Whole Life Insurance Vs Term Term Life Whole Life Duration Predetermined (5, 10, 15, 20, 25 Or 30 Years) Entire Life Premium Variations Typically Stays The Same Typically Stays The Same Premium.

Whole Life Insurance Vs Term. Term Life Insurance Can Be A Great Way To Protect Yourself.

SELAMAT MEMBACA!

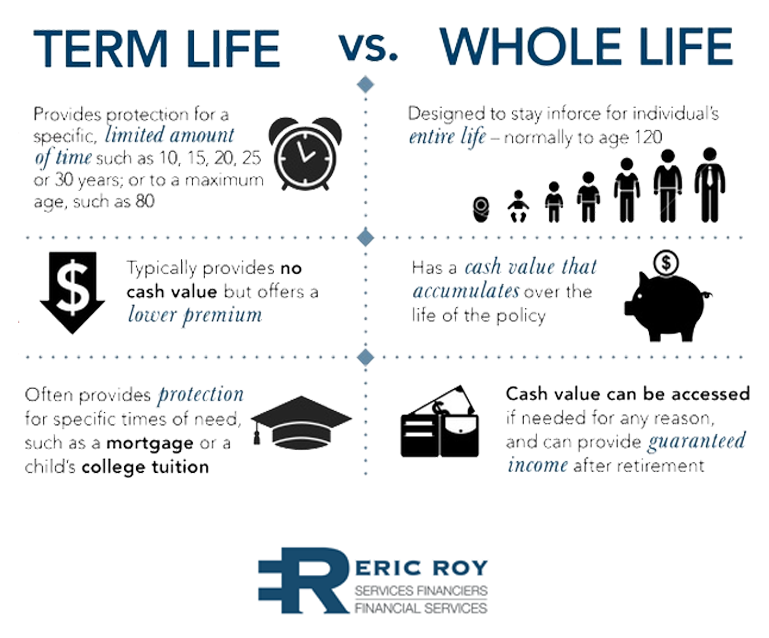

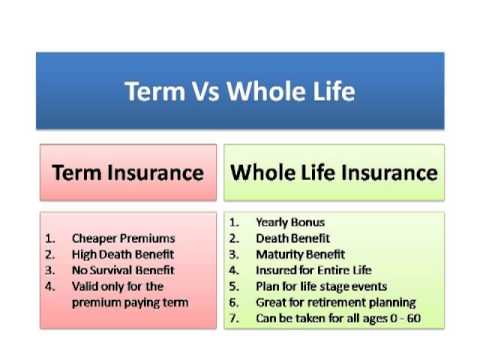

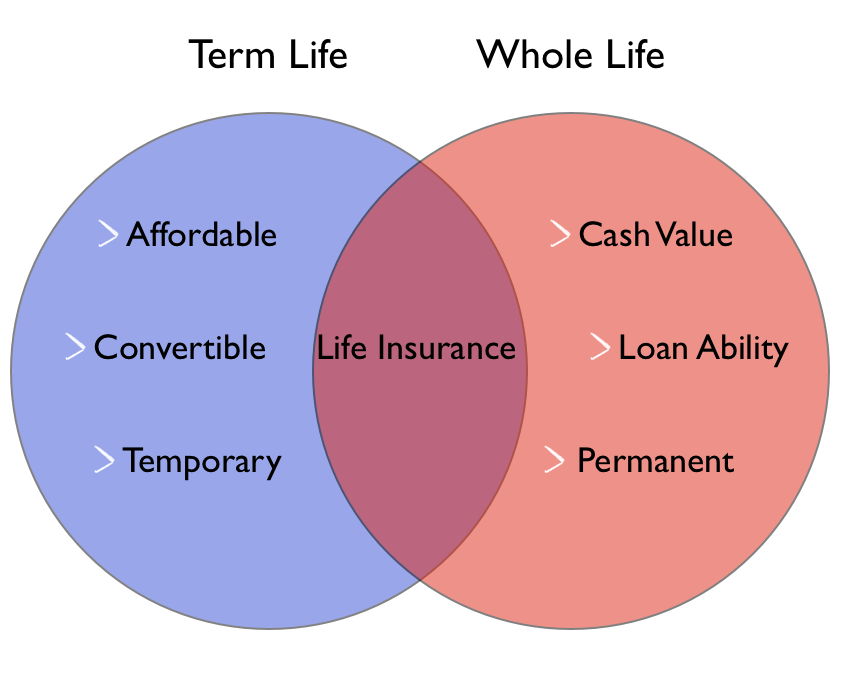

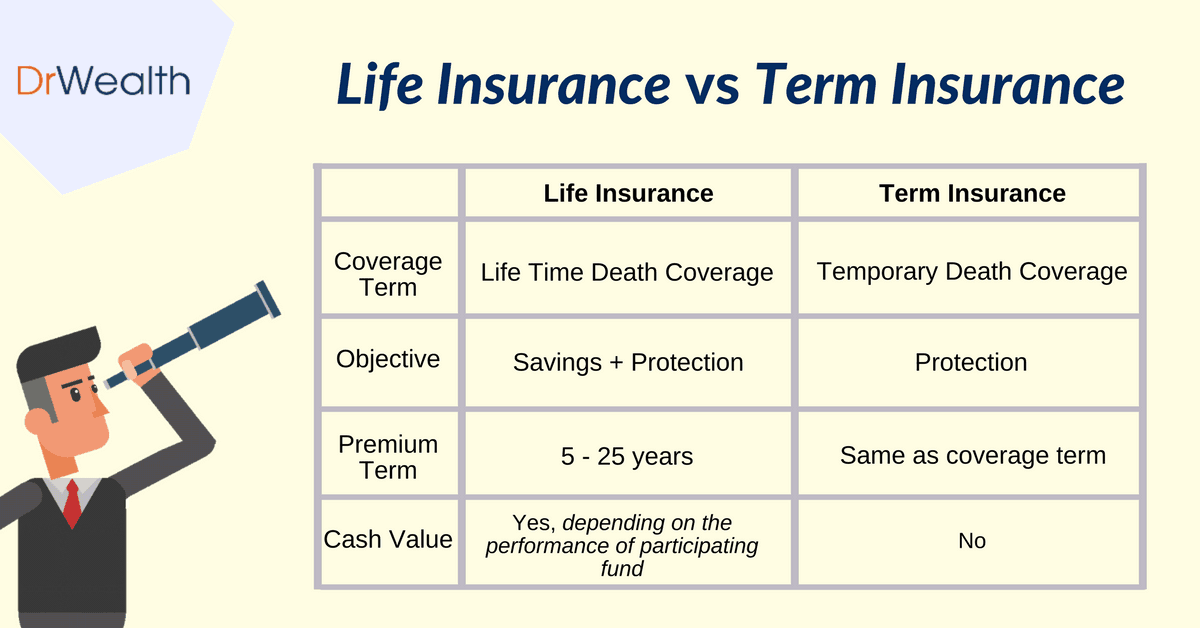

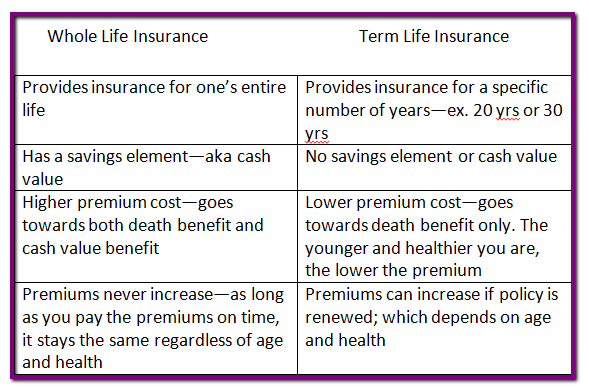

Whole life insurance is more complex and tends to cost more than term, but it offers additional benefits.

