Whole Life Insurance Vs Term Since Life Insurance Companies Do Not Have To Manage Anything For You This Cuts The Rate They Can Offer You On The Policy.

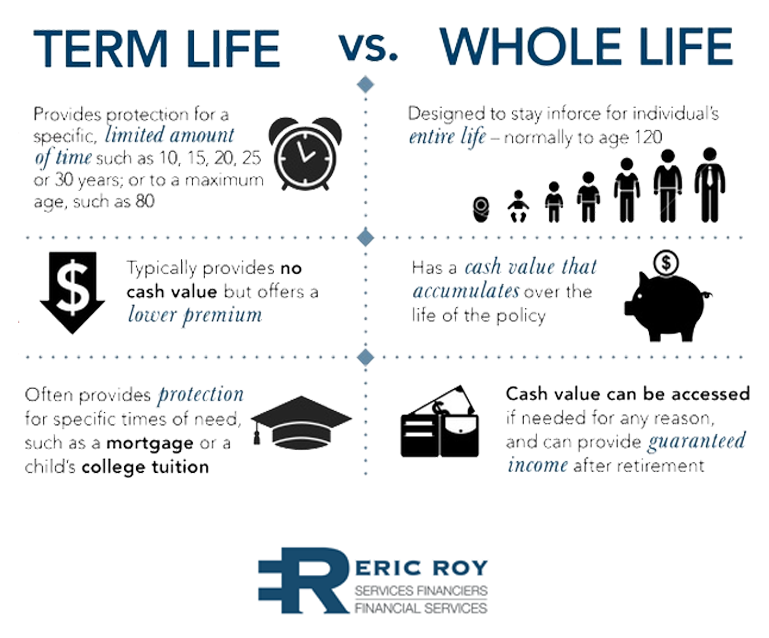

Whole Life Insurance Vs Term. Both Provide A Death Benefit To Your Designated Beneficiary, But That Is Where The The Biggest Difference Between Term Vs Whole Life Insurance Is Length.

SELAMAT MEMBACA!

What is the difference between term and whole life insurance?

