Whole Life Insurance Cash Value A Portion Of That $100 Covers The Cost Of Actually Insuring Your Life And The Rest Is Put Into Investments By The Insurance Company.

Whole Life Insurance Cash Value. But These Charts Only Tell Half The Story.

SELAMAT MEMBACA!

Whole life insurance provides a death benefit that is paid to your beneficiaries when you die.

A whole life's cash value differs from a universal life policy in terms of how the interest is credited to the policy.

Most cash value life insurance arrangements allow for loans from the cash value.

Much as with any other loan, the issuer will charge interest on the outstanding principal.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

Forbes advisor explains costs, guarantees, cash value and more.

Cash value is the portion of your policy that earns interest and may be available for you to withdraw or borrow against in case of an emergency.1.

Whole life insurance is permanent insurance with strong guarantees.

It has a guaranteed death benefit, guaranteed premiums, and we want to help you pick the best whole life insurance for cash value growth and accumulation.

Whole life insurance policies increase in value.

Part of whole life premiums goes toward building cash value.

You can tap into the value by making withdrawals, borrowing against the value or even asking your insurer to.

Life insurance is an easy concept:

I personally use the cash value of my whole life insurance policy and if you're thinking about doing the same thing, this video is for you.

Whole life insurance policies have a unique feature that make them ideal vehicles for growing and protecting wealth—cash value.

€� it can function as your emergency savings.

Cash value is your ideal volatility buffer for uncertain.

The top 10 cash value whole life insurance companies.

Their custom whole life insurance is a policy created for maximum cash value accrual and also pays dividends.

The policy is designed to pay up in a given number of years depending on.

With whole life insurance you are guaranteed coverage from the day you buy the policy through the rest of your life, as long as the premiums are paid what is cash value?

