Whole Life Insurance Pros And Cons Pros And Cons Of Whole Life Insurance.

Whole Life Insurance Pros And Cons. Whole Life And So Rather Than Just Accept A Blanket Pronouncement That Whole Life Insurance Is Always The Bad Choice, Let's Look At The Pros And Cons So You Can.

SELAMAT MEMBACA!

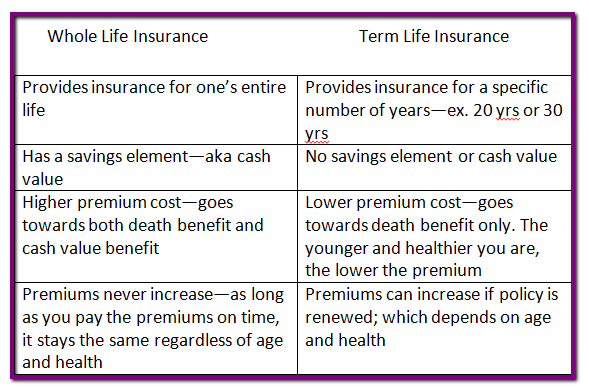

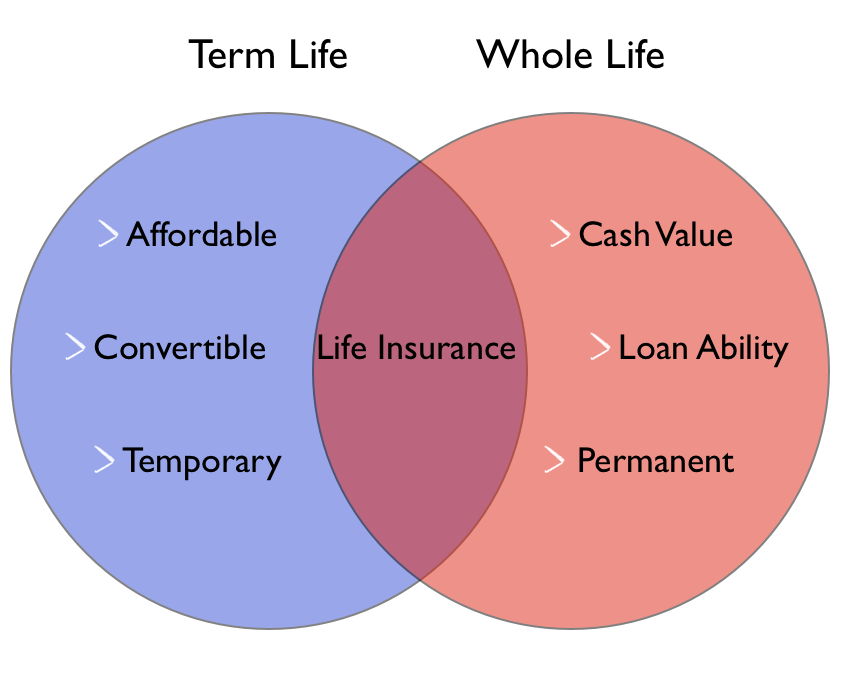

Whole life insurance is one type of permanent life insurance that can last for a lifetime.