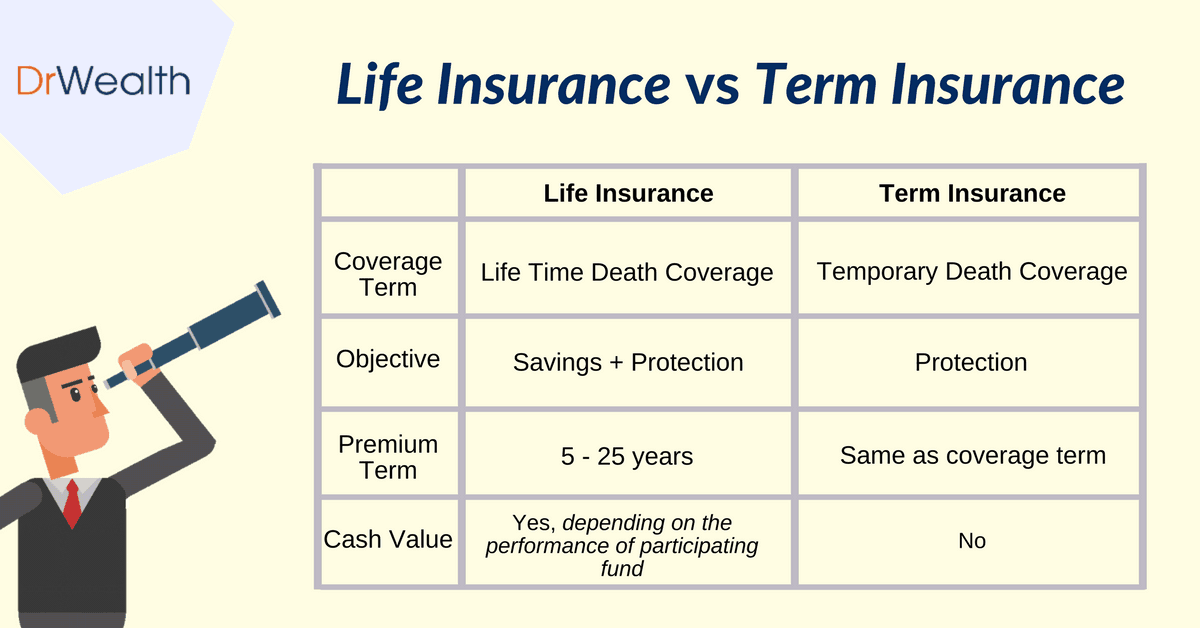

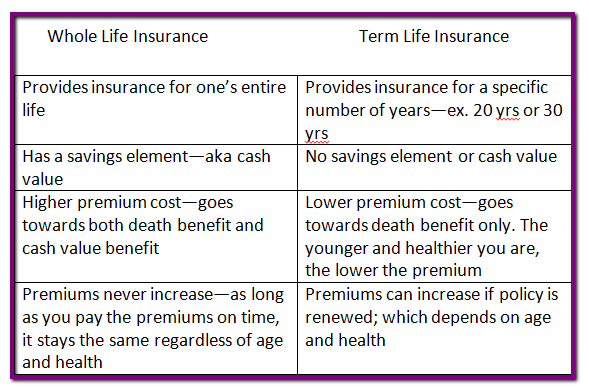

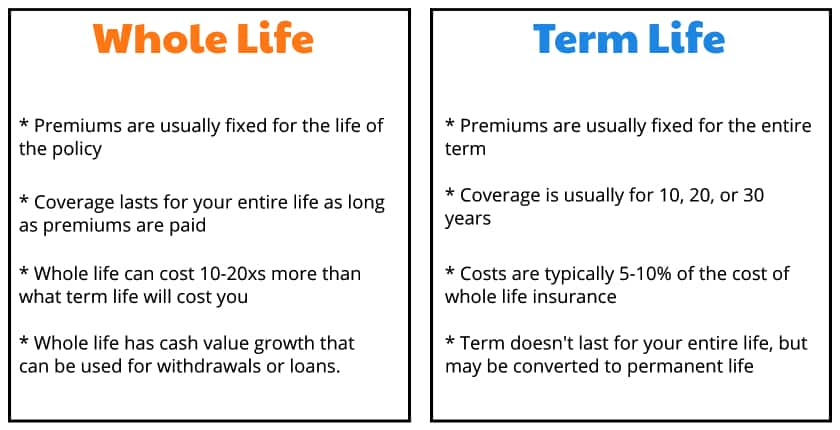

Unlike term insurance, whole life policies cover you for life and add cash value that you can tap for future needs.

Two of the oldest varieties of life insurance, term and whole life, remain among the most popular types.

The policy expires at the end of the term.

But it's because the part of his premium that isn't insuring him is.

(decide which is right for you).

Deciding whether to purchase whole life or term life insurance is a personal decision that should be based on the financial needs of your beneficiaries as well as your financial.

A term life insurance policy is exactly what the name implies:

It's a policy that provides coverage for a specific term or period of time, typically between 10 and 30 years.

Confused between term and whole life insurance?

Term life insurance can be a great way to protect yourself.

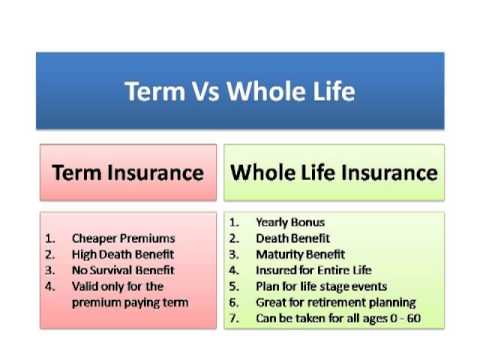

Term insurance is also the cheapest form of life insurance for these reasons.

Since life insurance companies do not have to manage anything for you this cuts the rate they can offer you on the policy.

Total face amount stems in part from the fact that term life insurance tends to be less expensive than whole life, since your risk of dying.

Term life insurance and whole life insurance policies differ in length of protection and cash benefits.

Find out which may be right for you.

3 min read october 17, 2019.

If you or your spouse passes away during this time, your beneficiaries will receive a payout from the policy.

Typically this works out to be $7 per month in 20 yr term, vs $100 with whole life cash value.

Term insurance is sometimes referred to as pure life insurance because its sole purpose is to provide financial unlike whole/universal life insurance, a term policy has no value other than the death benefit.