Unlike term insurance, whole life policies cover you for life and add cash value that you can tap for future needs.

Two of the oldest varieties of life insurance, term and whole life, remain among the most popular types.

The policy expires at the end of the term.

A term life insurance policy is exactly what the name implies:

It's a policy that provides coverage for a specific term or period of time, typically between 10 and 30 years.

Let's say we have a friend named greg who's in his 30s and wants to secure $250,000 of life insurance for if greg goes with the whole life, cash value option, he'll pay a hefty monthly premium.

Confused between term and whole life insurance?

Forbes advisor compares both extensively and helps you choose the right one for you.

Term life insurance can be a great way to protect yourself.

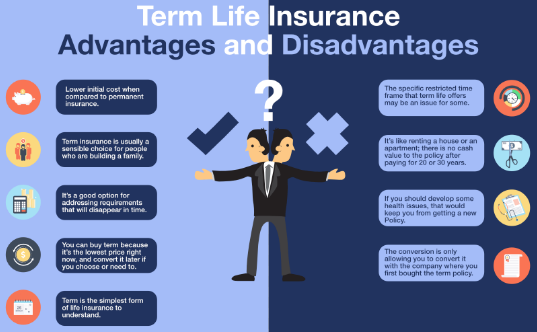

Since life insurance companies do not have to manage anything for you this cuts the rate they can offer you on the policy.

(decide which is right for you).

Deciding whether to purchase whole life or term life insurance is a personal decision that should be based on the financial needs of your beneficiaries as well as your financial.

Total face amount stems in part from the fact that term life insurance tends to be less expensive than whole life, since your risk of dying.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of buying the wrong coverage.here's how.

Please read our disclosure for more info.

Term vs whole life insurance:

Term insurance is sometimes referred to as pure life insurance because its sole purpose is to provide financial unlike whole/universal life insurance, a term policy has no value other than the death benefit.

Find out which may be right for you.

How to choose between term vs.

3 min read october 17, 2019.

Buying life insurance sounds like a complicated decision, but most people can start shopping by making a simple comparison:

Whole life money expert clark howard likes term life for most everyone.

In this article, i'll explain how term life and whole life insurance are different, i'll.

Typically this works out to be $7 per month in 20 yr term, vs $100 with whole life cash value.

Knowing the distinction between whole life and term life insurance can mean all the difference in the world for a head of household.

Term and whole life insurance are the two most commonly purchased types of life insurance policies.

Term has a set limit of time for coverage.

Similar to whole life, except with two lives insured.

Which is best for you?

But this should be one part of a comprehensive estate plan.

Term life insurance or whole life insurance:

What's the difference, which is best?

While there are many types of life insurance policies to choose from, two categories you'll see frequently are term and whole.

I have stayed generic since premiums will not be refunded in any scenario in term insurance policies unless a genuine claim against the death of the insured is made, in which.

Term insurance is life insurance taken for a certain period or term.

