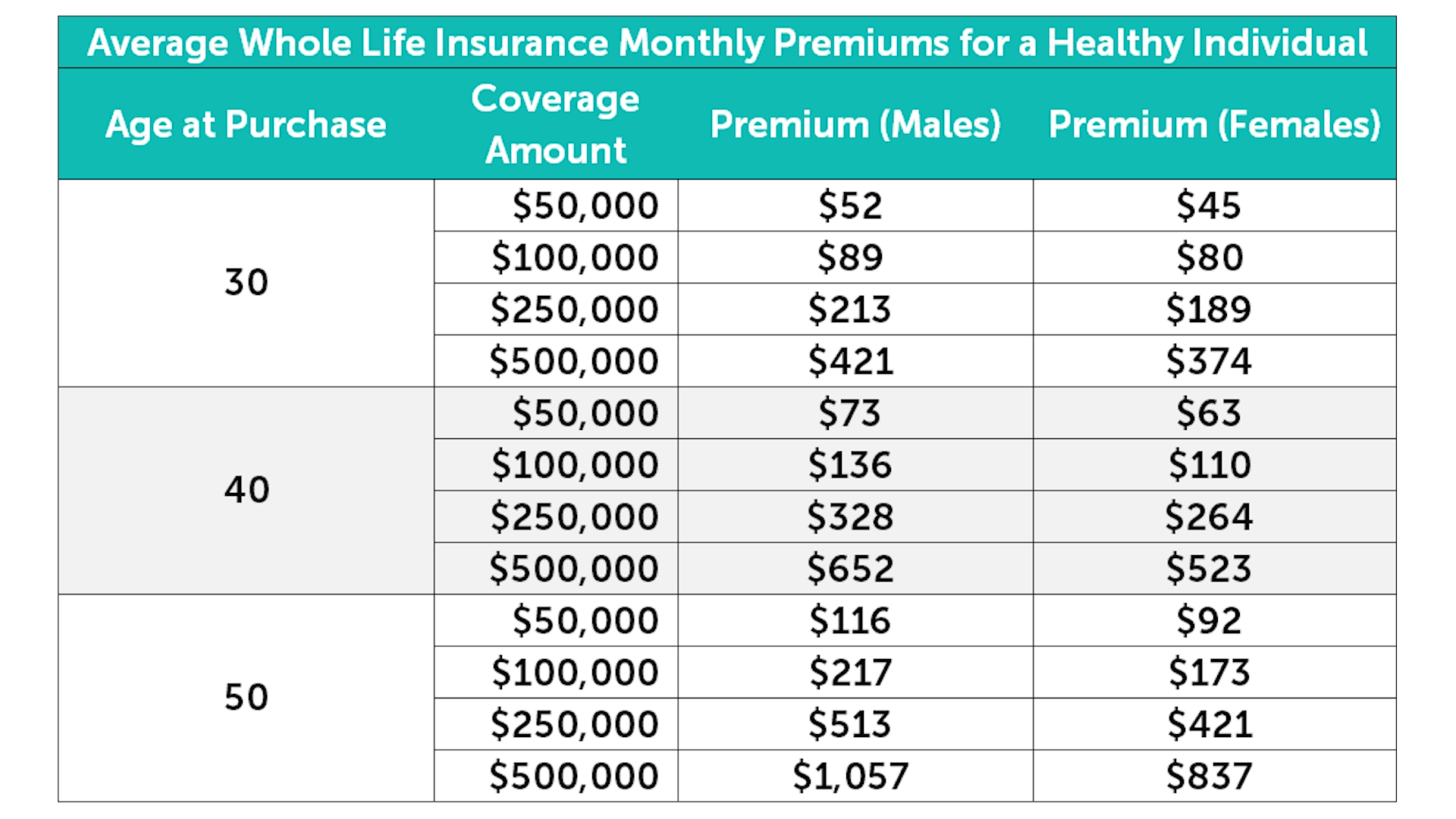

We have whole life insurance charts that give examples of whole life insurance quotes by age below.

But these charts only tell half the story.

Whole life insurance for children is a great choice because of the different lifetime benefits received.

Also, whole life insurance has a component called cash value.

Cash value is similar to a savings account that you can access if needed.

Who should consider whole life?

Whole life insurance rates by age chart.

Factors that impact your cost.

Simplefootage term life insurance rates by age chart.

The value of life insurance as an asset.

What is cash value life insurance daveramsey com.

Life insurance rate comparison insurance coverage auto.

Choosing life insurance is an important decision for your family's future.

