Whole Life Insurance Pros And Cons Here Are The Whole Life Insurance Pros And Cons That You Wanted To Know.

Whole Life Insurance Pros And Cons. Whole Life Insurance Is The Original Permanent Life Insurance Contract.

SELAMAT MEMBACA!

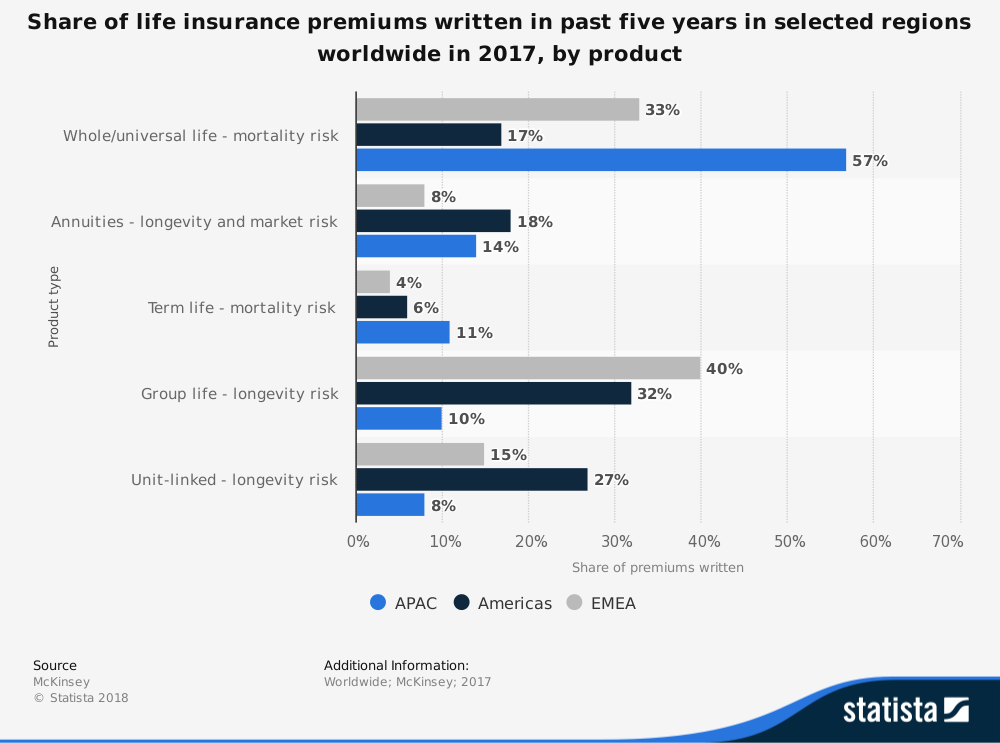

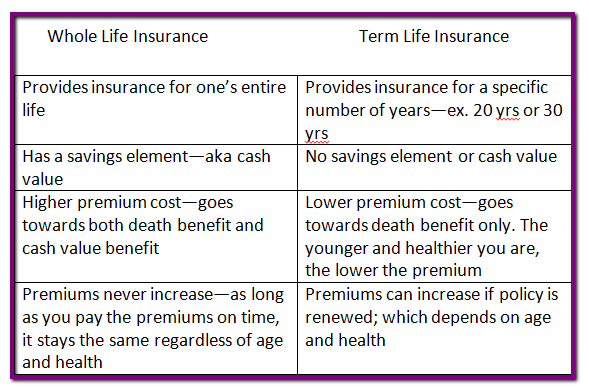

Whole life insurance is one type of permanent life insurance that can last for a lifetime.

