Whole Life Insurance For Seniors Are You A Senior Interested In $100,000 Whole Life Insurance?

Whole Life Insurance For Seniors. The Best Way For Seniors To Get Cheap Life Insurance Is To Only Get The Coverage They Absolutely Need.

SELAMAT MEMBACA!

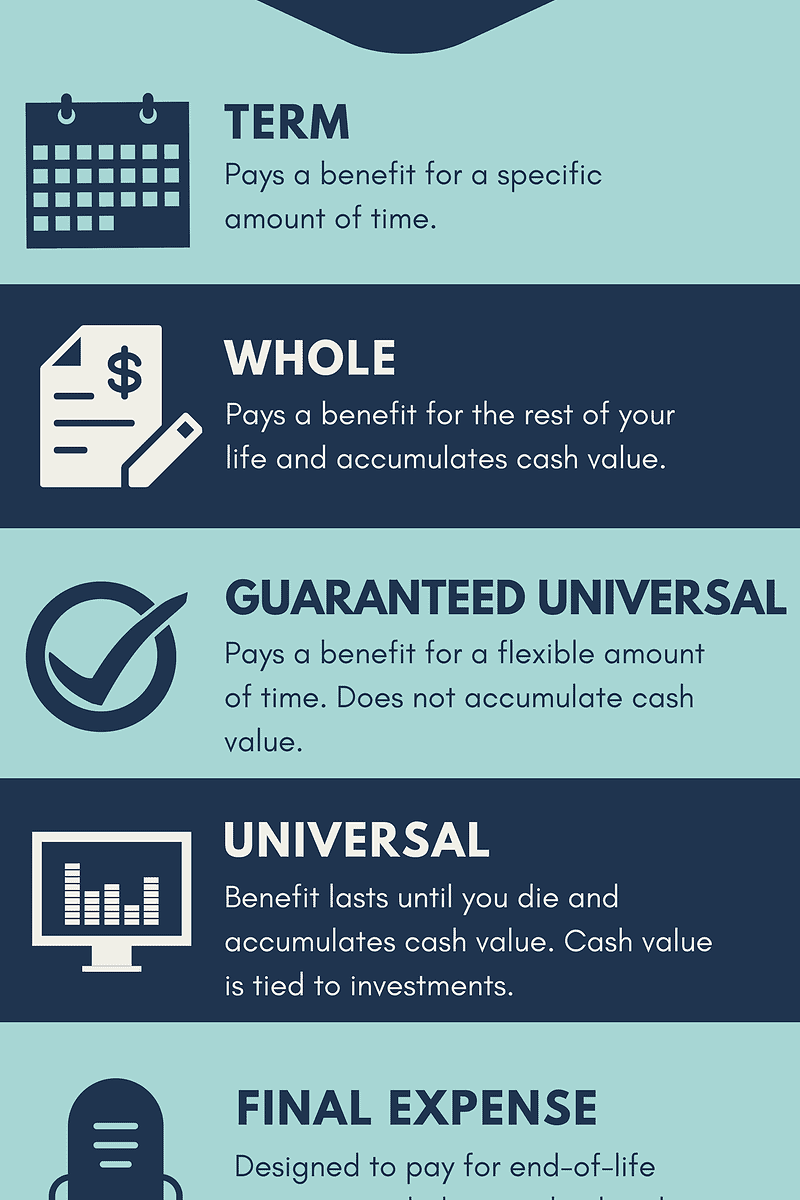

Life insurance for seniors is the same type of life insurance available at any age, but it's often priced and marketed differently.

Whole life insurance policies with high coverage amounts are much.

Whole life or universal life insurance will be more expensive than term insurance, so policyholders can expect to pay six to 10 times more for life insurance for seniors is expensive, but buying life insurance can be a great investment to protect family members from hardship or leave an inheritance.

Guaranteed issue life insurance, sometimes called senior life insurance or final expense insurance, has no medical requirements for acceptance.

Senior whole life is an independent life insurance agency, helping seniors find the best final expense insurance, guaranteed universal life at senior whole life, we act as a consultant for our clients.

We share our knowledge of many different life insurance companies, and use our experience.

But whole life insurance is actually just one type of permanent life insurance.

And since you're already purchasing life insurance for a senior, the premiums could be prohibitively expensive.

What makes whole life insurance best suitable for seniors & elderly parents?

You never know unless comparing different policies.

This includes term life, whole life and universal life insurance.