A term policy has no cash value, and you cannot borrow against it.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Some types of life insurance policies, including whole life, universal life and variable life, can accumulate cash value during the policyholder's lifetime.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

Forbes advisor explains costs, guarantees, cash value and more.

Whole life advantage® is a whole life insurance policy issued by allstate assurance company, 3075 sanders rd., northbrook il 60062 and is available in most states with contract series icc18ac1/nc18ac1 and rider series icc18ac2/nc18ac2.

Whole life insurance can help provide financial protection for your whole life.

Learn about the benefits of whole life insurance and get a free quote today.

Borrow against the cash value.

In the past, life insurance companies have made it difficult to find quotes for whole life insurance without first talking to an agent.

However, a lot of people just want an idea as to how much it costs, what sort of cash value will it build, and how much retirement income could it potentially provide.

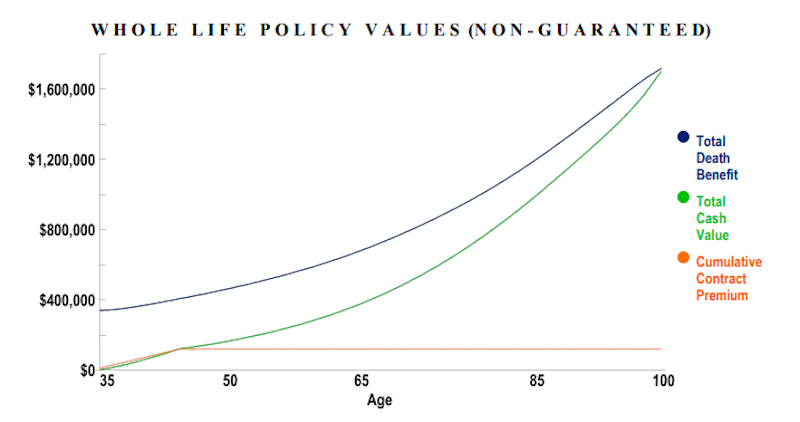

Though policyholders may make higher premium payments on a it also helps to refer to the cash value chart provided by most life insurance companies.

If you outlive the maturity of your whole life insurance.

Whole life insurance is one of the four main types of permanent life insurance.

They point to the higher premiums compared to.

Whole life insurance is the gold standard of life insurance policies.

This type of permanent life insurance is one of the most misunderstood a portion of your whole life policy's premium is set aside and accumulates as cash value.

Each time that you make a premium payment for your whole life insurance policy, the insurance company sets aside a small portion.

Cash value life insurance provides both lifelong coverage and an investment account.

Learn how to maximize the cash value in whole or cash value life insurance refers to any life insurance policies that not only have a death benefit but also accumulate value in a separate account within the.

You don't have to worry about premium hikes as you cash value builds while i wait for right opportunity to deploy the capital.

I have no intention of amassing great wealth in the death benefit, so all the value is.

Learn more about whole life cash value.

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and consistent premiums.

These policies include a cash value unlike some types of life insurance, whole life offers guaranteed returns on the policy's cash value.

In general, it's more expensive than term life.

It pays out when the policyholder dies, and it accumulates value while you can even use the earnings from your policy to pay the monthly premiums or withdraw cash for income.

Whole life, variable life and universal life.

The top 10 cash value whole life insurance companies.

Their custom whole life insurance is a policy created for maximum cash value accrual and also pays dividends.

When you pay premiums on a permanent insurance policy for example, whole life insurance (a type of permanent insurance) may feature a level premium.

Whole life insurance (cash value).

Whole life, universal life, and variable life insurance are the three primary types of cash value life insurance.

When you pay your premium, a portion of that payment is allocated towards the cash value.

Check out our life insurance chart to understand the plans and what life insurance you may need.

All benefits, riders, and product features may not be available in all states.

Your cash value life insurance policy accumulates value in a separate account within the policy.

You can also purchase participating whole life insurance, a.

Whole life insurance is a permanent life policy designed to last for the insured's lifetime.

Features include level premiums and guaranteed death benefits.

Features include level premiums and guaranteed death benefits. Whole Life Insurance Cash Value. You want an opportunity to build cash value that may help you with things such as making a down payment on a house, paying for a wedding or.Buat Sendiri Minuman Detoxmu!!Sejarah Gudeg JogyakartaResep Nikmat Gurih Bakso Lele5 Trik Matangkan ManggaResep Yakitori, Sate Ayam Ala JepangResep Cumi Goreng Tepung MantulKuliner Legendaris Yang Mulai Langka Di DaerahnyaResep Cream Horn PastryTrik Menghilangkan Duri Ikan BandengSusu Penyebab Jerawat???

Komentar

Posting Komentar