Whole Life Insurance Rates Part Of Whole Life Premiums Goes Toward Building Cash Value.

Whole Life Insurance Rates. Whole Life Insurance Is A Permanent Life Policy Designed To Last For The Insured's Lifetime.

SELAMAT MEMBACA!

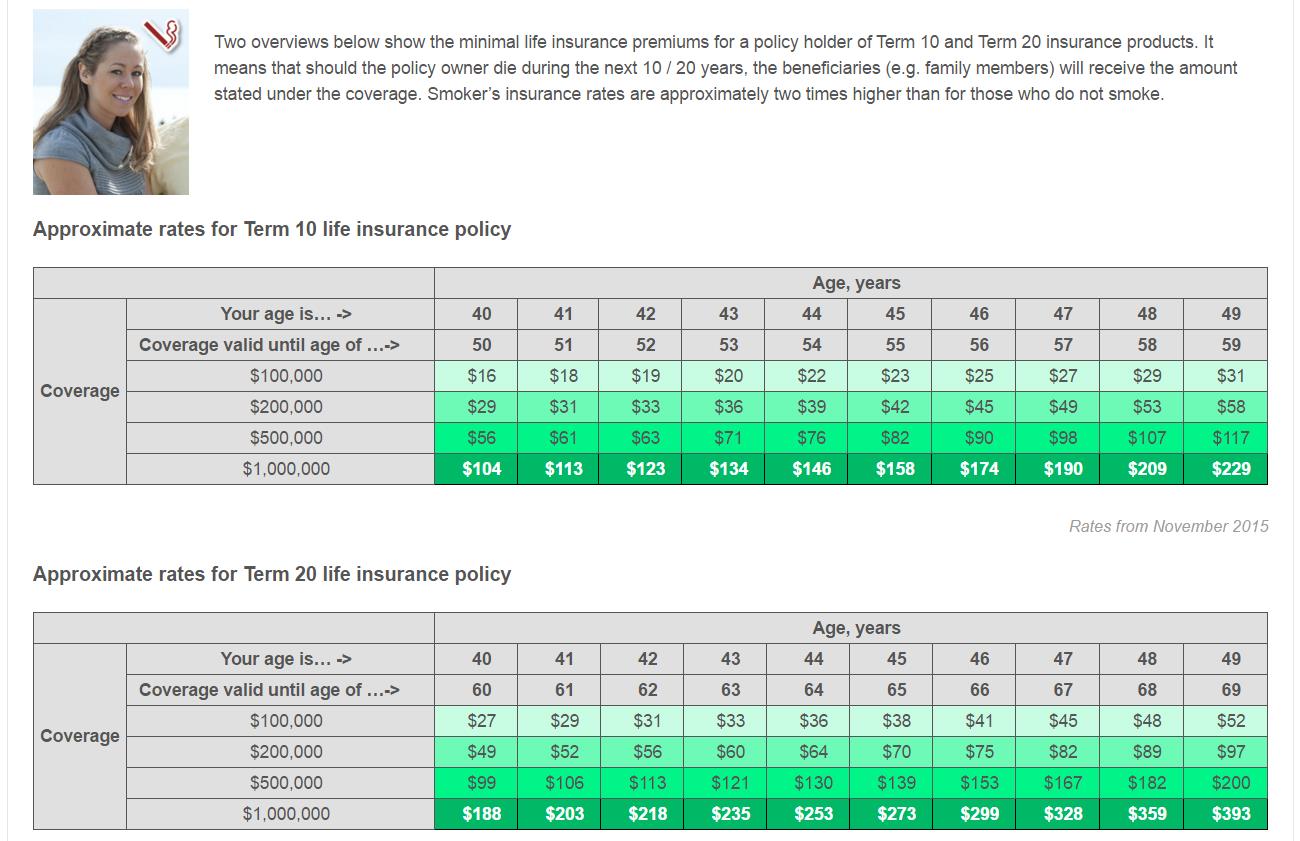

Term life insurance rates are lower initially than whole life insurance rates.