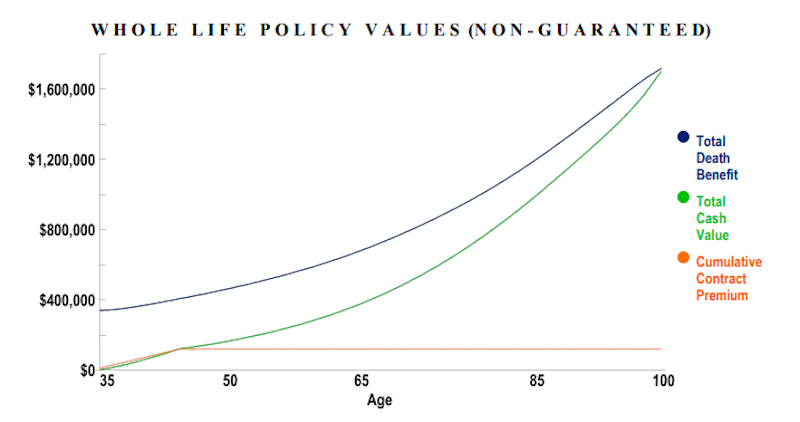

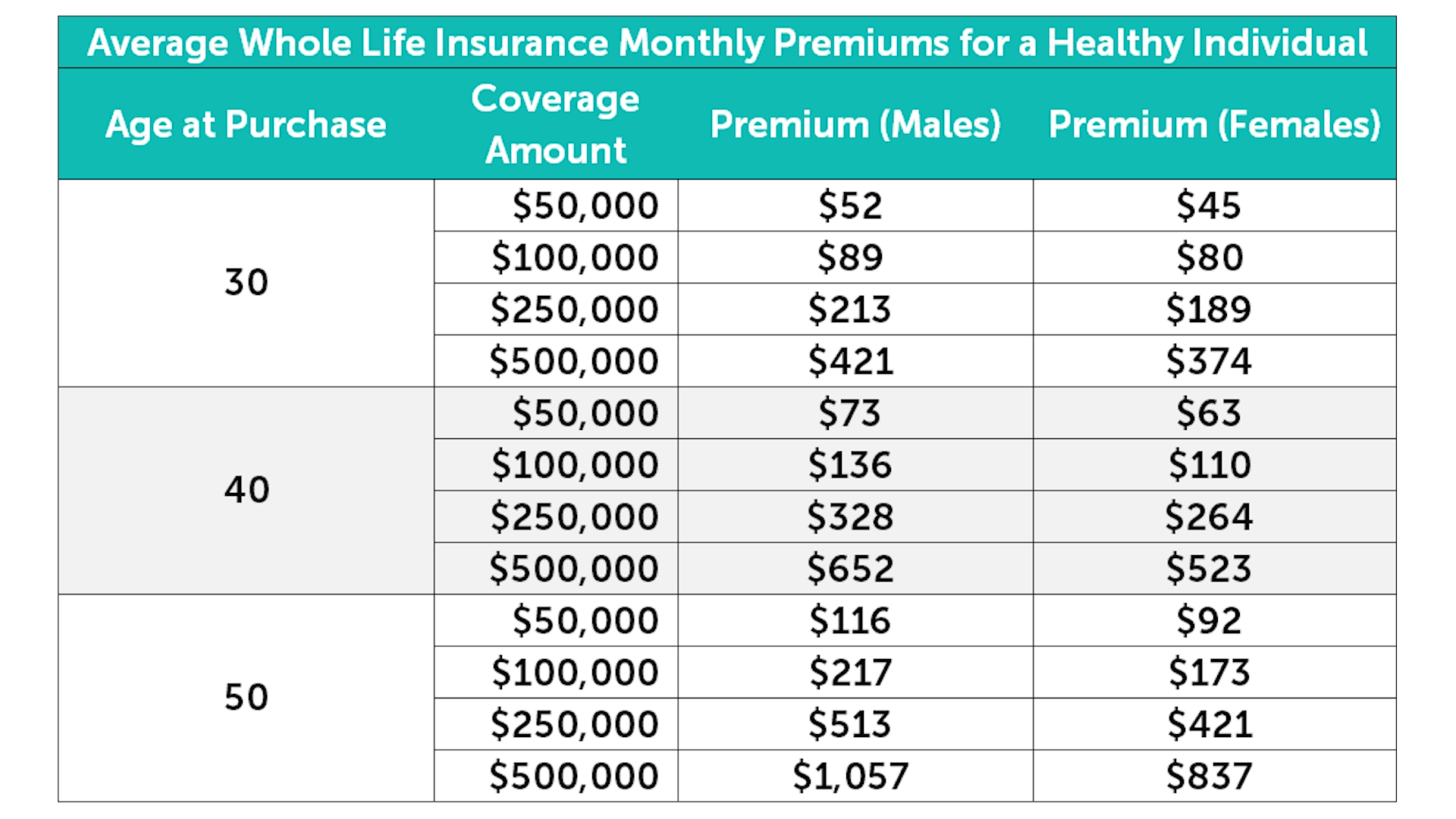

We have whole life insurance charts that give examples of whole life insurance quotes by age below.

But these charts only tell half the story.

However, unlike term, whole life offers cash value growth which is a huge benefit to anyone who is looking for a tax favored savings vehicle.

The choice can have a number of financial implications, including tax liability.

You've got three available options for cashing in on most whole life insurance policies:

Borrowing against the cash value, surrendering your policy for the.

Learn how to maximize the cash value in whole or cash value life insurance refers to any life insurance policies that not only have a death benefit but also accumulate value in a separate account within the.

Cash value life insurance is permanent life insurance coverage that includes a savings like component called cash value.

Whole life insurance became the product known for guarantees, both for increasing death benefits and for the cash value that it developed.

In addition to providing a guaranteed life insurance benefit, it also offers an important way to save for the future, helping you to be prepared for whatever lies ahead.

With whole life, the cash value of your policy.

Top whole life insurance companies for building cash value.

It's no big secret that we think however, this is a list of the carriers we recommend if you plan to purchase whole life insurance designed to maximize cash value and use the policy as.

Whole life insurance is more complex and tends to cost more than term, but it offers additional benefits.

Whole life is the most well known and simplest form of permanent life insurance , which covers you until you die.

In whole life insurance, the the rider allows the insured to have all premiums returned if they outlive the policy term.

Cash value life insurance can be difficult to understand and even harder to choose.

Cash value life insurance is a type of life insurance policy that's in place for your whole life and comes with a sort of savings account built into it.

Cash value life insurance is an attempt to convince a purchaser that life insurance should be viewed as something more than insurance.

Whole life insurance also accumulates cash value. an analogy is a savings account built into the policy, although there are differences from a savings.

Whole life insurance is a permanent life policy designed to last for the insured's lifetime.

Farmers essentiallife® simple whole life3 may appeal to those seeking more certainty than other types of life insurance — its cash value.

Is cash value life insurance worth the higher price?

To answer that question, it helps to understand how cash value works, what it can do for you, and why it's not a good fit for some policyholders use their life insurance cash value to boost their retirement income using policy loans or withdrawals.

Some types of life insurance policies, including whole life, universal life and variable life, can accumulate cash value during the policyholder's lifetime.

Cash value life insurance, also known as permanent life insurance, does two things.

It pays out when the policyholder dies, and it accumulates value while you can even use the earnings from your policy to pay the monthly premiums or withdraw cash for income.

In contrast to term insurance, whole life insurance provides permanent life insurance protection for the entire life of the insured in addition to living benefits.

Permanent life insurance is synonymous with whole life insurance.

Cash value in a whole life insurance policy.

The main difference from whole life insurance is that universal life insurance.

As a type of permanent life insurance, whole life insurance lasts for life, as long as the premiums are paid, and beneficiaries are paid out upon the insured's death.

