Whole Life Insurance Vs Term Term Life Insurance Vs Whole Life Insurance, There Are Many Differences Between The Two.

Whole Life Insurance Vs Term. Understanding The Differences Between The Two Policy Types Is Often Confusing.

SELAMAT MEMBACA!

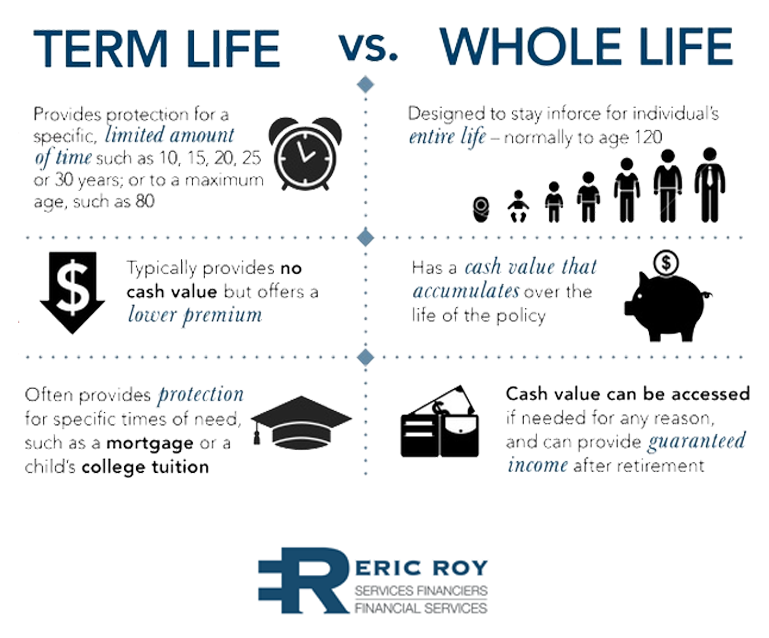

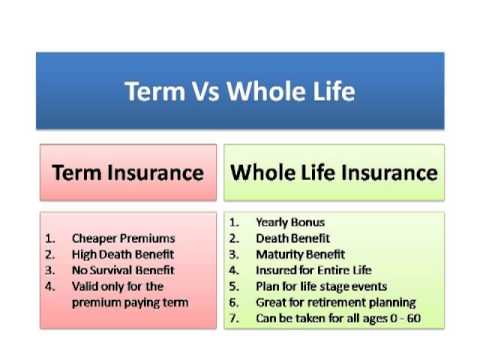

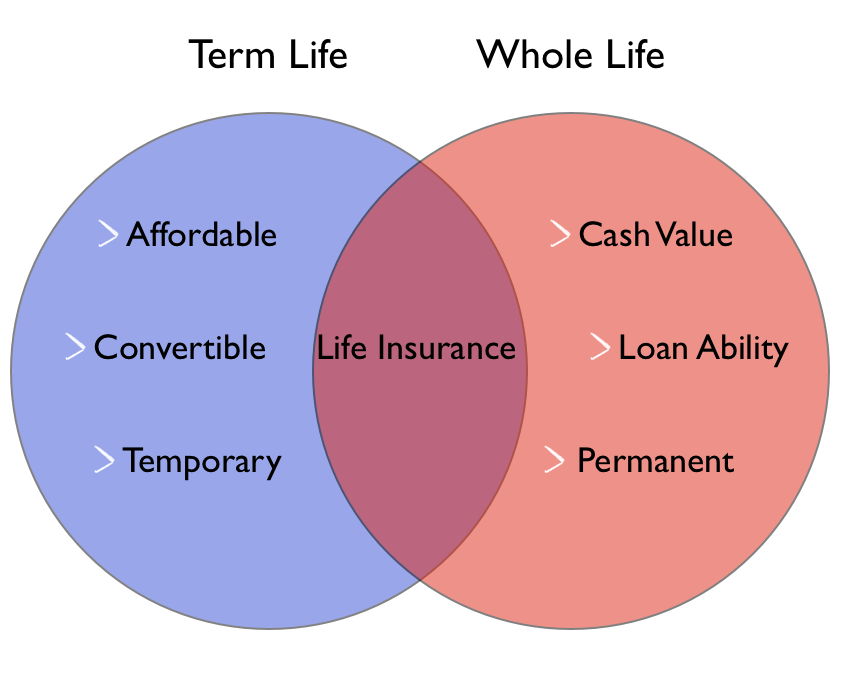

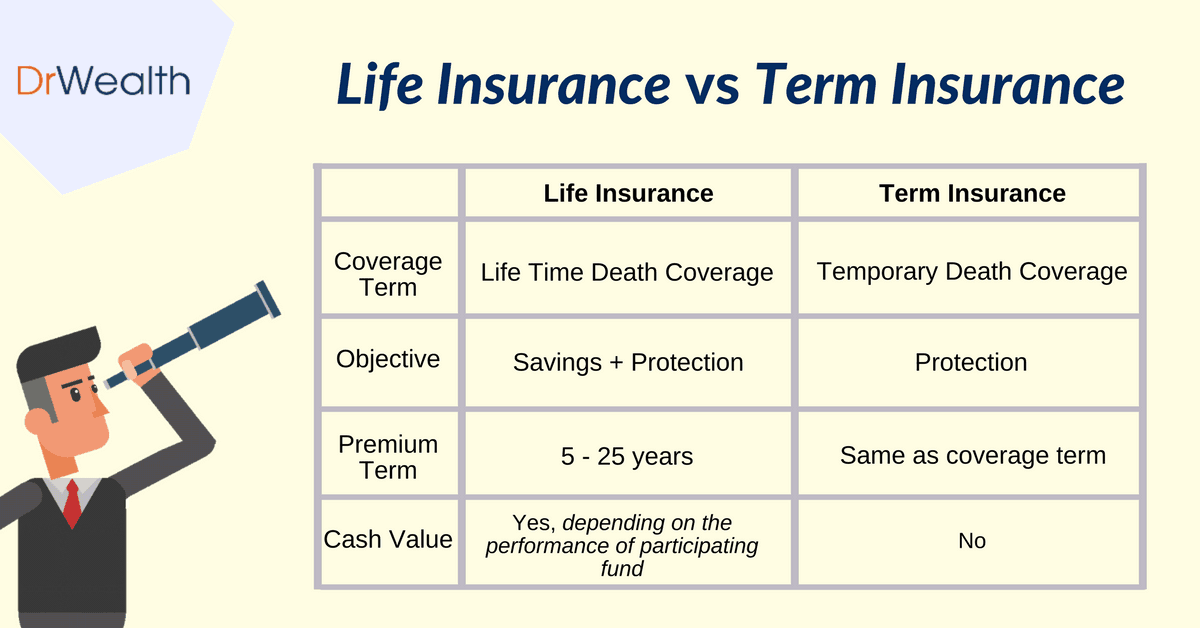

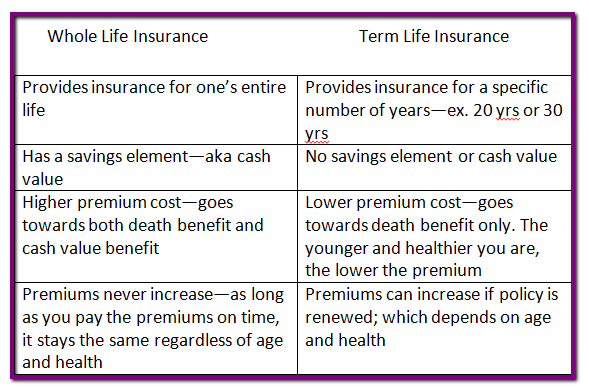

Whole life insurance is more complex and tends to cost more than term, but it offers additional benefits.

Unlike term insurance, whole life policies cover you for life and add cash value that you can tap for future needs.

Two of the oldest varieties of life insurance, term and whole life, remain among the most popular types.

The policy expires at the end of the term.

A term life insurance policy is exactly what the name implies:

It's a policy that provides coverage for a specific term or period of time, typically between 10 and 30 years.

Let's say we have a friend named greg who's in his 30s and wants to secure $250,000 of life insurance for if greg goes with the whole life, cash value option, he'll pay a hefty monthly premium.

Confused between term and whole life insurance?

Forbes advisor compares both extensively and helps you choose the right one for you.