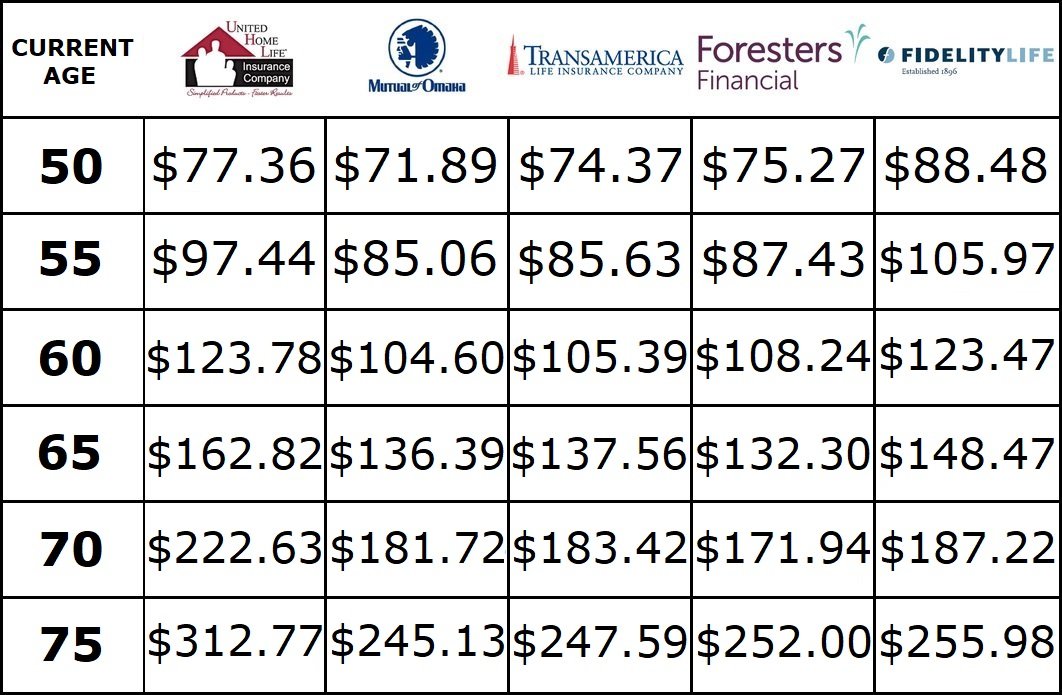

Whole life is much more expensive than term life insurance, which expires after a certain number of years.

A whole life policy also has a savings.

» is whole life insurance a good investment?

When you start shopping for life insurance, you will come across two different types:

Here is an objective review of whole life insurance as an investment option.

Whole life insurance offers coverage for your entire lifetime, tax benefits and a cash value component which grows over time.

By maxime croll updated april 5, 2021.

Find cheap life insurance quotes in your area.

Whole life insurance, specifically dividend paying whole life insurance, offered through a mutual insurance company, is a great tool for building a solid financial foundation.

Whole life insurance policies are a lot like rodney dangerfield, they get no respect.

Spend five minutes researching term life vs.

Whole life and so rather than just accept a blanket pronouncement that whole life insurance is always the bad choice, let's look at the pros and cons so you can.

Whole life insurance builds cash value over time as you pay your premiums.

Depending on your policy, that cash value could grow to a substantial amount in the future.

Whole life insurance is the original permanent life insurance contract.

That's what we intend to discuss today.

Yes, sure life insurance have pros and cons.

It will provide benefits, predictable premiums/returns,various tax advantages.

Here are the whole life insurance pros and cons that you wanted to know.

Whole life insurance has greater flexibility in order to fit your unique situation, needs and goals.

This flexibility makes it extremely important to make some knowledgeable move with well known consequences.

Beyond a need for a death benefit, permanent life insurance can provide many living benefits as well, says stephen stricklin.

