Whole Life Insurance Meaning Often People Will View Whole Life Insurance As An An Indeterminate Premium Whole Life Policy Allows For Adjustable Premiums Over The Years.

Whole Life Insurance Meaning. Life Insurance That Is Kept In Force For A Person's Whole Life As Along As The Scheduled Premiums Are Maintained And Where Benefits Are Payable To A Beneficiary On Death Of The Insured, Whenever That Occurs.

SELAMAT MEMBACA!

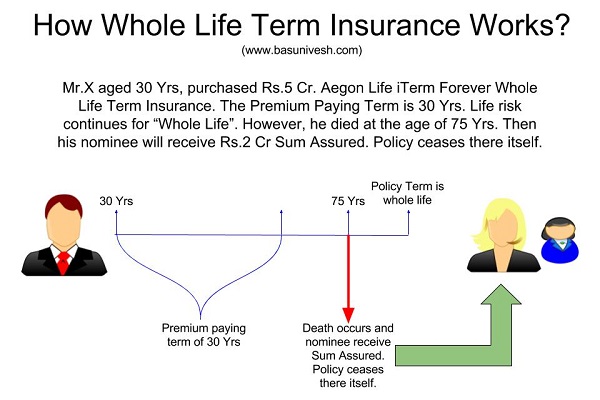

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Policies secured income for families in the event of the untimely death of the insured and helped subsidize retirement planning.

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance is, first and foremost, permanent life insurance protection that lasts your entire life;

By contrast, term life insurance only covers a permanent estate:

Whole life insurance provides a guaranteed death benefit for the entire life of the insured.

What is permanent life insurance?

A company's financial rating and selection of policies doesn't mean much if it delivers poor customer service.

Professional and consumer reviews shed some light on how easy a company is to work with, from submitting your.

That's because having a policy with a mutual life insurance company means you own a part of the company and can share in the mutual's profits in the form of an annual dividend payout.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Getting insurance and a savings account with one monthly payment?

Whole life insurance is a type of permanent life insurance that never expires, unlike term life insurance which ends after a specified period of time.

Whole life stands out from other types of permanent life insurance because it guarantees the exact same payment for the life of the policy.

Whole life insurance is a type of life insurance meant to last for the entire life of the insured person of the policy.

If the whole life policy is purchased from a mutual company, it is also an ownership stake in the company itself.

Whole life insurance can give you lifelong coverage and provide extra support during retirement.

You can borrow money against.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

Whole of life insurance is a type of policy that guarantees an insurance provider will pay out a lump sum to your loved ones when you die, rather than within a fixed time frame.

The term 'assurance' means that the policy guarantees to pay out upon death, and 'whole of life' insurance is typically the.

Rates are generally fixed, and the policy builds cash value over time.

In term life, you buy the policy for a predetermined amount of time.

If the insured does not pass away during the policy term, a new policy must be.

Traditionally, whole life insurance is a consumer demanded product.

That means that a whole life insurance policy, besides providing a death benefit, will also provide potential for cash value build up.

And that benefit can be substantial after 20 or 30 years, even to the point of representing an additional retirement resource.

![What is Whole Life Insurance? [A Quick & Simple Guide]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2015/10/What-is-Whole-Life-Insurance_-410x1024.png)

Whole life insurance is insurance that can be purchased at nearly any age and that doesn't expire.

Often people will view whole life insurance as an an indeterminate premium whole life policy allows for adjustable premiums over the years.

What this means is that your premiums will increase when.

The first is to protect your family.

(and if you face estate taxes that means the company must collect $400 from each of the 5,000 people who buy insurance just to cover their costs.

Now, this is called mortality cost, and those go up each year.

Term insurance is a life insurance policy that is only good for a certain term, or the average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional term life.

In our article whole life insurance for dummies, we will help you understand the basics about whole life.

Life insurance is an excellent decision for your financial future.

Learn more about whole life insurance (a type of permanent life insurance), including whether it's the best option for you, from the experts at lifeinsure.com.

The policy will remain in force for the lifetime of the insured as long as the premiums are paid.

This means the insurer cannot cancel your.

The premium payment can happen for a specified number of years or throughout life.

Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholder's life and has a savings component.

Moreover, the money in the savings component also grows at an agreed upon interest rate.

Whole life insurance means the life insurance policy that:

Whole life insurance, also called permanent life insurance, is designed to last your lifetime.

That means your family and beneficiaries are covered for the duration of your life*.

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

We work with experts who can get you the cover you need.

Whole life insurance is a permanent insurance policy that is guaranteed to remain active for as long as the insured individual is alive and as long as premiums are paid.

At the point when you initially apply for inclusion, you are consenting to an agreement in which the insurance organization vows to pay.

A contract with both insurance and investment components:

Whole life insurance is actually a type of permanent life insurance.

This insurance doesn't just have a death benefit.

It also includes a savings component.

But it also means that premiums are more expensive, and these policies are more.