Buying life insurance sounds like a complicated decision, but most people can start shopping by making a simple comparison:

Whole life money expert clark howard likes term life for most everyone.

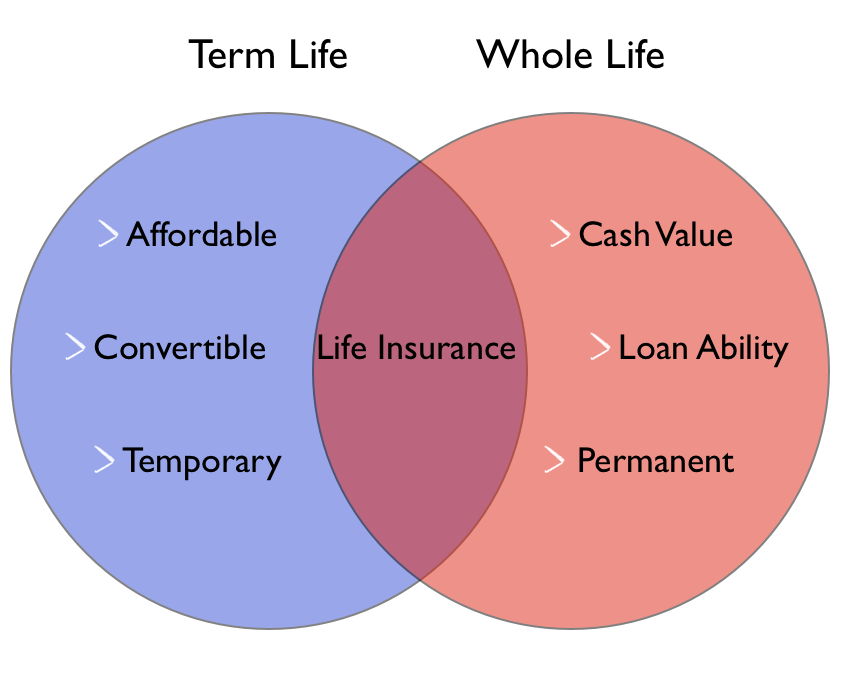

Unlike term life policies, whole life insurance policies (also known as permanent life insurance) offer coverage for your entire life.