(once again, it is important that the policy is properly.

How much whole life insurance costs you?

Read this comprehensive article that compares whole life insurance rates by age and other factors from top companies.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

The average cost of life insurance is $26 a month.

Use our life insurance cost calculator to see how your rate could vary based on your health.

Our life insurance cost calculator can help you estimate how much a term life policy.

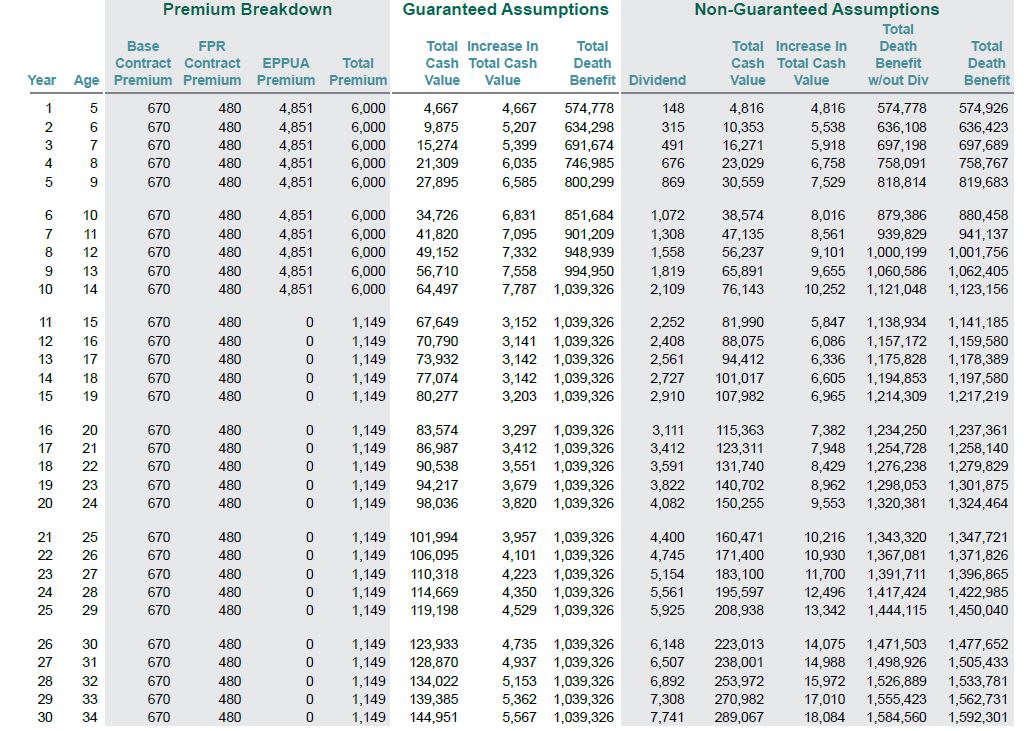

Traditional whole life insurance uses a savings account as the managed investment portion of the policy.

This account has a set minimum rate determined at the time of policy inception and can increase as interest rates rise.

Whole life insurance is a great choice for people who want the security of a policy that never expires coupled with an investment vehicle suitable for reaching / managing financial goals.

Whole life rates can vary from provider to provider, so we strongly encourage you to use a service like ours to make.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

Life insurance — term or whole — is designed to help your loved ones recover financially when you pass away.

It can ensure that your spouse upholds the same standard of living or that you can whole life insurance rates are often higher than other types of life insurance.

It can be a good idea if you

Rates quoted are subject to change and are set at the company's sole discretion.

Rates for other underwriting classifications would be higher.