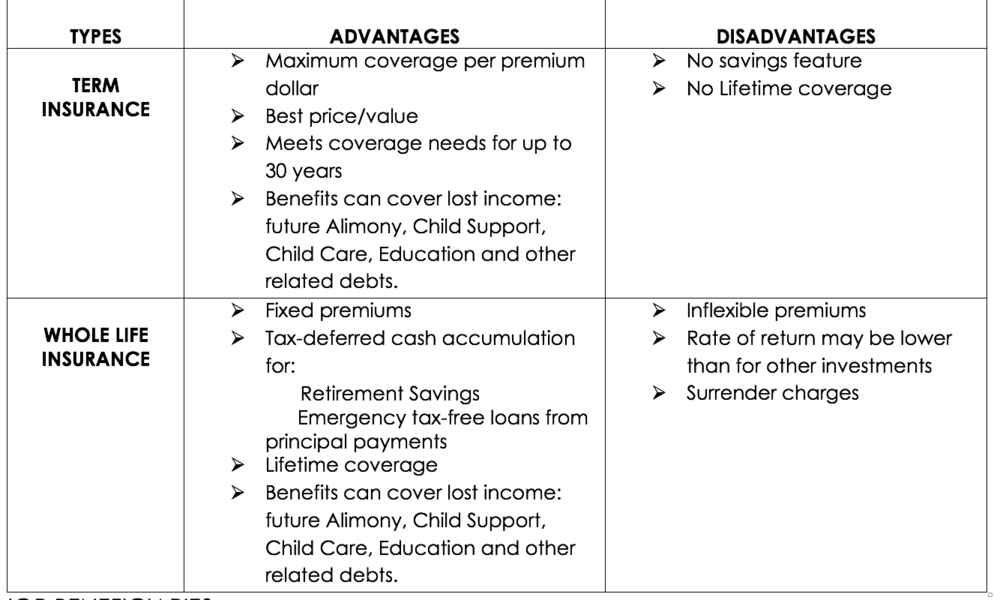

Pros and cons of term life insurance cons:

The insurance industry has repeatedly rebranded this pos insurance to change the name so they can continue to con people into paying super high.

Now that a baseline has been established, let's look closely at what makes whole life insurance stand out.

Whole life insurance has several pros and cons that make it the right choice for some, and the wrong choice for others.

For example, whole life insurance premiums can be as much as 10 times higher than term life premiums for the same level of coverage.

If the primary purpose for considering this product is to offer a death benefit to your loved ones, then there are cheaper products out there which can serve this need when compared to a.

Life insurance that pays a death benefit to your beneficiaries whenever you die.

There is no term limit.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

In truth, there are both pros and cons when it comes to whole life insurance.

In general, it's true that you're better off to buy term and investment difference, but what if you don't actually invest the difference?

In case the insured terminates then there is a risk of not being paid by the company because they may take it as the insured is not paying the premiums during that time.

Participating whole life insurance (pwli) is a contract that is designed to remain in force for the insured's whole life and typically requires premiums to be paid every year.

Instant whole life quotes, who whole life is best suited for, pros and cons, and how whole life insurance works.

Pros of whole life insurance.

Fixed premiums for life even as you age and your health status changes, you will not pay more for your policy.

Cons of whole life insurance.

Whole life insurance, also known as traditional permanent life insurance, is one of the most common and oldest forms of life insurance.

That is being said there are pros and cons of whole life insurance.

When should you buy whole life insurance?

Whole life insurance policies pros and cons [2021 guide].

The whole life insurance consists of the death benefit, accelerated rider, and the investments.

This policy has a savings or investment component and is considered as the most popular and whole life insurance advantages.

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

Pros and cons of whole life insurance.

Both term life insurance and whole life insurance offer guarantees:

Pros and cons of guaranteed issue life insurance.

Whole life insurance is the most established type of permanent policy on the market, and its stability and ease of use keep it a popular option.

Describes a few pros and cons of this type of life coverage.

What are the main pros and cons of whole life insurance?

Danielle barak cltc & financial advisor at northwestern mutual.

Sehat Sekejap Dengan Es BatuAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Jam Piket Organ Tubuh (Jantung)Ternyata Cewek Curhat Artinya SayangMulti Guna Air Kelapa Hijau4 Titik Akupresur Agar Tidurmu Nyenyak6 Khasiat Cengkih, Yang Terakhir Bikin HebohObat Hebat, Si Sisik Naga5 Rahasia Tetap Fit Saat Puasa Ala KiatSehatkuIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatWhat are the main pros and cons of whole life insurance? Whole Life Insurance Pros And Cons. Danielle barak cltc & financial advisor at northwestern mutual.

Whole life insurance plans provide a permanent, guaranteed death benefit and build cash reserves as you pay into the policy.

My mom got a whole life insurance three years back.

Her monthly premium is $290.

I've read quite a lot of negative comment on whole life insurance i checked her life insurance account last night.

Say, you have a whole life insurance with 250k death benefit.

Premium is $2500 per year.

Whole life insurance is one type of permanent life insurance that can last for a lifetime.

Of the several varieties of permanent life insurance on the market, traditional whole life is the oldest and best known.

This article explores its advantages and.

» is whole life insurance a good investment?

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

When you start shopping for life insurance, you will come across two different types:

Here is an objective review of whole life insurance as an investment option.

Whole life insurance offers coverage for your entire lifetime, tax benefits and a cash value.