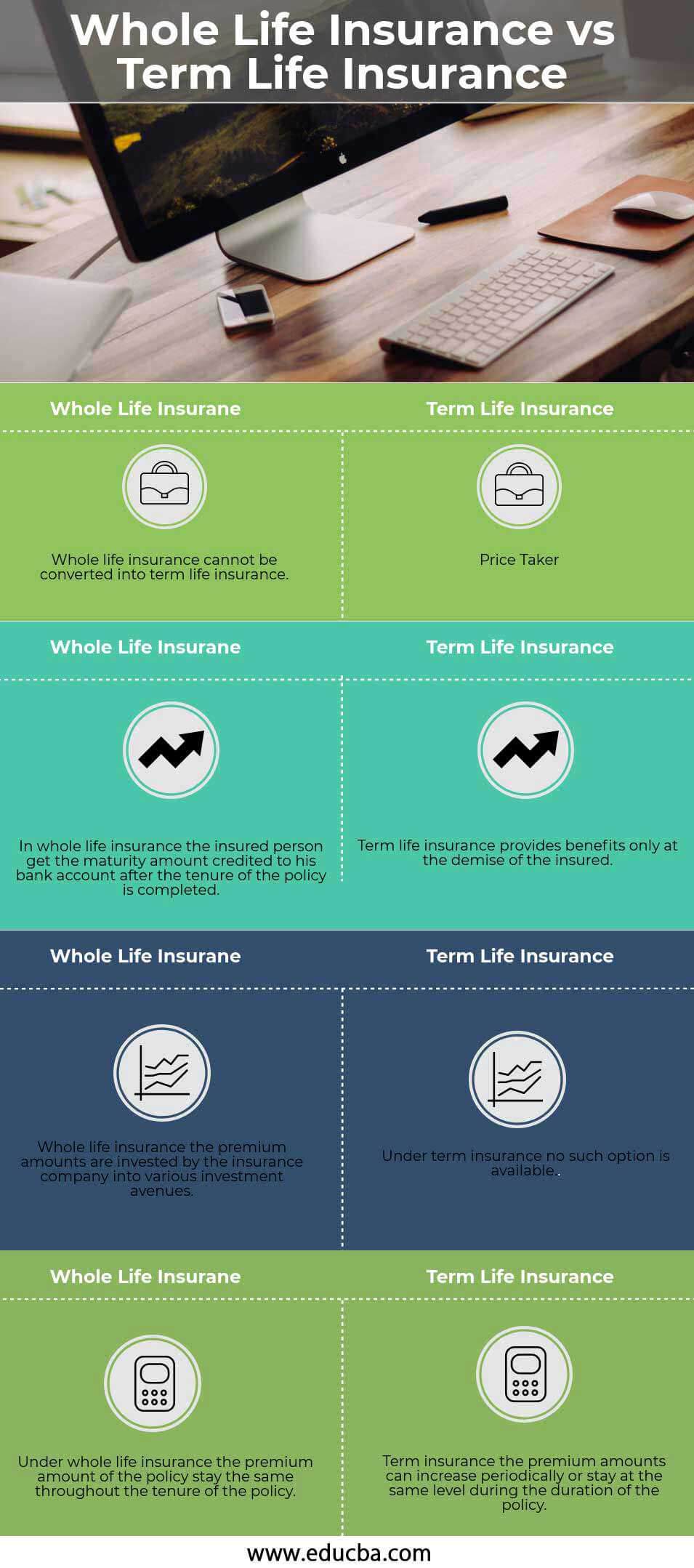

For a clearer picture of some of the similarities and differences between the two, we created this whole vs.

Term life insurance comparison chart.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of buying the wrong coverage.here's how.

This post may contain affiliate links.

Term and whole life insurance are the two most commonly purchased types of life insurance policies.

Both provide a death benefit to your designated beneficiary, but that is where the the biggest difference between term vs whole life insurance is length.

Term has a set limit of time for coverage.

These plans have pricier premiums, but they squirrel away savings that can help grow the benefit for those.

Term life insurance vs whole life:

As a licensed insurance agent, i recommend term life insurance for 95% of the entire u.s.

I have stayed generic term insurance and whole life insurance has their own benefits and they need to be bought based on your objectives.

Since you have directly asked for.

Term life insurance or whole life insurance:

See the pros and cons of each, and find the best option for your family.

While there are many types of life insurance policies to choose from, two categories you'll see frequently are term and whole.

Similar to whole life, except with two lives insured.

Things get complicated when you add in all the types of each category of life insurance.

But this should be one part of a comprehensive estate plan.

Term insurance is life insurance taken for a certain period or term.

This has been a guide to term life insurance vs whole life insurance.

Here we discuss the top differences between this.

Term life insurance can be one way to balance affordability with future financial security.

Term life whole life duration predetermined (5, 10, 15, 20, 25 or 30 years) entire life premium variations typically stays the same typically stays the same premium.

Key differences between whole life insurance vs term life insurance.

This has a been a guide to the top difference between both life insurance.

Term life insurance vs whole life insurance, there are many differences between the two.

Learn the differences between term and whole life insurance and discover their unique benefits.

New york life can get you the right fit for the right situation.

How is term life insurance different from whole life?

Term life insurance covers you for a specified length of time.

Many insurers offer term lengths in increments of five years — like 5, 10, 15, 20, 25 or 30 years.

As you're deciding which policy is right for you, consider the following differences in features

10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)Obat Hebat, Si Sisik NagaJam Piket Organ Tubuh (Hati)Awas!! Ini Bahaya Pewarna Kimia Pada MakananPentingnya Makan Setelah OlahragaCara Baca Tanggal Kadaluarsa Produk MakananMengusir Komedo Membandel - Bagian 2Jam Piket Organ Tubuh (Jantung) Bagian 2Jam Piket Organ Tubuh (Lambung) Bagian 2Ternyata Menikmati Alam Bebas Ada ManfaatnyaWhole life insurance tends to be more expensive than term life insurance and sometimes people underestimate how much the payments will be, so they term vs. Whole Life Insurance Vs Term. As you're deciding which policy is right for you, consider the following differences in features

Whole life insurance premiums are much higher because the coverage lasts for a lifetime, and the policy has cash value, with a guaranteed rate of investment return on a portion of the money that you pay.