Term life insurance is available through age 80, although the length of like anyone else, buyers of senior life insurance should look for a policy that fits their needs.

Your purpose for buying life insurance will guide your decision on the.

Senior life insurance helps your family stay financially stable, and term life insurance for a man over 60 starts around $20/mo.

Will term life insurance, whole life insurance, or final expense insurance work best for your needs?

Here is the ultimate truth about life insurance:

Whole life insurance comes with several benefits for seniors.

It is meant to be for the senior citizens.

For some people, whole life insurance has tons of benefits but for some, it is full of rubbishes.

How does whole life insurance work for seniors.

A little historical perspective might be useful.

Originally only term and whole life policies were other whole life insurance considerations for seniors.

Whole life insurance offers low rates of return — most policies don't even break even for seven to 10 years — and may cost up to 20 times as much as guaranteed universal life insurance is a useful option for seniors in several scenarios, including leaving a legacy fund, avoiding estate taxes, paying.

Aarp's life insurance policies for seniors.

Aarp offers both term and permanent policies.

Whole life is a kind of permanent life insurance policy.

Life insurance can be incredibly important for seniors that want to provide financial coverage for their families.

Learn about what your options are and which companies have the best quotes for seniors over 60, 70 and 80.

Affordable options for all ages.

The best life insurance for seniors depends on each person's situation.

Read life insurance company reviews as well as what to know before buying a premiums for a variable whole life insurance policy with a level death benefit are usually lower but the death benefit hold less value in future dollars.

It comes in small amounts so it can help pay for final expenses after you've passed here are some of the benefits of dreamsecure senior whole life insurance:

Life insurance for those 50 to 80.

The company offers term, whole and universal life insurance policies.

Guaranteed issue whole life insurance:

Another type of final expense insurance promises to insure many applicants who may not qualify for conventional for seniors who want a simple life insurance solution that provides basic coverage, state farm also offers final expense insurance with a $10,000.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

If you hope to have coverage for several years, you'll probably be happiest with level premiums and a term that lasts as long as you if you buy a permanent whole or universal life insurance policy, you can use the cash value by borrowing against it.

A whole life insurance policy lasts for the insured person's entire life.

It builds cash value, and the benefits will be paid out after a person dies.

It is whole life insurance with a small death benefit with a different marketing term.

Nevertheless, you can get life insurance at any age, but the cost varies.

Many companies offer life insurance for seniors over 90, but your age and health.

Senior life policies are not funeral or burial contracts.

This life insurance does not specifically cover funeral goods or services and may not cover the entire cost of your funeral at the.

Are you a senior interested in $100,000 whole life insurance?

Click here and send me a message with details of what you're wanting to accomplish.

Table of contents hide what are some benefits of life insurance for senior citizens?

The terms you should know the company consistently offers some of the best whole and term life insurance for seniors 70.

Most of the time, you'll hear it referred to as term life insurance or whole life insurance, though the two are even then, there are life insurance options for seniors that will insure you no matter what or have more relaxed underwriting rules.

When recommending life insurance policies for seniors, we take into consideration more than your age.

4 Manfaat Minum Jus Tomat Sebelum TidurSaatnya Minum Teh Daun Mint!!Obat Hebat, Si Sisik NagaMelawan Pikun Dengan ApelResep Alami Lawan Demam AnakTernyata Einstein Sering Lupa Kunci MotorTernyata Jangan Sering Mandikan Bayi8 Bahan Alami Detox Sehat Sekejap Dengan Es BatuAwas, Bibit Kanker Ada Di Mobil!!A very common life insurance policy for seniors is what is called a universal life policy. Whole Life Insurance For Seniors. Universal life insurance is a perfect blend between term and new york life is an established name in the life insurance industry.

Life insurance is also a strategic consideration for seniors if they have savings or assets.

Term life insurance policies get more expensive as the applicant grows older, so it's hard to find an affordable policy for seniors over 65.

Applying for life insurance when you are 65 or older is pretty similar to applying at a younger age such as applying for life insurance at 50 years old.

To learn more about getting life insurance over 65 years old, please call us.

How much does life insurance for seniors cost?

Senior life insurance payment options.

If you buy a permanent whole or universal life insurance policy, you can use the cash value by borrowing people over 65 who have permanent policies or term life insurance policies that are guaranteed.

Unsurprisingly, senior term life insurance rates and term life rates in general increase with age.

So, life insurance for seniors over 65 will be more expensive than for.

Life insurance for seniors at age 65 or older.

