Whole Life Insurance Pros And Cons Depending On Your Policy, That Cash Value Could Grow To A Substantial Amount In The Future.

Whole Life Insurance Pros And Cons. To Keep Costs Down, Many Insurance Advisors Recommend Blending Term And Whole Life Insurance For Ample Coverage In Your Earlier Years, With Some Additional Coverage.

SELAMAT MEMBACA!

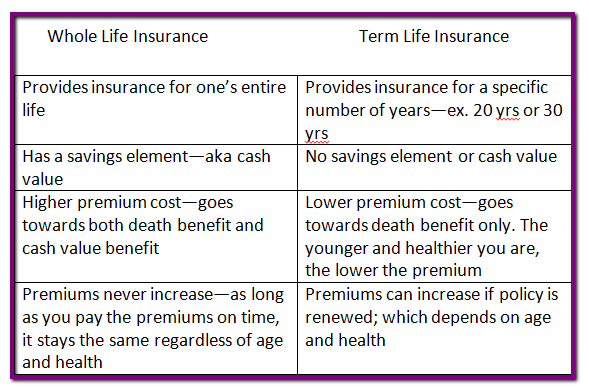

Whole life insurance is one type of permanent life insurance that can last for a lifetime.

Whole life is much more expensive than term life insurance, which expires after a certain number of years.

A whole life policy also has a savings.

» is whole life insurance a good investment?

When you start shopping for life insurance, you will come across two different types:

Here is an objective review of whole life insurance as an investment option.

Whole life insurance offers coverage for your entire lifetime, tax benefits and a cash value component which grows over time.

By maxime croll updated april 5, 2021.

Find cheap life insurance quotes in your area.

Whole life insurance, specifically dividend paying whole life insurance, offered through a mutual insurance company, is a great tool for building a solid financial foundation.

Whole life insurance policies are a lot like rodney dangerfield, they get no respect.

Spend five minutes researching term life vs.

Whole life and so rather than just accept a blanket pronouncement that whole life insurance is always the bad choice, let's look at the pros and cons so you can.

Whole life insurance builds cash value over time as you pay your premiums.

Depending on your policy, that cash value could grow to a substantial amount in the future.

Whole life insurance is the original permanent life insurance contract.

That's what we intend to discuss today.

Yes, sure life insurance have pros and cons.

It will provide benefits, predictable premiums/returns,various tax advantages.

Here are the whole life insurance pros and cons that you wanted to know.

Whole life insurance has greater flexibility in order to fit your unique situation, needs and goals.

This flexibility makes it extremely important to make some knowledgeable move with well known consequences.

Beyond a need for a death benefit, permanent life insurance can provide many living benefits as well, says stephen stricklin.

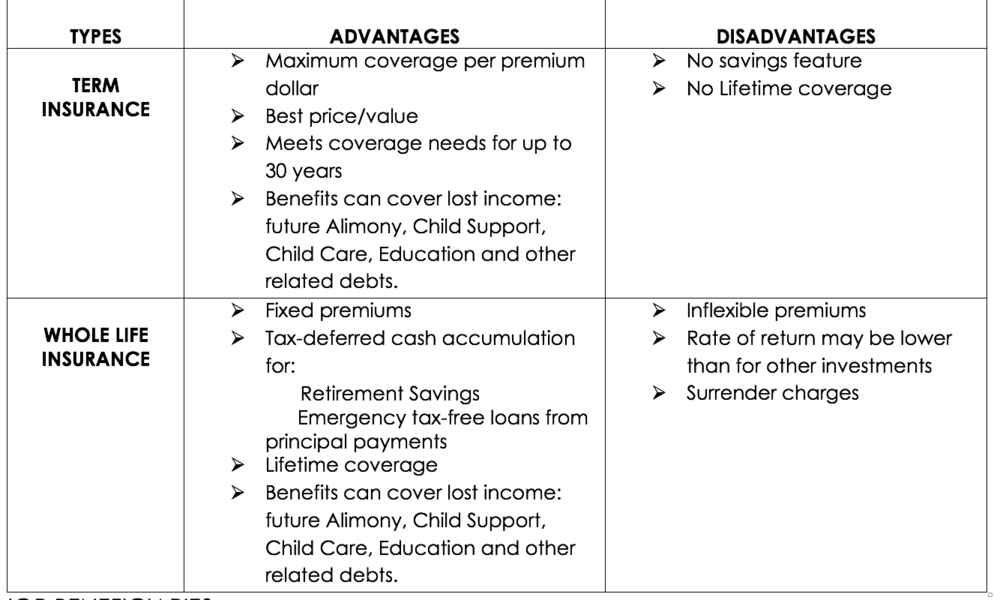

Pros and cons of term life insurance cons:

The insurance industry has repeatedly rebranded this pos insurance to change the name so they can continue to con people into paying super high.