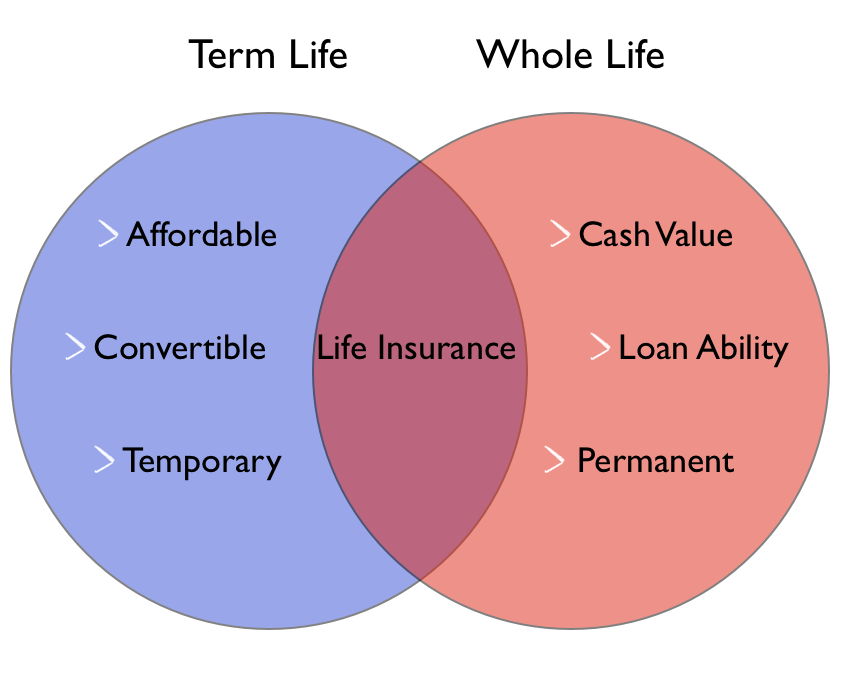

Whole life is much more expensive than term life insurance, which expires after a certain number of years.

A whole life policy also has a savings.

» is whole life insurance a good investment?

When you start shopping for life insurance, you will come across two different types:

Here is an objective review of whole life insurance as an investment option.

Whole life insurance is the original permanent life insurance contract.

That's what we intend to discuss today.

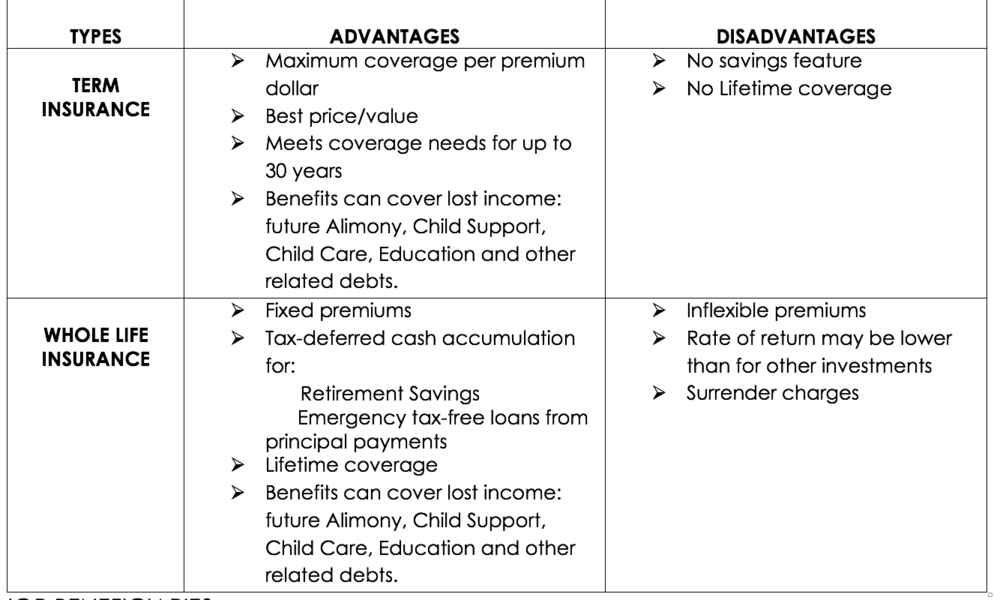

Yes, sure life insurance have pros and cons.

It will provide benefits, predictable premiums/returns,various tax advantages.

Learn more about the pros and cons of this life insurance policy.

By maxime croll updated april 5, 2021.

Find cheap life insurance quotes in your area.

Whole life insurance builds cash value over time as you pay your premiums.

Depending on your policy, that cash value could grow to a substantial amount in the future.

Whole life insurance policies are a lot like rodney dangerfield, they get no respect.

Whole life and so rather than just accept a blanket pronouncement that whole life insurance is always the bad choice, let's look at the pros and cons so you can.