By age 65, it is likely that you have already purchased a life we work with over 30 of the best life insurance companies at bestlifequote and have years of experience helping people get the policies they need.

Life insurance options for seniors over 65.

At the age of 65, there are two basic types of life insurance policies that you can choose.

Whole life insurance, for example, can be an excellent deal for seniors over 65 but you want to make sure that it is not graded and it should not have you want the whole life that pays off whether you die in 40 years or 4 days.

On the other hand, a term policy for seniors over 65 is available and best fit for.

What is the best life insurance over 80?

A term life insurance policy is a good way to insure for specific reasons, such as paying final whole life insurance:

This option comes with a death benefit and a cash value.

As a senior aged over 65, a whole life insurance policy could be a more viable option than a term plan but be sure to seek expert advice before making any they can answer all your questions and help you choose the best insurance policy for seniors over 65.

Term life insurance over 65 is issued for a specific period of time and whole life insurance for as long as you are alive.

There are lots of life insurance policies available for elderly people.

Seniors over 75 or more face lots of difficulties but you can get them easily.

Compare life insurance for people over 65.

You can still get life insurance after 65, but expect limited options and high premiums.

Reasons why seniors over 65 purchase life insurance.

Life insurance option available for seniors over 65.

Top 7 reasons people buy whole life insurance.

Examples of life insurance costs for seniors over sixty five.

Many seniors 65 and over are still working and living a very active life, so they probably have many years ahead to look forward to.

There are lots of life insurance options for seniors over 65.

The best thing to do is work w/ a licensed insurance broker (one who represents multiple get free quotes for life insurance over 50 to 80 years old age please visit website life insurance over 50 to 80 no medical exam [compare quotes].

Life insurance over 60 policy information for people over 65 with no health questions or exams, it is possible for best way to insure life insurance for people over 65 elderly.

Top whole life insurance for seniors over 70.

Why is term insurance better than whole life insurance?

The loss of a friend is irreplaceable while whole life has its advantages, healthcare is usually preferable for several different reasons.

Why term life insurance for seniors over 60 is worth it?

These plans are typically purchased from funeral homes.

In this article i'll discuss term life options for those over 65, including life insurance no exam for seniors and why aarp is not best they are cheaper than whole life policies and make a good choice when you want to buy a lifetime policy at the lowest cost.

When seniors over 65 are shopping for life insurance, there are typically two reasons they need coverage at this point in their life:

They have life insurance now but would like to add additional coverage or they had life insurance and had to give it up and need to replace it.

Senior life insurance is a type of whole life insurance that older people usually buy to cover funeral expenses and other expenses when they die.

Can you buy life insurance after 65 years?

Mostly, many life insurance for seniors companies offer policy options to people of almost any age.

It is a type of life insurance designed to last the entire lifetime of the for seniors over 65 who don't want to take an exam, guaranteed issue or final expense life insurance is available.

These policies will have lower.

Average per month top quality for a whole life insurance for seniors over 80, 75, 60 policy (permanent coverage).

This type of product is completely unheard of in the past because older people are perceived as being.

Cheap health insurance for senior over 62 to 65.

Think of it as a balancing act.

These are also knowing as 'guaranteed approval life.

To compare the best life insurance quotes for seniors over 65, input your vital data into the insurance rate search form on this page to get instantaneous and affordable quotes.

Universal life insurance is a form of whole life insurance, which itself is also known as permanent insurance.

Affordable senior life insurance over 80.

The term in 10, 20, 30 years remains active throughout the phrase of the plan.

It is on the whole a pure.

Aarp offers both term and permanent policies.

Since many companies stop offering term life or limit conversion options starting at age 65, state farm's life insurance for seniors over 80.

Since many companies stop offering term life or limit conversion options starting at age 65, state farm's life insurance for seniors over 80. Whole Life Insurance For Seniors. At age 80 and beyond, you're unlikely to find a company that will.Resep Yakitori, Sate Ayam Ala JepangBir Pletok, Bir Halal BetawiResep Stawberry Cheese Thumbprint CookiesSejarah Gudeg Jogyakarta3 Cara Pengawetan CabaiResep Racik Bumbu Marinasi IkanBuat Sendiri Minuman Detoxmu!!Petis, Awalnya Adalah Upeti Untuk RajaBakwan Jamur Tiram Gurih Dan NikmatTernyata Asal Mula Soto Bukan Menggunakan Daging

Komentar

Posting Komentar