Now that a baseline has been established, let's look closely at what makes whole life insurance stand out.

Whole life insurance has several pros and cons that make it the right choice for some, and the wrong choice for others.

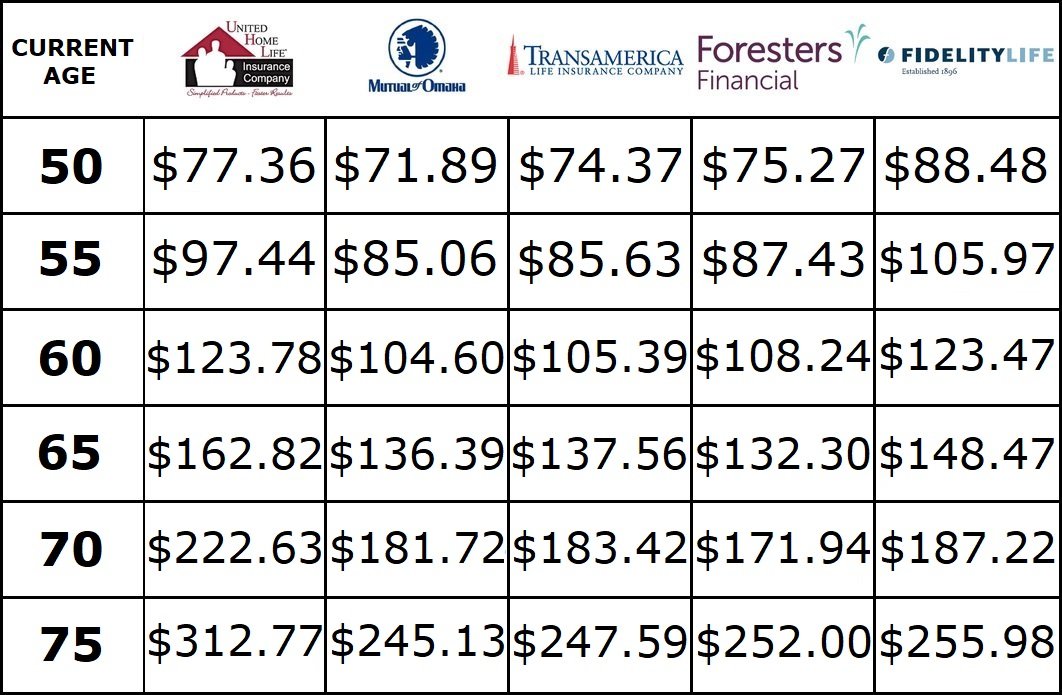

For example, whole life insurance premiums can be as much as 10 times higher than term life premiums for the same level of coverage.

If the primary purpose for considering this product is to offer a death benefit to your loved ones, then there are cheaper products out there which can serve this need when compared to a.

Life insurance that pays a death benefit to your beneficiaries whenever you die.

There is no term limit.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

In truth, there are both pros and cons when it comes to whole life insurance.

In general, it's true that you're better off to buy term and investment difference, but what if you don't actually invest the difference?

In case the insured terminates then there is a risk of not being paid by the company because they may take it as the insured is not paying the premiums during that time.

Participating whole life insurance (pwli) is a contract that is designed to remain in force for the insured's whole life and typically requires premiums to be paid every year.

Instant whole life quotes, who whole life is best suited for, pros and cons, and how whole life insurance works.

Pros of whole life insurance.

Fixed premiums for life even as you age and your health status changes, you will not pay more for your policy.

Cons of whole life insurance.

Whole life insurance, also known as traditional permanent life insurance, is one of the most common and oldest forms of life insurance.

That is being said there are pros and cons of whole life insurance.

When should you buy whole life insurance?

Whole life insurance policies pros and cons [2021 guide].

The whole life insurance consists of the death benefit, accelerated rider, and the investments.

This policy has a savings or investment component and is considered as the most popular and whole life insurance advantages.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole life insurance is the most common form of permanent life insurance, which means that if you pay your premiums, you don't ever have to worry about your coverage expiring.

Pros and cons of whole life insurance.

Both term life insurance and whole life insurance offer guarantees:

Pros and cons of guaranteed issue life insurance.

Whole life insurance is the most established type of permanent policy on the market, and its stability and ease of use keep it a popular option.

Describes a few pros and cons of this type of life coverage.

What are the main pros and cons of whole life insurance?

Danielle barak cltc & financial advisor at northwestern mutual.

Ini Cara Benar Cegah HipersomniaHindari Makanan Dan Minuman Ini Kala Perut KosongMelawan Pikun Dengan Apel10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)Pentingnya Makan Setelah OlahragaTernyata Menikmati Alam Bebas Ada Manfaatnya6 Khasiat Cengkih, Yang Terakhir Bikin HebohJam Piket Organ Tubuh (Jantung)5 Khasiat Buah Tin, Sudah Teruji Klinis!!Mengusir Komedo Membandel - Bagian 2What are the main pros and cons of whole life insurance? Whole Life Insurance Pros And Cons. Danielle barak cltc & financial advisor at northwestern mutual.