Whole life insurance, specifically dividend paying whole life insurance, offered through a mutual insurance company, is a great tool for building a solid financial foundation.

And with a solid financial foundation in place, it will free you up to make better use of your money.

Here are the whole life insurance pros and cons that you wanted to know.

Whole life insurance has greater flexibility in order to fit your unique situation, needs and goals.

This flexibility makes it extremely important to make some knowledgeable move with well known consequences.

Now that a baseline has been established, let's look closely at what makes whole life insurance stand out.

Whole life insurance has several pros and cons that make it the right choice for some, and the wrong choice for others.

For example, whole life insurance premiums can be as much as 10 times higher than term life premiums for the same level of coverage.

Beyond a need for a death benefit, permanent life insurance can provide many living benefits as well, says stephen stricklin.

The pros and cons of whole life insurance depend on what your financial objectives happen to be at this time.

If the primary purpose for considering this product is to offer a death benefit to your loved ones, then there are cheaper products out there which can serve this need when compared to a.

The insurance industry has repeatedly rebranded this pos insurance to change the name so they can continue to con people into paying super high.

Life insurance that pays a death benefit to your beneficiaries whenever you die.

There is no term limit.

Whole life insurance, also known as traditional permanent life insurance, is one of the most common and oldest forms of life insurance.

That is being said there are pros and cons of whole life insurance.

Pros of whole life insurance.

Cons of whole life insurance.

High monthly premiums you'll pay.

In truth, there are both pros and cons when it comes to whole life insurance.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Instant whole life quotes, who whole life is best suited for, pros and cons, and how whole life insurance works.

To keep costs down, many insurance advisors recommend blending term and whole life insurance for ample coverage in your earlier years, with some additional coverage.

Let's take a look at both of these.

The knowledge could help you save lots on money.

Whole life insurance, simply put, is a permanent life insurance policy.

Participating whole life insurance (pwli) is a contract that is designed to remain in force for the insured's whole life and typically requires premiums to be paid every year.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

Forbes advisor explains costs, guarantees, cash value and more.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

Pros and cons of whole life insurance.

Whole life insurance is a type of coverage that stays in place for the entire lifetime of the person insured.

The insurance doesn't expire and it cannot be taken away.

Not only does whole life insurance provide for your loved ones when you die, but it also becomes a cash asset over time.

What are the main pros and cons of whole life insurance?

With so many life insurance options out there, deciding on a policy can be difficult.

Whole life insurance policies pros and cons [2021 guide].

Whole of life insurance is a policy that pays out a lump sum to your loved ones when you die.

How is whole life insurance different from level term?

As the name implies, whole life insurance covers you until the day you die.

Ternyata Mudah Kaget Tanda Gangguan MentalIni Manfaat Seledri Bagi KesehatanFakta Salah Kafein KopiMengusir Komedo Membandel - Bagian 2Cara Benar Memasak Sayuran5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuIni Cara Benar Cegah Hipersomnia6 Khasiat Cengkih, Yang Terakhir Bikin HebohTips Jitu Deteksi Madu Palsu (Bagian 2)Ternyata Tidur Terbaik Cukup 2 Menit!How is whole life insurance different from level term? Whole Life Insurance Pros And Cons. As the name implies, whole life insurance covers you until the day you die.

Whole life insurance is one type of permanent life insurance that can last for a lifetime.

Permanent life insurance refers to coverage that never expires, unlike term life insurance, and combines a death benefit with a savings component.

» is whole life insurance a good investment?

A look at the pros and cons.

Here is an objective review of whole life insurance as an investment option.

Unlike term insurance, whole life does not have a set term;

The insured can keep the insurance for life.

Whole life policies, also called permanent insurance, include universal and variable life.

Unlike a term life insurance policy, which ends at a certain point in time, a whole life policy will pay a death benefit regardless of when you die.

The cash value of whole life insurance is guaranteed to grow at a certain rate, which is based on assumptions life insurance companies make.

What are the pros and cons of term life insurance and whole (aka permanent) life insurance?

Life insurance that pays a death benefit to your beneficiaries if you die within the terms of the policy.

Whole life insurance generally has higher premiums than term life insurance, at least while the insured is young.