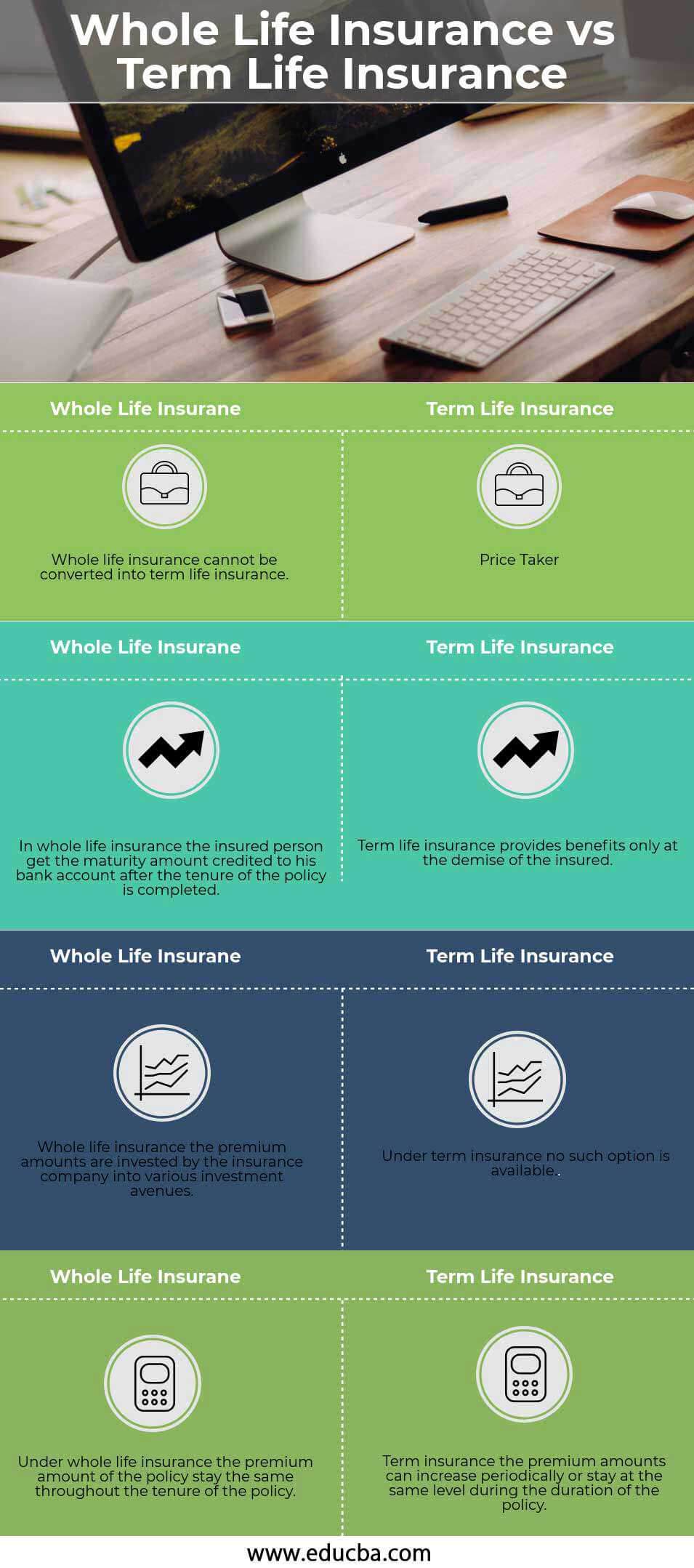

Let's see the top differences between term life vs whole life insurance.

Understanding the differences between the two policy types is often confusing.

Term life whole life duration predetermined (5, 10, 15, 20, 25 or 30 years) entire life premium variations typically stays the same typically stays the same premium.

New york life can get you the right fit for the right situation.

Term life insurance can be one way to balance affordability with future financial security.

Meanwhile, like other permanent life insurance, whole life policies last your entire lifetime.

Key differences between whole life insurance vs term life insurance.

This has a been a guide to the top difference between both life insurance.

Here we also discuss the whole life insurance vs term life insurance key differences with infographics, and comparison table.

As a licensed insurance agent, i recommend term life insurance for 95% of the entire u.s.

This is because they are very easy to understand and the premiums are super affordable.

Find out which type is right for you.

When weighing term life insurance vs.

Whole life insurance, it may boil down to two things:

Obat Hebat, Si Sisik NagaTernyata Mudah Kaget Tanda Gangguan MentalTernyata Tidur Terbaik Cukup 2 Menit!Sehat Sekejap Dengan Es BatuMengusir Komedo Membandel - Bagian 2Pentingnya Makan Setelah OlahragaTernyata Menikmati Alam Bebas Ada Manfaatnya5 Manfaat Posisi Viparita KaraniTernyata Merokok + Kopi Menyebabkan KematianSalah Pilih Sabun, Ini Risikonya!!!How long you think you'll need coverage, and how much for more information on term life insurance vs. Whole Life Insurance Vs Term. Term life insurance vs whole life insurance, there are many differences between the two.

