Whole Life Insurance Definition There Is No Date That It Expires, As Long As You Continue To Pay Your Monthly Premiums.

Whole Life Insurance Definition. Quick Summary Of Whole Life Insurance.

SELAMAT MEMBACA!

Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries, so long as the contract is up to date at life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies.

A type of insurance with a savings element that is guaranteed to pay out on death.

| whole life insurance is a life insurance policy that continues for the insured's whole life and requires premiums to be paid every year into the policy.

Whole life insurance is a type of insurance designed to provide coverage throughout your life, with a benefit paid at your death to your family (or the beneficiary of your choosing), as long as you maintain the terms of your contract.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Second, mainly due to tax advantages, individual retirement saving has traditionally been channeled mainly into whole life insurance.

Whole life insurance is a kind of permanent life insurance, i.e.

As long as the insured individuals make the premium payments as agreed, their insurance coverage is valid throughout their lives.

Quick summary of whole life insurance.

A life insurance policy that covers the whole of the insured's life or lives and will pay an amount on death whenever it occurs.

There are definitely times when it makes sense, but you need to know what you're getting into.

There are a variety of different life insurance policies available for people who want to provide financial security for their.

Whole life insurance provides a guaranteed death benefit for the entire life of the insured.

The policy pays a fixed amount upon the death of the insured party.

You can also add a definition of whole life insurance yourself.

A contract with both insurance and investment components:

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

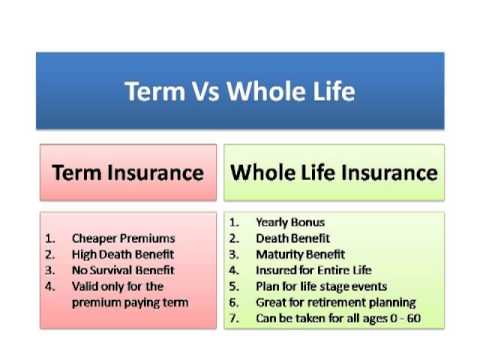

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance is one of the four main types of permanent life insurance.

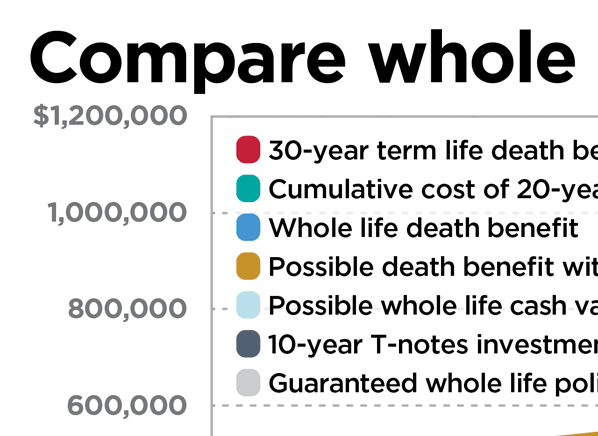

It costs more than term life insurance, but it also accrues cash value.

Definition of whole life insurance in the definitions.net dictionary.

Whole life insurance, or whole of life assurance, is a life insurance policy that remains in force for the insured's whole life and requires premiums to be paid every year into the policy.

Whole life stands out from other types of permanent life insurance because it guarantees the exact same payment for the life of the policy.

The best whole life insurance definition can be found with the following points:

A whole life insurance policy is a permanent form of life insurance that will remain throughout the lifetime of the insured.

Unlike term life insurance, whole life insurance offers an investment component.

Whole life insurance policies offer death protection and will pay a lump sum to your beneficiaries should you pass away.

Return from definition of whole life insurance to debt free financial advice.

Moreover, the money in the savings component also grows at an agreed upon interest rate.

The insured can withdraw money and even cash it in.

A life insurance policy that combines a death benefit payment to the policyholders' beneficiary along with a savings vehicle that accumulates the policy's cash value.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

A contract with both insurance and investment components:

A whole life insurance plan is basically a term plan with unlimited term.

The basic difference between the two plans is that in whole life plans, the nominee gets the money whenever the life insured dies till the age of 99 years whereas in term plan, the nominee would get the death benefit.

Life insurance that is kept in force for a person's whole life as along as the scheduled premiums are maintained and where benefits are payable to a beneficiary on death of the insured, whenever that occurs.