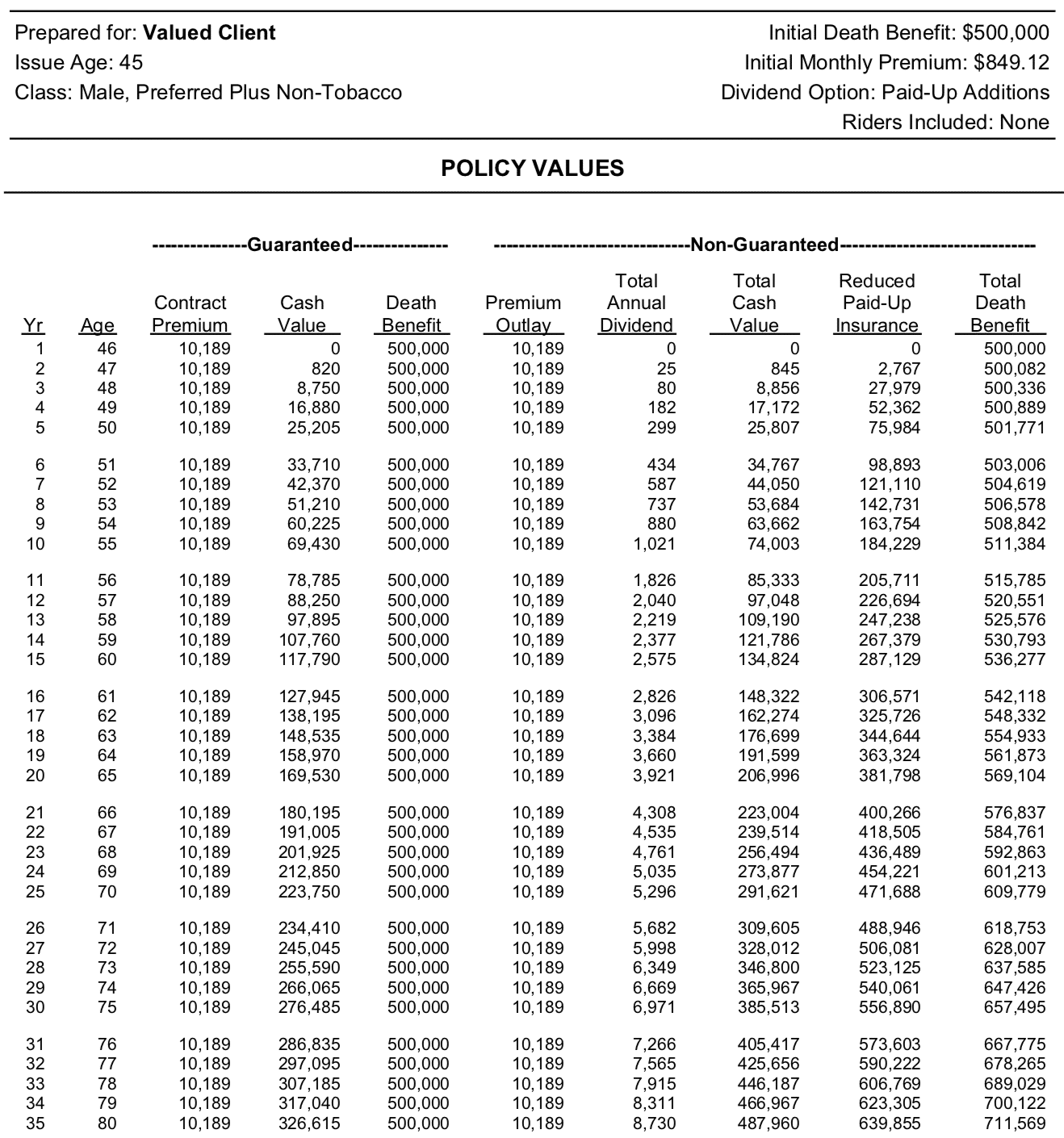

Whole life insurance policies increase in value.

You can tap into the value by making withdrawals, borrowing against the value or even asking your insurer to increase.

Generally, whole life insurance is more expensive than the same amount of term life insurance coverage.

During the underwriting process, a category is assigned based on these factors, and the rate is determined by how desirable the policyholder is considered to be.