Whole life insurance policies are a lot like rodney dangerfield, they get no respect.

Spend five minutes researching term life vs.

Whole life and you'll and whole life policies have a cash value that is returned to the insured if the policy is ever canceled.

Here are the pros and cons of whole life insurance.

Whole life insurance has many potential benefits that might make it a strong part of your financial plan.

It will pay a benefit.

Whole life insurance, specifically dividend paying whole life insurance, offered through a mutual insurance company, is a great tool for building a solid financial foundation.

And with a solid financial foundation in place, it will free you up to make better use of your money.

As with many financial topics, americans may hear conflicting.

The reason people prefer taking whole life insurance is it.

Whole life insurance is, first and foremost, permanent life insurance protection that lasts your entire life;

By contrast every whole life contract is unique to the person insured, taking into account their mortality risk, desired coverage level, and what are the pros and cons of whole life insurance?

The silly buyer just naturally assumes he's getting the insurance portion at the going rate (such as what he would.

Here are the whole life insurance pros and cons that you wanted to know.

Whole life insurance has greater flexibility in order to fit your unique situation, needs and goals.

Whole life insurance is the original permanent life insurance contract.

But what are the benefits and drawbacks to owning it?

That's what we intend to discuss today.

It will provide benefits, predictable premiums/returns,various tax advantages.

Buying life insurance is important, particularly life insurance for seniors.

The pros and cons of life insurance plans vary, however, based on the term life, death benefits, and insurance premiums.

![How to protect your children and family [options and steps]](https://onestoplifeinsurance.com/wp-content/uploads/2017/08/Term-Vs-WL-vs-UL.png)

Not only does whole life insurance provide for your loved ones when you die, but it also becomes a cash asset over time.

Advantages and disadvantages of whole life insurance.

The pros and cons of having an insurance policy and investment product rolled into one.

According to the irs, life insurance proceeds you receive as a beneficiary due to the death of the insured person are not generally includable in gross income, and you don't have to.

See our list of pros and cons of whole life insurance along with information about whole life insurance has living benefits, such as the accumulation of cash value which you can access when and how you wish, while term insurance only pays out if the insured dies during the term of the policy.

The pros and cons of whole life insurance depend on what your financial objectives happen to be at this time.

Best life insurance best term life insurance companies best senior life insurance companies compare life insurance quotes cheap life insurance guide to whole life insurance.

What are the pros and cons of term life insurance and whole (aka permanent) life insurance?

Cash value life insurance reviews.

The primary professional for everlasting existence insurance coverage is that so long as your coverage is in excellent status, your the con is that you could have to pay the premiums for your whole existence.

Let's say you purchase it at age 30.

Pros of whole life insurance.

Cons of whole life insurance.

High monthly premiums you'll pay.

Whole life insurance is a must when building your financial foundation, because it grows safely and steadily no matter the economic circumstance, and often does navigating the pros and cons.

In truth, there are both pros and cons when it comes to whole life insurance.

In general, it's true that you're better off to buy term and investment difference, but what if you don't actually invest the difference?

With whole life insurance, the insured is not able to terminate the contract before he or she has reached the required age.

Whole life insurance has several pros and cons that make it the right choice for some, and the wrong choice for others.

One other pro revolves around premiums.

You'll likely find that whole life insurance policies offer fixed premiums.

Deciding between term life insurance and whole life insurance is the first step.

While whole life insurance has pricier premiums, they'll stay consistent for your entire life.

While whole life insurance has pricier premiums, they'll stay consistent for your entire life. Whole Life Insurance Pros And Cons. On the other hand, term life insurance premiums will be far more expensive if you end up purchasing another plan later in life.Waspada, Ini 5 Beda Daging Babi Dan Sapi!!Stop Merendam Teh Celup Terlalu Lama!Buat Sendiri Minuman Detoxmu!!Sejarah Gudeg JogyakartaSusu Penyebab Jerawat???Bakwan Jamur Tiram Gurih Dan NikmatSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatKhao Neeo, Ketan Mangga Ala Thailand3 Jenis Daging Bahan Bakso TerbaikResep Selai Nanas Homemade

Komentar

Posting Komentar