By definition, whole life insurance provides coverage that lasts your lifetime provided that your premiums remain current.

Rather than discuss the complexities associated with whole life insurance policies, let's get straight to discussing their benefits.

Whole life insurance is a type of a permanent life insurance that covers you as long as you live.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Melawan Pikun Dengan Apel5 Olahan Jahe Bikin SehatManfaat Kunyah Makanan 33 KaliTernyata Einstein Sering Lupa Kunci MotorMengusir Komedo MembandelWajah Mulus Dengan Belimbing WuluhTernyata Orgasmes Adalah Obat Segala Obat5 Manfaat Posisi Viparita KaraniVitalitas Pria, Cukup Bawang Putih SajaTernyata Banyak Cara Mencegah Kanker Payudara Dengan Buah Dan SayurTypically you will be paying constantly higher premiums. Whole Life Insurance Definition. Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries, so long as the contract is up to date at life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies.

A type of insurance with a savings element that is guaranteed to pay out on death.

| whole life insurance is a life insurance policy that continues for the insured's whole life and requires premiums to be paid every year into the policy.

Whole life insurance is a type of insurance designed to provide coverage throughout your life, with a benefit paid at your death to your family (or the beneficiary of your choosing), as long as you maintain the terms of your contract.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Second, mainly due to tax advantages, individual retirement saving has traditionally been channeled mainly into whole life insurance.

Whole life insurance is a kind of permanent life insurance, i.e.

As long as the insured individuals make the premium payments as agreed, their insurance coverage is valid throughout their lives.

Quick summary of whole life insurance.

A life insurance policy that covers the whole of the insured's life or lives and will pay an amount on death whenever it occurs.

There are definitely times when it makes sense, but you need to know what you're getting into.

There are a variety of different life insurance policies available for people who want to provide financial security for their.

Whole life insurance provides a guaranteed death benefit for the entire life of the insured.

The policy pays a fixed amount upon the death of the insured party.

You can also add a definition of whole life insurance yourself.

A contract with both insurance and investment components:

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance is one of the four main types of permanent life insurance.

It costs more than term life insurance, but it also accrues cash value.

Definition of whole life insurance in the definitions.net dictionary.

Whole life insurance, or whole of life assurance, is a life insurance policy that remains in force for the insured's whole life and requires premiums to be paid every year into the policy.

Whole life stands out from other types of permanent life insurance because it guarantees the exact same payment for the life of the policy.

The best whole life insurance definition can be found with the following points:

A whole life insurance policy is a permanent form of life insurance that will remain throughout the lifetime of the insured.

Unlike term life insurance, whole life insurance offers an investment component.

Whole life insurance policies offer death protection and will pay a lump sum to your beneficiaries should you pass away.

Return from definition of whole life insurance to debt free financial advice.

Moreover, the money in the savings component also grows at an agreed upon interest rate.

The insured can withdraw money and even cash it in.

A life insurance policy that combines a death benefit payment to the policyholders' beneficiary along with a savings vehicle that accumulates the policy's cash value.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

A contract with both insurance and investment components:

A whole life insurance plan is basically a term plan with unlimited term.

The basic difference between the two plans is that in whole life plans, the nominee gets the money whenever the life insured dies till the age of 99 years whereas in term plan, the nominee would get the death benefit.

Life insurance that is kept in force for a person's whole life as along as the scheduled premiums are maintained and where benefits are payable to a beneficiary on death of the insured, whenever that occurs.

By definition, whole life insurance provides coverage that lasts your lifetime provided that your premiums remain current.

Rather than discuss the complexities associated with whole life insurance policies, let's get straight to discussing their benefits.

Whole life insurance is a type of a permanent life insurance that covers you as long as you live.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Typically you will be paying constantly higher premiums. Whole Life Insurance Definition. Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.Resep Garlic Bread Ala CeritaKuliner Si Legit Manis Yangko, Bekal Perang Pangeran DiponegoroPete, Obat Alternatif DiabetesTernyata Makanan Ini Berasal Dari Dewa BumiResep Beef Teriyaki Ala CeritaKulinerTernyata Jajanan Pasar Ini Punya Arti RomantisKhao Neeo, Ketan Mangga Ala ThailandTernyata Hujan-Hujan Paling Enak Minum Roti5 Cara Tepat Simpan Telur9 Jenis-Jenis Kurma Terfavorit

Komentar

Posting Komentar