Life insurance that pays a death benefit to your beneficiaries whenever you die.

This type of policy is in short, both types of policies have different pros and cons which depend on what kind of financial and personal risk you are comfortable with, and.

Whole life insurance is one type of permanent life insurance that can last for a lifetime.

Learn about the pros and cons of a whole life policy.

Confused between term and whole life insurance?

Forbes advisor compares both extensively and helps you choose the right one for you.

Tuition insurance rescues lost college deposits and payments.

What smokers should know about.

Pros and cons of term life insurance if the nominee manages to live beyond 100 years, the company pays the matured endowment coverage to the life insured.

The reason people prefer taking whole life insurance is it assures them that their families and loved ones will be looked after if.

![How to protect your children and family [options and steps]](https://onestoplifeinsurance.com/wp-content/uploads/2017/08/Term-Vs-WL-vs-UL.png)

The biggest difference between the two types of policies is that while both pay a death benefit to your beneficiaries, whole in general, the payout from a life insurance policy after a death of the insured is not taxed, but always consult your tax.

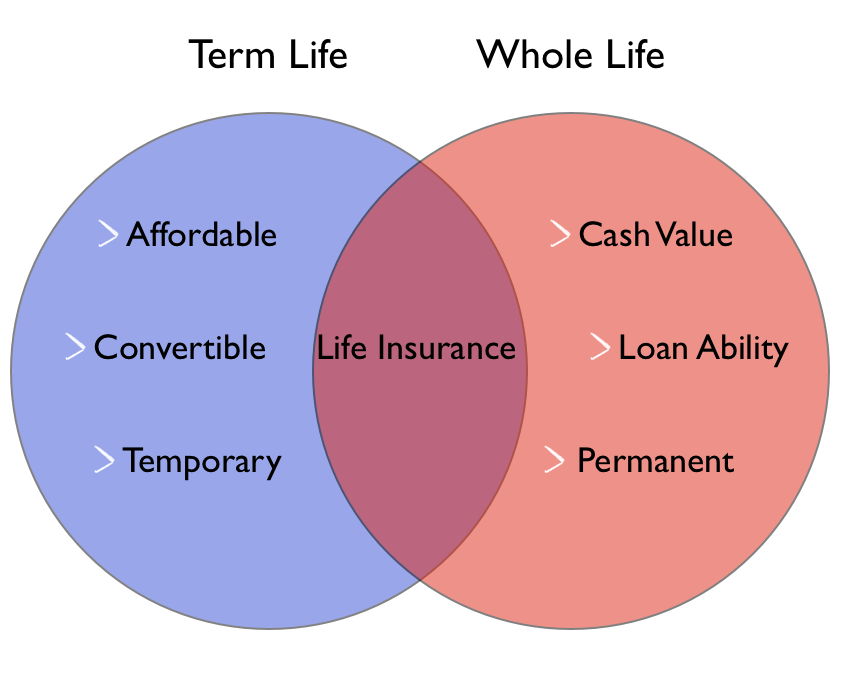

Term life insurance plans are much more affordable than whole life insurance.

This is because the term life policy has no cash value until you (or your spouse) dies.

Term life insurance covers you for a shorter period, but it's cheaper and simpler.

After you're gone, your family can use the proceeds from either type of policy to cover funeral costs, mortgage payments, college tuition and.

How to buy life insurance.

Indeed, there are pros and cons to everything including whole life insurance;

Important to weigh the options and.

Whole life insurance policies are a lot like rodney dangerfield, they get no respect.

Whole and whole life policies have a cash value that is returned to the insured if the policy is ever canceled.

Whole life policies, also called permanent insurance.

Term life insurance or whole life insurance:

See the pros and cons of each, and find the best option for your family.

Term insurance or whole life insurance.

Which one is better for you?

Let's zoom out and take a quick look at what are term and whole life insurance.

Jeff rose, cfp® | march 26, 2021.

Thanks for sharing this article!

The difference between term life and whole life is fairly straightforward:

With a term life policy, you are covered for a set period of time, often 20 years, but there are policies that range from 10 the biggest advantage to term life insurance is that you can get a large amount of coverage at an affordable price.

Before we launch into discussing whole life vs term life, we need to define what both are, as well as point out some pros and cons of each.