Whole life insurance offers consistent premiums and guaranteed cash value accumulation while universal life insurance gives consumers flexibility.

Permanent life insurance refers to coverage that never expires, unlike term life insurance, and combines a death benefit with a savings component.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Let's say we have a friend named greg who's in his 30s and wants to secure $250.

If the distinction between term and whole life insurance seems vague to you, you're not alone.

But to protect your family, it's important to know the basics.

What are the pros and cons to each kind of policy?

What should you consider before buying a policy?

I have stayed generic since the answer is relevant for all markets.

Jeff rose, cfp® | march 26, 2021.

Term life insurance can be a great way to protect yourself.

Term insurance is a life insurance policy that is only good for a certain term, or amount of time such as 10, 20, 0r 30 years.

Term life insurance generally provides a higher death benefit for a smaller premium, because it does not need to last your entire life.

Whole life insurance is the most expensive type of life insurance.

The advantages of a whole life insurance policy include guaranteed death benefits, guaranteed cash values term life insurance provides life insurance coverage for a specified term of years in exchange for a specified premium.

Moreover, often there are hidden costs in whole life insurance policies such as

The key difference between whole life insurance and term life insurance is, as the names may suggest, the duration the insurance lasts for.

(decide which is right for you).

Best life insurance for seniors.

Term vs whole life insurance.

How much life insurance do you really need?

And once you understand the types of coverage that are available, it's really not that confusing.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of buying the wrong coverage.here's how.

Which is a better choice for you?

Term life insurance or whole life insurance:

What's the difference, which is best?

If you or your spouse passes away during this time, your whole life is a form of permanent life insurance with 3 components:

Cash value accumulation (savings aspect) when you.

Confused about the difference between whole life insurance and term life insurance?

It is not our partner's responsibility to ensure all posts or questions are answered.

Why choose whole life insurance.

Lower cost for term vs whole life.

To prequalify, you must answer a long list of choosing between term life vs whole life will depend on your goals and needs.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whether you're entering adulthood or nearing retirement, you may have a need for life insurance… but understanding which policy is best for you can be confusing.

In case of death of the policyholder, the sum assured is paid to the what is whole life insurance?

The life policies are legal contracts and the terms and conditions mentioned describe the limitations of the insured events.

Are you in the market for whole life insurance?

With pros and cons across the board, it's important to keep one you can learn as much as you want about whole and term life insurance, but only you can make a final decision as to which coverage suits you best.

Learn about the difference between term and whole life insurance policies, and which term life insurance covers you for a specified length of time.

Whole life insurance appeared first on smartasset blog.

Term life insurance is often offered at lower prices due to its set term length and is easier to conceptually understand.

Due to this getting a life insurance or medical insurance for any amount of money or tenure becomes a paramount requirement these days.

Both life insurance are popular choices in the market;

It's designed to protect your dependents and family members if you pass away prematurely.

When you apply for term life, the insurance company quotes you a rate based on your age, health (including whether you smoke), gender and other factors.

Difference between term life and whole life.

![How to protect your children and family [options and steps]](https://onestoplifeinsurance.com/wp-content/uploads/2017/08/Term-Vs-WL-vs-UL.png)

Term insurance is pure insurance.

If you die, the insurance company will pay your beneficiaries the face amount of the policy.

Should you determine that you have a permanent need for life insurance, you will find a wide variety of whole and universal life insurance policies on the market, all with.

The biggest difference when it comes to term life insurance vs.

Whole life insurance is that term life coverage has an expiration date.

How does whole life insurance compare to a term policy? Whole Life Insurance Vs Term. The reasons for taking out life insurance may well vary, and this could affect the type of policy one looks to take out.Resep Yakitori, Sate Ayam Ala JepangKuliner Jangkrik Viral Di JepangTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiResep Kreasi Potato Wedges Anti Gagal3 Jenis Daging Bahan Bakso TerbaikResep Beef Teriyaki Ala CeritaKulinerTernyata Kamu Tidak Tau Makanan Ini Khas Bulan RamadhanKhao Neeo, Ketan Mangga Ala Thailand9 Jenis-Jenis Kurma Terfavorit5 Makanan Pencegah Gangguan Pendengaran

Komentar

Posting Komentar