Awas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`4 Titik Akupresur Agar Tidurmu NyenyakTernyata Inilah HOAX Terbesar Sepanjang MasaTernyata Merokok + Kopi Menyebabkan KematianTernyata Tertawa Itu DukaTernyata Ini Beda Basil Dan Kemangi!!Gawat! Minum Air Dingin Picu Kanker!Ternyata Tidur Terbaik Cukup 2 Menit!PD Hancur Gegara Bau Badan, Ini Solusinya!!Melawan Pikun Dengan ApelThis means you can maintain insurance for the rest of your life. Whole Life Insurance Meaning. But it also means that premiums are more expensive, and these policies are more.

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

Life insurance or life assurance especially in the commonwealth of nations is a contract between state farm whole life insurance policies offer level premiums and life insurance protection for as life insurance online life insurance plans polices in india.

Premium tamil tamil magazine buy.

Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries, so long as the contract is up to date at life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies.

All whole life policies have three elements:

Premiums, a death benefit, and cash value.

Most whole life plans have guaranteed level premiums.

What is term insurance in tamil.

Simple ஆ சொல்லுங்க term insurance என்றால் என்ன ?

Benefits of term insurance tamil.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Pension funds are shown to be much more adversely affected by quantitative restrictions in this sample than are life insurance companies.

Whole life insurance covers you for a lifetime with steady premiums and a guaranteed return on the policy's cash value.

Find out how whole life insurance works.

Term life insurance can be a great way to protect yourself.

Term insurance is a life insurance policy that is only good for a certain term, or amount of term insurance is also the cheapest form of life insurance for these reasons.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Getting insurance and a savings account with one monthly payment?

It might sound like a smart way to kill two birds with one stone, but really, the only bird.

With a traditional whole life insurance policy, you'll pay a fixed premium for the entire length of your policy, meaning your required premium payments will never go up.

Whole life insurance can help provide financial protection for your whole life.

Learn about the benefits of whole life insurance and get a free quote today.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings if the insured lives beyond the policy expiration, the cash value is paid out to the insured.

The cash value can also be used to borrow money against.

Definition of whole life insurance in the definitions.net dictionary.

Insurance on the life of the insured for a fixed amount at a definite premium that is paid each year in the same amount during the entire lifetime of the insured.

Whole life insurance as an investment option.

With whole life insurance, your premiums are used to cater for various things.

With this type of life insurance, you are investing a huge amount of money with a single.

Life insurance that is kept in force for a person's whole life as along as the scheduled premiums are maintained and where benefits are payable to a beneficiary on death of the insured, whenever that occurs.

The premium payment can happen for a specified number of years or throughout life.

It does not expire as term life insurance does.

If the whole life policy is purchased from a mutual company, it is also an ownership stake in the company itself.

Whole life insurance includes the following products:

If an insured were to pay a premium that directly.

Whole life insurance is designed to provide coverage for the life of the insured.

Whole life policies generally offer fixed premiums, guaranteed death benefits and are designed to build tax deferred cash value.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of buying the wrong coverage.here's how.

If your family is at financial risk that goes beyond your life (meaning you face estate tax liabilities ), you will need whole life insurance to transfer estate tax risk.

One benefit of whole life insurance is that it accumulates cash value that can be borrowed against during your lifetime.

Massmutual sells whole life insurance as one of its core business operations.

There are good and valid reasons for including.

Your premium never goes up, and your benefits never go down.

Whole life insurance, as the name implies, is insurance which provides coverage for the policyholder's entire lifetime.

Whole life policies can be divided into two categories:

However, whole life insurance has been around for much longer.

Whole life is a type of permanent insurance that, in most cases, you pay for your your health rating will be close to a standard rating.

Standard rate means you may have to pay a little more than your average (medical) full underwriting.

The longer the period of time over which you pay the premiums, the lower the premiums.

Whenever you die, your beneficiary gets the.

Whole life insurance plans offer permanent life insurance protection that comes with fixed level premiums which are payable for a given number of years as well as insurance protection that's there for life.

Whole life insurance provides a fixed coverage amount with premiums and benefits that won't change as you grow older.

Other benefits include guaranteed coverage, family options.

How does whole life insurance work?

That means your family and beneficiaries are covered for the duration of your life*.

In addition to providing financial protection, whole life policies build cash value which allows you an opportunity to build your.

That means your family and beneficiaries are covered for the duration of your life*. Whole Life Insurance Meaning. In addition to providing financial protection, whole life policies build cash value which allows you an opportunity to build your.Tips Memilih Beras BerkualitasResep Nikmat Gurih Bakso LeleStop Merendam Teh Celup Terlalu Lama!Resep Stawberry Cheese Thumbprint CookiesResep Cumi Goreng Tepung Mantul3 Cara Pengawetan CabaiResep Racik Bumbu Marinasi IkanNanas, Hoax Vs FaktaSusu Penyebab Jerawat???Bir Pletok, Bir Halal Betawi

Komentar

Posting Komentar