Term life insurance can be a great way to protect yourself.

Since life insurance companies do not have to manage anything for you this cuts the rate they can offer you on the policy.

(decide which is right for you).

Deciding whether to purchase whole life or term life insurance is a personal decision that should be based on the financial needs of your beneficiaries as well as your financial.

Total face amount stems in part from the fact that term life insurance tends to be less expensive than whole life, since your risk of dying.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of buying the wrong coverage.here's how.

Please read our disclosure for more info.

Term vs whole life insurance:

Term insurance is sometimes referred to as pure life insurance because its sole purpose is to provide financial unlike whole/universal life insurance, a term policy has no value other than the death benefit.

Find out which may be right for you.

How to choose between term vs.

3 min read october 17, 2019.

Buying life insurance sounds like a complicated decision, but most people can start shopping by making a simple comparison:

Whole life money expert clark howard likes term life for most everyone.

In this article, i'll explain how term life and whole life insurance are different, i'll.

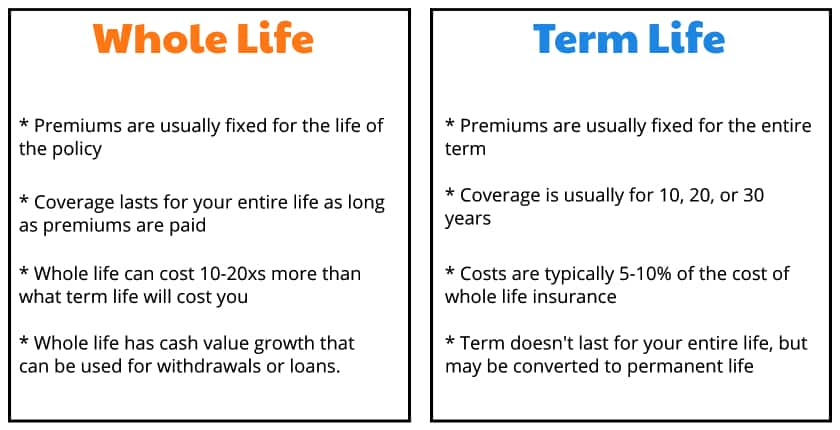

Typically this works out to be $7 per month in 20 yr term, vs $100 with whole life cash value.

Knowing the distinction between whole life and term life insurance can mean all the difference in the world for a head of household.

Term and whole life insurance are the two most commonly purchased types of life insurance policies.

Term has a set limit of time for coverage.

Similar to whole life, except with two lives insured.

Which is best for you?

But this should be one part of a comprehensive estate plan.

Term life insurance or whole life insurance:

What's the difference, which is best?

While there are many types of life insurance policies to choose from, two categories you'll see frequently are term and whole.

I have stayed generic since premiums will not be refunded in any scenario in term insurance policies unless a genuine claim against the death of the insured is made, in which.

Term insurance is life insurance taken for a certain period or term.

Let's see the top differences between term life vs whole life insurance.

Understanding the differences between the two policy types is often confusing.

Term life whole life duration predetermined (5, 10, 15, 20, 25 or 30 years) entire life premium variations typically stays the same typically stays the same premium.

New york life can get you the right fit for the right situation.

Term life insurance can be one way to balance affordability with future financial security.

Meanwhile, like other permanent life insurance, whole life policies last your entire lifetime.