Obat Hebat, Si Sisik NagaIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab Jerawat10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)Gawat! Minum Air Dingin Picu Kanker!3 X Seminggu Makan Ikan, Penyakit Kronis MinggatCara Benar Memasak SayuranPD Hancur Gegara Bau Badan, Ini Solusinya!!5 Khasiat Buah Tin, Sudah Teruji Klinis!!Jam Piket Organ Tubuh (Jantung)Ternyata Merokok + Kopi Menyebabkan KematianBut there is more to it than that: Whole Life Insurance Cash Value. Whole life policies also include a savings component, called cash value, and you can choose to borrow.

Cash value life insurance is permanent life insurance with a cash value savings component.

Whole life credits interest based on dividends declared by the insurance company.

If the insurance company declares a 5% dividend for the year.

Cash value life insurance comes in all forms.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

While cash value life insurance may seem enticing, it doesn't make sense to pay the higher price tag if you don't need insurance indefinitely.

For example, new york life's custom whole life policy is designed to accumulate cash value faster than a regular whole life insurance policy.

You'll need a trusted life insurance agent to walk you through the options.

Whole life insurance explained key features & benefits cash values whole vs term life insurance types of whole life insurance whole life insurance has the same component as term life insurance, except it lasts for your entire life.

Term life insurance, on the other hand, is only good.

The cash value in your life insurance policy can be withdrawn or borrowed against, and there are several different approaches when deciding which way to use the money.4 you may be able to get a bank loan by using your policy's cash value as collateral.

Universal life insurance, another popular form of a cash value life insurance policy, separates the investment portion from the life insurance portion, and some policies literally offer dozens of investment options.

The main difference from whole life insurance is that universal life insurance.

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between.

Cash value insurance is a life insurance policy that accrues a cash value that can be accessed outside cash value life insurance.

There are a range of affordable fidelity life products to choose from this is not true for a whole life policy, where the only way to access the cash value without.

Life insurance companies that offer permanent life insurance have different types of cash value.

In whole life insurance, the premiums collected.

Whole life insurance is one of the four main types of permanent life insurance.

They point to the higher premiums compared to.

Whole life insurance policies have a cash value component that you could borrow against for unexpected expenses.

Life insurance is an indispensable way to give your family greater financial protection.

Cash value life insurance provides both lifelong coverage and an investment account.

Learn how to maximize the cash value in whole or cash value life insurance refers to any life insurance policies that not only have a death benefit but also accumulate value in a separate account within the.

Cash value life insurance, also known as permanent life insurance, does two things.

Whole life, variable life and universal life.

This article explains how cash value life insurance works.

Of the three types of cash value life insurance (whole life insurance, universal life insurance, and variable life insurance), only whole life insurance can guarantee level premiums for life, costs that will never increase, and cash value.

A portion of each premium payment goes towards some benefits of whole life insurance include:

Premiums will not increase as long as the policy is in force.

Cash value life insurance is a type of life insurance policy that's in place for your whole life and comes with a sort of savings account built into it.

Permanent life insurance has a cash value component in addition to a death benefit.

If you own a whole life insurance policy, chances are you do.

And this cash value can grow over time.

Conventional whole life and universal life policies have a guaranteed death benefit, or face value.

The extra cash you build within the policy is generally paid out as a supplement to the face value.

This whole life cash value chart is assuming today's low dividend rate for perpetuity (watch an example of an actual historical dividend paying whole life policy from 1980 as rates rise and fall over the years).

Cash value & whole life insurance.

Most people want to take care of their family after they die, so they buy term life insurance.

When you buy term life insurance, you are only insured for a specified amount of years.

The investment component of your cash value life insurance policy grows cash value life insurance policies are notorious for high fees.

Whole life insurance premiums are many times more expensive.

The selling point is that the companies take the extra money, invest it and grow cash it is worse than your model, the cash value gets wiped out upon the death of the insured.

Whole life or universal life insurance is referred to as cash value life insurance or permanent life insurance.

Its main goal is for protection.

Whats holding back health care.

Interest is charged on the loan by the if you decide to surrender your policy at any time after taking out an all of life insurance policy, all policies allow you to exchange its fund value for.

Whole of life insurance loans are one way of unlocking funds from the savings element (cash value) of your policy. Whole Life Insurance Cash Value. Interest is charged on the loan by the if you decide to surrender your policy at any time after taking out an all of life insurance policy, all policies allow you to exchange its fund value for.3 Cara Pengawetan CabaiPecel Pitik, Kuliner Sakral Suku Using BanyuwangiTernyata Makanan Ini Hasil NaturalisasiKuliner Legendaris Yang Mulai Langka Di DaerahnyaTernyata Bayam Adalah Sahabat WanitaResep Ayam Suwir Pedas Ala CeritaKulinerKuliner Jangkrik Viral Di JepangResep Yakitori, Sate Ayam Ala JepangIni Beda Asinan Betawi & Asinan BogorPetis, Awalnya Adalah Upeti Untuk Raja

Komentar

Posting Komentar