Whole life insurance is more complex and tends to cost more than term, but it offers additional benefits.

Unlike term insurance, whole life policies cover you for life and add cash value that you can tap for future needs.

Two of the oldest varieties of life insurance, term and whole life, remain among the most popular types.

The policy expires at the end of the term.

A term life insurance policy is exactly what the name implies:

It's a policy that provides coverage for a specific term or period of time, typically between 10 and 30 years.

Let's say we have a friend named greg who's in his 30s and wants to secure $250,000 of life insurance for if greg goes with the whole life, cash value option, he'll pay a hefty monthly premium.

Confused between term and whole life insurance?

Forbes advisor compares both extensively and helps you choose the right one for you.

Term life insurance can be a great way to protect yourself.

Since life insurance companies do not have to manage anything for you this cuts the rate they can offer you on the policy.

(decide which is right for you).

Deciding whether to purchase whole life or term life insurance is a personal decision that should be based on the financial needs of your beneficiaries as well as your financial.

Total face amount stems in part from the fact that term life insurance tends to be less expensive than whole life, since your risk of dying.

Should you buy term term life insurance vs whole life insurance?

Avoid making the mistake of buying the wrong coverage.here's how.

Please read our disclosure for more info.

Term vs whole life insurance:

Term insurance is sometimes referred to as pure life insurance because its sole purpose is to provide financial unlike whole/universal life insurance, a term policy has no value other than the death benefit.

Find out which may be right for you.

How to choose between term vs.

3 min read october 17, 2019.

Buying life insurance sounds like a complicated decision, but most people can start shopping by making a simple comparison:

Whole life money expert clark howard likes term life for most everyone.

In this article, i'll explain how term life and whole life insurance are different, i'll.

Typically this works out to be $7 per month in 20 yr term, vs $100 with whole life cash value.

Knowing the distinction between whole life and term life insurance can mean all the difference in the world for a head of household.

Term and whole life insurance are the two most commonly purchased types of life insurance policies.

Term has a set limit of time for coverage.

Similar to whole life, except with two lives insured.

Which is best for you?

But this should be one part of a comprehensive estate plan.

Term life insurance or whole life insurance:

What's the difference, which is best?

While there are many types of life insurance policies to choose from, two categories you'll see frequently are term and whole.

I have stayed generic since premiums will not be refunded in any scenario in term insurance policies unless a genuine claim against the death of the insured is made, in which.

Term insurance is life insurance taken for a certain period or term.

Let's see the top differences between term life vs whole life insurance.

Understanding the differences between the two policy types is often confusing.

Term life whole life duration predetermined (5, 10, 15, 20, 25 or 30 years) entire life premium variations typically stays the same typically stays the same premium.

New york life can get you the right fit for the right situation.

Term life insurance can be one way to balance affordability with future financial security.

Meanwhile, like other permanent life insurance, whole life policies last your entire lifetime.

Key differences between whole life insurance vs term life insurance.

This has a been a guide to the top difference between both life insurance.

Here we also discuss the whole life insurance vs term life insurance key differences with infographics, and comparison table.

As a licensed insurance agent, i recommend term life insurance for 95% of the entire u.s.

This is because they are very easy to understand and the premiums are super affordable.

Find out which type is right for you.

When weighing term life insurance vs.

Whole life insurance, it may boil down to two things:

How long you think you'll need coverage, and how much for more information on term life insurance vs. Whole Life Insurance Vs Term. Term life insurance vs whole life insurance, there are many differences between the two.Resep Nikmat Gurih Bakso Lele9 Jenis-Jenis Kurma TerfavoritKuliner Legendaris Yang Mulai Langka Di Daerahnya3 Cara Pengawetan CabaiResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangIkan Tongkol Bikin Gatal? Ini PenjelasannyaTips Memilih Beras BerkualitasResep Racik Bumbu Marinasi IkanSusu Penyebab Jerawat???Resep Ponzu, Cocolan Ala Jepang

Komentar

Posting Komentar