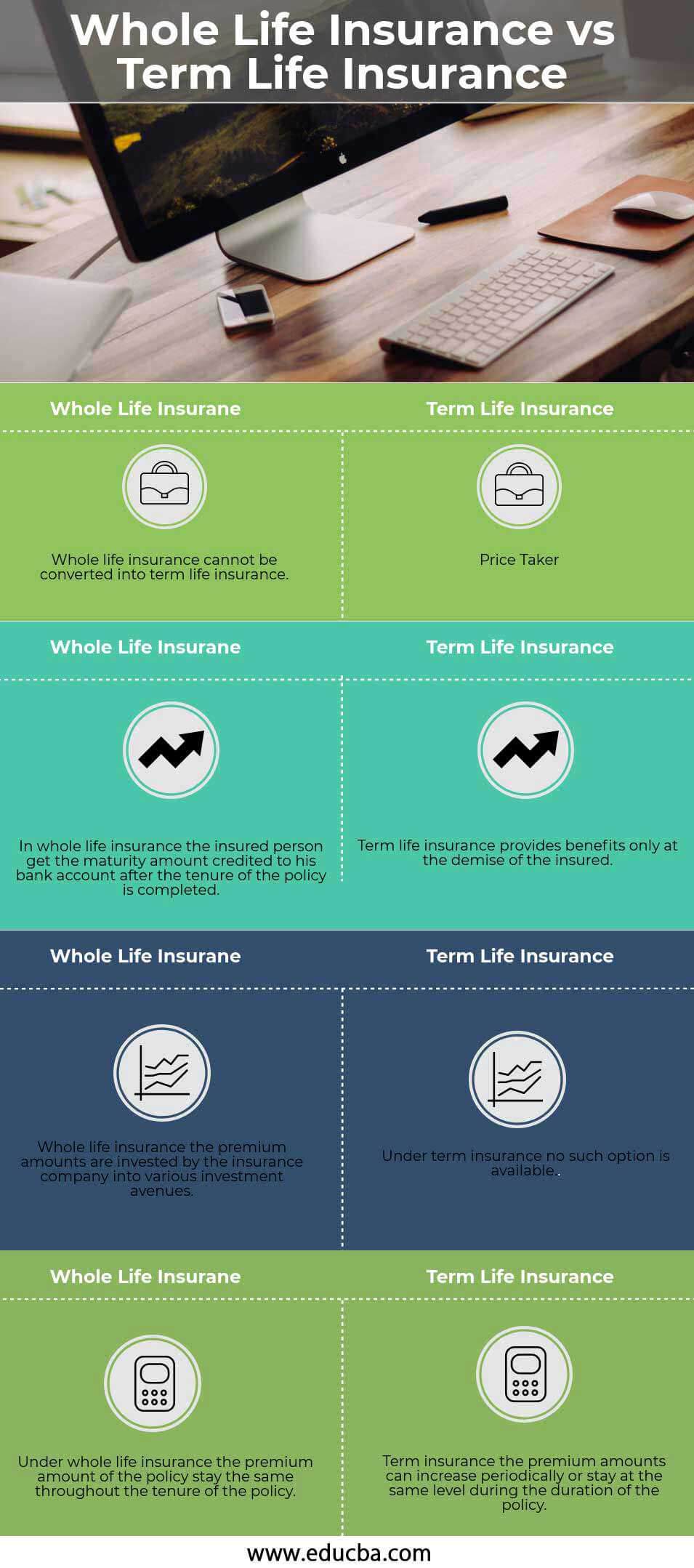

Key differences between whole life insurance vs term life insurance.

This has a been a guide to the top difference between both life insurance.

Here we also discuss the whole life insurance vs term life insurance key differences with infographics, and comparison table.

As a licensed insurance agent, i recommend term life insurance for 95% of the entire u.s.

This is because they are very easy to understand and the premiums are super affordable.

Find out which type is right for you.

When weighing term life insurance vs.

Whole life insurance, it may boil down to two things:

Cara Baca Tanggal Kadaluarsa Produk Makanan3 X Seminggu Makan Ikan, Penyakit Kronis MinggatIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatResep Alami Lawan Demam AnakAwas!! Ini Bahaya Pewarna Kimia Pada MakananFakta Salah Kafein KopiTernyata Inilah HOAX Terbesar Sepanjang MasaTips Jitu Deteksi Madu Palsu (Bagian 1)5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatku4 Titik Akupresur Agar Tidurmu NyenyakHow long you think you'll need coverage, and how much for more information on term life insurance vs. Whole Life Insurance Vs Term. Term life insurance vs whole life insurance, there are many differences between the two.

Whole life insurance premiums are much higher because the coverage lasts for a lifetime, and the policy has cash value, with a guaranteed rate of investment return on a portion of the money that you pay.

Two of the oldest varieties of life insurance, term and whole life, remain among the most popular types.

Not that insurance companies haven't tried to make it more complicated to reach.

Term and whole insurance policies aren't mutually exclusive.

Deciding whether to purchase whole life or term life insurance is a personal decision that should be based on the financial needs of your beneficiaries as well as your financial.