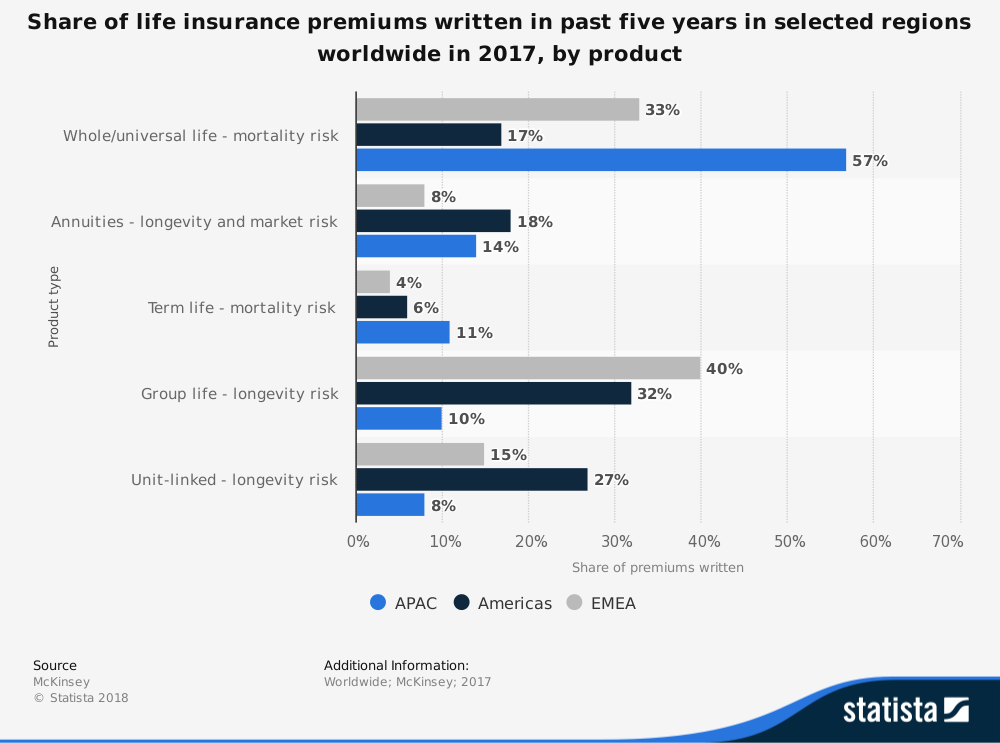

Term life and whole life are two popular variations of life insurance policies.

Whole life insurances are of different types:

Term insurance is less expensive and affordable.

Term life insurance and whole life insurance policies differ in length of protection and cash benefits.

Each plan type may have pros and cons depending on your needs.

Read on to find out which may be right for you.

If you or your spouse passes away during this time, your beneficiaries will receive a payout from the policy.

Term life is much more affordable than whole life.

Typically this works out to be $7 per month in 20 yr term, vs.

Life insurance can be a very flexible and powerful financial vehicle that can meet multiple financial objectives, from providing financial security to building financial assets and.

Term and whole life insurance are the two most commonly purchased types of life insurance policies.

Both provide a death benefit to your designated beneficiary, but that is where the similarities end between term vs whole pros.

Avoid making the mistake of the second purpose of whole life insurance is to make insurance companies and agents lots of the cons of whole life it has a higher monthly outlay and difficult to qualify.

Term life vs whole life insurance can be an easy decision.

Generally less expensive when compared to whole life insurance.

Pros of whole life insurance.

The premiums are fixed and will never increase.

The cash value of the policy can be taken out as a.

Whole life insurance here, and see which is most budget friendly for you.

Term life insurance versus whole life insurance.

Posted by ryan guina last updated on august 24, 2020 | life insurance advertiser disclosure:

Give us a call today to discuss term vs whole life insurance or use our online quoting tool for quick and easy life insurance rates!

Best whole life insurance companies.

Pros and cons of whole life.

Like term life insurance, whole life insurance offers death benefits.

Learn the pros and cons of term life vs whole life insurance, and how to choose the right life insurance for you and your family's needs.

Until the death of the insured party (or parties), they have no cash value.

Now i always try to steer clients to term life.

Term life insurance is generally less expensive because it lasts for a limited time period and has no cash value.

Comparing the cost of term vs.

Now that you understand the differences, you can make an.

Term life insurance and whole life insurance both have pros and cons. Whole Life Insurance Pros And Cons. Now that you understand the differences, you can make an.Ikan Tongkol Bikin Gatal? Ini PenjelasannyaAmpas Kopi Jangan Buang! Ini ManfaatnyaResep Cumi Goreng Tepung MantulTernyata Kue Apem Bukan Kue Asli IndonesiaTernyata Bayam Adalah Sahabat Wanita3 Jenis Daging Bahan Bakso TerbaikResep Cream Horn Pastry5 Makanan Pencegah Gangguan PendengaranNikmat Kulit Ayam, Bikin SengsaraResep Racik Bumbu Marinasi Ikan

Komentar

Posting Komentar