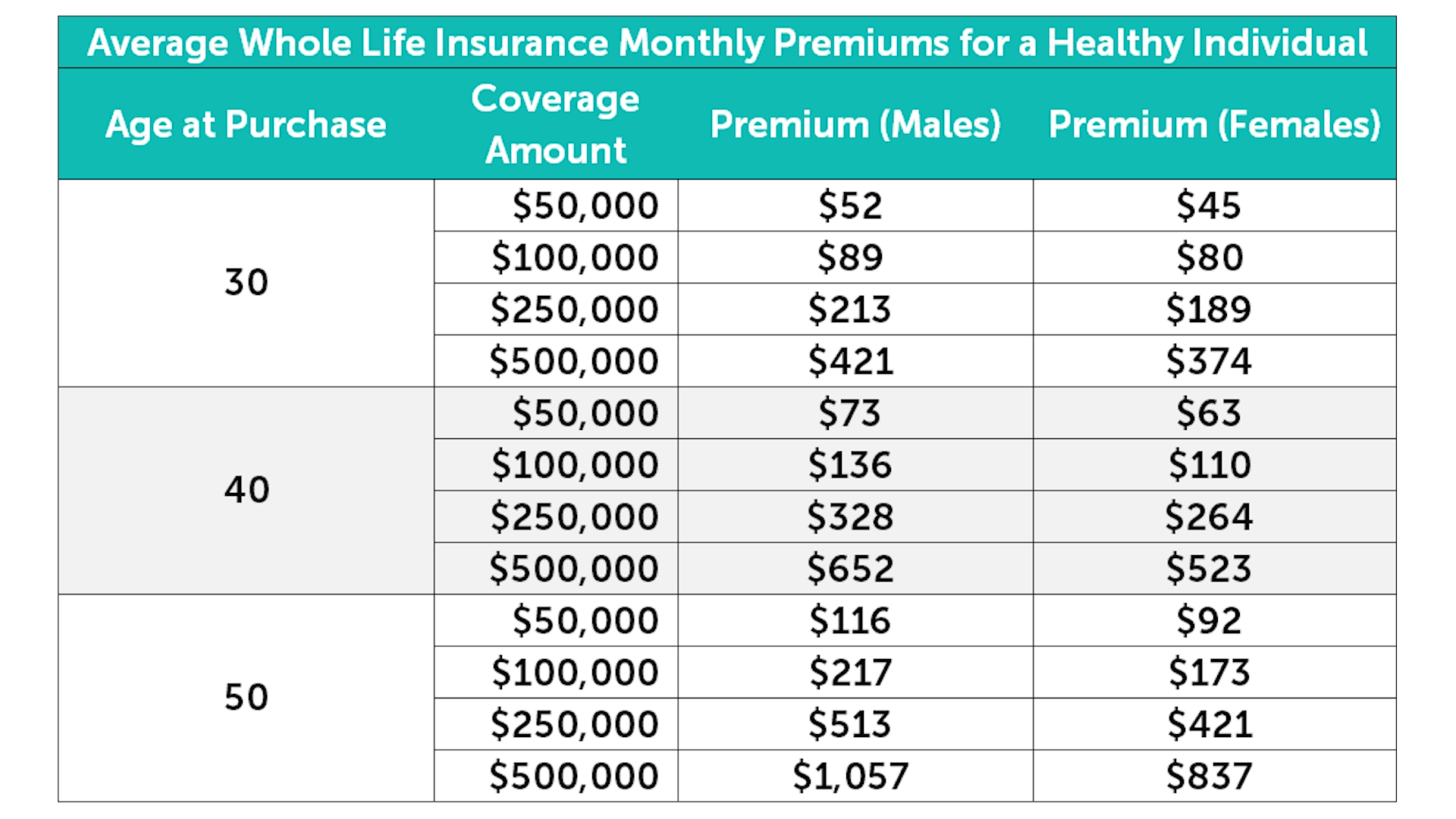

Let us now take a look at the average cost of a whole life policy for men and women at different ages.