Term and whole life insurance are the two most commonly purchased types of life insurance policies.

Both provide a death benefit to your designated beneficiary, but that is where the it is important to understand the way term life vs whole life policies work and to be clear about your goals and needs.

A typical term life insurance policy will cost only a fraction of the premium of a whole life policy.

That will enable you to either save money on the premiums or in a real way:

Term life insurance debate is something like trying to predict the future.

Unlike whole/universal life insurance, a term policy has no value other than the death benefit.

One of the biggest benefits of term life insurance is that premiums remain the same throughout the term of the policy, which provides cost certainty.

Also, term insurance is usually less expensive than.

Whole life and term life policies have payouts, called death benefits, that are guaranteed and don't change.

Term life insurance can be a great way to protect yourself.

Term insurance is a life insurance policy that is only good term insurance is also the cheapest form of life insurance for these reasons.

A term life insurance policy is exactly what the name implies:

It's a policy that provides coverage for a specific term or period of time, typically between every person is unique, and the decision to buy a whole vs.

A term policy should be guided by your specific situation in life and the things that matter.

Total face amount stems in part from the fact that term life insurance tends to be less expensive than whole life, since your.

Term life insurance policies have much lower premiums than whole life insurance policies because they have no cash value unless you die during price:

The average cost is about $30/month vs.

Whole life insurance is a permanent policy — meaning it lasts your whole life, as long as you pay your premiums.

Like term life insurance, whole life insurance offers death benefits.

What is a whole life policy?

Comparing the costs of term vs whole life.

Term life insurance vs whole life:

As a licensed insurance agent, i recommend term life insurance for 95% of the entire u.s.

Whole life policy premiums can also be much more expensive than term life premiums, mainly because they pay the insurance company and fund the cash value component.

Term life insurance and whole life insurance are two of the most familiar types of policies.

Both feature a number of benefits, but it can be confusing.

It is difficult to do an objective comparison of term and whole life policies.

News & articles insurance guide.

Whole life insurance does give the policy owner the option of using dividend payments to purchase additional paid up insurance, so hypothetically a whole life policy can have an increasing death benefit over time if.

Unlike term life, whole life insurance policies remain in effect for your lifetime, assuming you continue to make premium payments.

Whole life insurance, which is a type of permanent coverage, also has an investment component known as cash value.

Think of it as a forced savings account whereby a.

Moreover, often there are hidden costs in whole life insurance policies such as:

High fees and commissions that can lop off as much as 3 percentage points from the annual return (apy).

Best life insurance for seniors.

How much life insurance do you really need?

Let's break down the two basic types of life insurance:

We'll explain the differences between them, and the different variations within those two categories.

We dive into the pros and cons of each so you can make the right choice.

To purchase term life insurance, sometimes you must undergo a medical exam before the insurance company agrees to a policy.

Term life policies have a much lower premium than whole life policies.

Suze orman says that permanent insurance is too expensive and the returns you get from the cash value.

Term life insurance and whole life insurance policies differ in length of protection and cash benefits.

Find out which may be right for you.

I have stayed generic if you are young, term life insurance policy would provide a much larger cover at a much lower premium compared to a whole life insurance policy.

If you're reading this, you're probably considering purchasing a life insurance policy.

It's one of the best ways to protect your family and will bring you peace of mind for years to come.

It's more expensive than term life insurance, but your monthly the premiums of a whole life insurance policy are higher because part of the payment goes to building this cash value.

Whole life insurance covers you for your entire life (typically until age 100, but you can also choose a shorter term). Whole Life Insurance Vs Term. It's more expensive than term life insurance, but your monthly the premiums of a whole life insurance policy are higher because part of the payment goes to building this cash value.Trik Menghilangkan Duri Ikan BandengTernyata Jajanan Pasar Ini Punya Arti RomantisAmpas Kopi Jangan Buang! Ini Manfaatnya3 Jenis Daging Bahan Bakso TerbaikResep Nikmat Gurih Bakso LeleTips Memilih Beras BerkualitasIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Yakitori, Sate Ayam Ala JepangResep Segar Nikmat Bihun Tom YamResep Kreasi Potato Wedges Anti Gagal

Komentar

Posting Komentar