Term insurance is great for low cost coverage but whole life insurance in small amounts has a place too.

However, before purchasing a term life insurance policy it is important to make an informed choice.

Here are some pros and cons of the same

If you survive the term, your premiums are given back to make your beneficiaries aware about the policy and watch your pros and cons of whole life insurance turn into just pros when you choose the best.

Whole life insurance is the original permanent life insurance contract.

But what are the benefits and drawbacks to owning it?

Overall insurance are beneficial for all and will provide you fruitful results in.

Whole life insurance offers coverage for your entire lifetime, tax benefits and a cash value component which grows over time.

Learn more about the pros and whole life insurance policies are generally more expensive than alternatives, such as term life insurance.

Unlike term insurance, whole life is permanent, and is guaranteed to pay out as long as it stays in force (the premiums get paid).

Since death is a guaranteed event, permanent insurance is 100% likely to be used.

How many other assets have those same guarantees?

Like any other financial planning tool, life insurance, whether term or whole life, can be used to fulfill various planning goals, says frank pare, president of pf wealth management group in oakland, california.

Term life insurance should be used to cover risks over a certain period of time.

Whole life insurance is a costly product to purchase.

If the primary purpose for considering this.

Whole life insurance has several pros and cons that make it the right choice for some, and the wrong choice for others.

One other pro revolves around premiums.

Some term life policies increase your premiums every year.

What is whole life insurance?

What are the pros and cons to each kind of policy?

![How to protect your children and family [options and steps]](https://onestoplifeinsurance.com/wp-content/uploads/2017/08/Term-Vs-WL-vs-UL.png)

A term life insurance policy is exactly what the name implies:

It's a policy that provides coverage for a specific term or period of time, typically between 10 and 30 years.

Confused between term and whole life insurance?

Tuition insurance rescues lost college deposits and payments.

Pros and cons of guaranteed issue life insurance.

What smokers should know about.

Cons of whole life insurance.

High monthly premiums you'll pay more since the insurance company takes on more risk with this lifelong.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

For individuals with a terminal disease, they can buy a policy that is basically guaranteed acceptance.

While these are technically whole life policies, they are 100% approval plays.

Here we cover how whole life insurance works, all of the pros and cons of it, and how it compares to term insurance.

A term life insurance is known as the cheapest and simplest life insurance product, and is designed specifically for those who are seeking a temporary coverage over specific financial commitments.

In truth, there are both pros and cons when it comes to whole life insurance.

In general, it's true that you're better off to buy term and investment difference, but what if you don't actually invest the difference?

In a whole life insurance policy, you'll pay more than the costs of insurance and administration, and that excess will accumulate in a cash value account.

Advantages or pros of whole life insurance.

It provides death benefit for one's entire life unlike term insurance, according the penn state university study whole life insurance cash value withdrawal and death benefits are income and estate tax free if the policy is structured and withdrawal done in the.

The pros and cons of having an insurance policy and investment product rolled into one.

Whole life insurance does that, and also becomes a cash asset over time.

But it might be years before you'll be able to make the most of its living benefits.

Thanks for sharing this article!

I really appreciate how you have listed all the pros and cons for both group and individual coverage.this is something that can help a lot of people who are looking or are considering getting a.

Deciding between term life insurance and whole life insurance is the first step.

On the other hand, term life insurance premiums will be far more expensive if you end up purchasing another plan later in life.

The whole life insurance consists of the death benefit, accelerated rider, and the investments.

The whole life insurance consists of the death benefit, accelerated rider, and the investments. Whole Life Insurance Pros And Cons. This policy has a savings or investment component and is considered as the most popular and established type of life whole term life insurance rate a lot of people ask the question, what is whole…Resep Yakitori, Sate Ayam Ala JepangPete, Obat Alternatif DiabetesPetis, Awalnya Adalah Upeti Untuk RajaResep Kreasi Potato Wedges Anti GagalResep Ayam Kecap Ala CeritaKulinerCegah Alot, Ini Cara Benar Olah Cumi-CumiResep Racik Bumbu Marinasi IkanStop Merendam Teh Celup Terlalu Lama!Resep Cream Horn PastryBuat Sendiri Minuman Detoxmu!!

Komentar

Posting Komentar