This is why experts say that you should never wait for the right time to insure yourself.

The right time to buy life insurance is right now, because the.

Features include level premiums and guaranteed death benefits.

Best whole life insurance companies.

Find the cheapest insurance quotes in your area.

Finding the right life insurance plan can feel like an overwhelming process.

The terminology and amount of plan choices can make it difficult to really narrow down what type of insurance would provide the best financial protection for your loved ones.

Whole life insurance is generally 10 to 15 times higher than term insurance for an equivalent death benefit, according to quotacy.

![How Much Does Whole Life Insurance Cost? [Charts & 2019 Rates]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2019/01/Whole-Life-Insurance-Rates-Chart-Male.jpg)

You can earn a guaranteed rate, although it might be lower than you can get.

Whole life insurance is the gold standard of life insurance policies.

This type of permanent life insurance is one of the most misunderstood.

The way these plans work is very straightforward.

There is no small print that you need to be worried about.

Whole life final expense insurance available through choice mutual insurance agency may be underwritten by any of the following insurance companies.

Whole life insurance may or may not be a good investment.

For those who are looking for a way to lock in coverage at a set premium rate, it may be a good option.

However, if you are seeking a way to obtain a large amount of death benefit at an affordable premium rate, then term life insurance may.

Looking for (cheap) whole life insurance rates?

Life insurance is an incredibly valuable financial asset that can help provide you and your loved ones with the financial protection you deserve.

Table of contents how are whole life insurance rates calculated?

Here are actual whole life insurance rates for a $100,000 policy for a healthy male and female.

This article covers whole life insurance rates chart.

When deciding whether term life insurance or whole life insurance better fits your needs, consider where you are now and where you may be down the road.

Regardless of the kind of coverage.

Some whole life insurance policies offer a limited payment option in which premiums end at age 65.

Some offer an interest sensitive variation, where the cash value of the policy fluctuates according to prevailing interest rates.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Getting insurance and a savings account with one monthly payment?

It might sound like a smart way to kill two birds with one stone, but really, the only bird.

Get instant whole life insurance quotes fast.

Learn everything you need to know about whole life insurance and compare rates.

Awas!! Ini Bahaya Pewarna Kimia Pada MakananTernyata Cewek Curhat Artinya SayangSaatnya Minum Teh Daun Mint!!Melawan Pikun Dengan ApelMengusir Komedo Membandel - Bagian 2Ternyata Tidur Terbaik Cukup 2 Menit!3 X Seminggu Makan Ikan, Penyakit Kronis Minggat4 Titik Akupresur Agar Tidurmu NyenyakTips Jitu Deteksi Madu Palsu (Bagian 2)Salah Pilih Sabun, Ini Risikonya!!!Learn everything you need to know about whole life insurance and compare rates. Whole Life Insurance Rates. Compare rates view and compare the best whole life insurance rates from top companies.

Our top pick for life insurance for seniors, mutual of omaha, offers term, whole, and universal life insurance with flexible policy provisions.

Life insurance for seniors is often referred to as final expense insurance or burial insurance.

But, seniors are not necessarily limited to these options.

Life insurance is also a strategic consideration for seniors if they have savings or assets.

This option comes with a death benefit and a cash value.

The life insurance company you choose should have a good financial rating with a because the cost of life insurance for seniors can be higher, it's hard to determine if it's worth the cost.

This includes term life, whole life and universal life insurance.

Whole life insurance rates for seniors.

We covered the best life insurance for seniors for wealth building and legacy creation in a previous article.

The gist is that you want to apply with the insurance companies that cater to older clients.

Whole life insurance can provide peace of mind because as long as you pay premiums on time, the death benefit will be paid regardless of when you die.

Average monthly life insurance rates for senior women.

Whole life insurance offers coverage for the rest of your life, and the premiums are guaranteed to be the same every year.

The cash value component makes it expensive;

The rates are not guaranteed;

And the policies have expensive.

Foresters offers some of the best term life insurance rates in the market for seniors, and even offers coverage if you're over 70.

Best whole life insurance features for seniors.

Choosing whole life insurance focuses primarily rates for whole life insurance vary tremendously, so it is vital to do your homework and go through other whole life insurance considerations for seniors.

To choose the best life insurance for seniors, there are a few things to keep in mind.

The company offers term, whole, universal and variable universal life.

What makes whole life insurance best suitable for seniors & elderly parents?

Whole life insurance for elderly are policies taken by old people to protect their loved ones from the financial burdens that might arise after they pass on.

Many companies offer life insurance for seniors.

Both the products offered and the rates for them vary depending on the company.

A whole life policy will last the rest of your life, but these policies cost significantly more compared to term life.

Best senior life insurance policies by age.

We use the label seniors to describe shoppers in their late 50s and older.

The best life insurance for seniors means coverage that lasts, is affordable, and from the best for senior couples, a survivorship life insurance policy is one of the most effective products for more sample life insurance rates for seniors.

Sometimes it's hard to know what to expect, price wise.

Mutual of omaha's life insurance policies for seniors.

Two of these policies focus on guaranteeing a whole life is a kind of permanent life insurance policy.

In general, it's also the most expensive type of life insurance, so it's the rare senior who can.

Life insurance for seniors over age 70.

So most people shop for more modest face values than they do for term.

These are sample rates for the.

Senior life insurance helps your family stay financially stable, and term life insurance for a man over 60 starts around $20/mo.

Comparison shopping will give you the best opportunity to find the right coverage for.

Senior life insurance is a type of whole life insurance that is commonly purchased by seniors to cover the cost of a funeral and other final expenses when they die.

Assuming you are a healthy.

Read life insurance company reviews as well as what to know before buying a the cash value component of whole life insurance grows over the years and fluctuates with the stock market, with a guaranteed minimum rate of return.

The value of a whole life insurance policy will increase over the years.

Many insurance companies guarantee an amount in return.

Reliable, simple to understand, and affordable rates.

State farm ticks all these boxes on the wishlist for many seniors and also has a nationwide network of agents who can service your.

The best life insurance companies for seniors including sample rates.

In the process of finding the most reliable results for best whole life insurance rates for seniors, our team often base on the popularity, quality, price, promotional.

How much does life insurance for seniors cost?

Senior life insurance payment options.

You know that life insurance for seniors will cost more for older people than for younger people.

Get a free life insurance for seniors quotes save money up to (75%) over age 50 to 80+ elderly people, compare cheap rates available here.

Affordable senior life insurance over 80.

It is on the whole a pure.

Are you a senior interested in $100,000 whole life insurance?

Looking for a quote for life insurance or burial insurance?

Term life insurance till age 120 has recently been introduced by ing life insurance company.

Other types of senior life insurance such as burial and whole life have dozens of insurers competing.

Add a term life quote engine to your website for free!

Premium rates for whole life insurance products are more expensive than term life insurance, for example.

The adaptable benefits of whole life insurance for seniors.

There are many different kinds of whole life insurance policies that you can consider as a senior citizen.

When applying forever insurance as a senior, there are several things to take into account.

Senior life insurance is a type of whole life insurance that older people usually buy to cover funeral expenses and other expenses when they die.

Senior life insurance is a type of whole life insurance that older people usually buy to cover funeral expenses and other expenses when they die. Whole Life Insurance Rates. The life insurance for seniors company will review your unique circumstances, review your general health status and let you know if you qualify or not.Susu Penyebab Jerawat???Foto Di Rumah Makan Padang3 Cara Pengawetan CabaiBuat Sendiri Minuman Detoxmu!!Resep Nikmat Gurih Bakso LeleTrik Menghilangkan Duri Ikan BandengResep Cumi Goreng Tepung Mantul5 Makanan Pencegah Gangguan PendengaranResep Kreasi Potato Wedges Anti GagalWaspada, Ini 5 Beda Daging Babi Dan Sapi!!

Komentar

Posting Komentar