Whole Life Insurance Deutsch Whole Life Insurance Provides Lifelong Protection.

Whole Life Insurance Deutsch. Client And Company Manage Investments.

SELAMAT MEMBACA!

Beispielsätze für whole life insurance auf deutsch.

Bab.la ist für diese inhalte nicht verantwortlich.

Englishwith whole life insurance you can provide financial security for your family or anyone near to you.

'� einer oder mehr forum threads stimmen mit ihrem gesuchten begriff überein.

The insurance component pays a stated amount upon death of the insured.

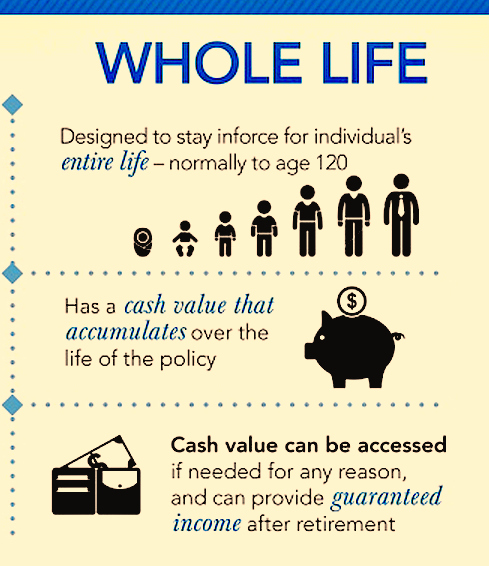

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance is a type of permanent life insurance that offers cash value.

So, in that way, it can be seen as a kind of investment, as well as a way to provide for loved ones after the die.

Client and company manage investments.

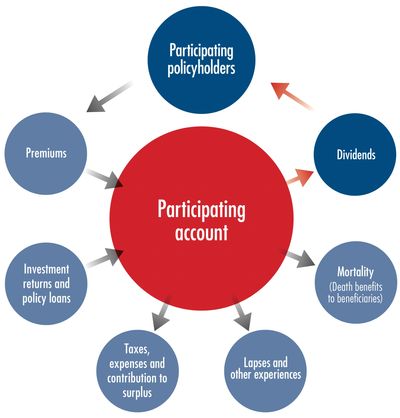

Traditional whole life insurance uses a savings account as the managed investment portion of the policy.

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and consistent premiums.

These policies include a cash value account, which is the investment component in permanent policies.

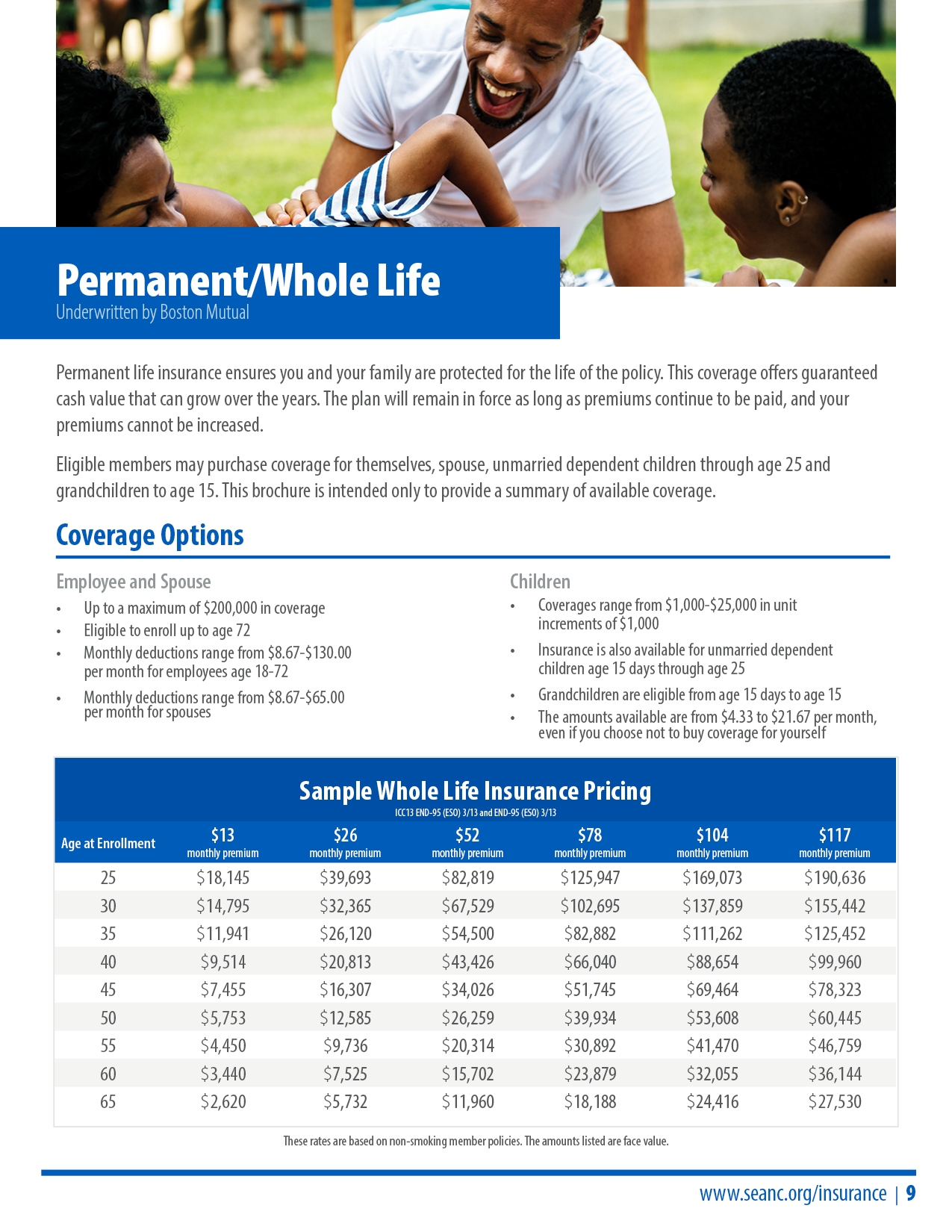

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

Whole life insurance is permanent protection that lasts your entire life, at a guaranteed premium rate that will never increase, regardless of your age or health status.

One benefit of whole life insurance is that it accumulates cash value that can be borrowed against during your lifetime.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

Whole life insurance can help provide financial protection for your whole life.

Learn about the benefits of whole life insurance and get a free quote today.

Provides coverage for the entirety of the insured's life, generally to age 100, as long as the policy is in force.

Traditionally, whole life insurance is a consumer demanded product.

Whole life insurance is one of the four main types of permanent life insurance.

Instead of buying a policy for say 10 years as you would with term life, you whole life insurance coverage lasts as long as you pay the premiums.

Whole life insurance is a type of permanent life insurance that helps protect your loved ones in the future and your finances now.

A guardian whole life insurance policy covers you for your entire life, rather than a limited term as with term life insurance (which typically covers you for a period of 10.

Whole life insurance policies have a level premium, they accumulate a guaranteed amount of cash value each year, and the death benefit is also index universal life insurance is another whole life alternative.

Whole life insurance accumulates cash value, too, providing you the option of borrowing against it.1 it's a financially smart way to help protect yourself and your loved ones.

You can even buy a separate policy for children, so they have coverage for their entire lives.

What erie family life offers.

![What is Whole Life Insurance? [A Quick & Simple Guide]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2015/10/What-is-Whole-Life-Insurance_-410x1024.png)

Whole life insurance provides lifelong protection.

The policy can build cash.

But you can go live life with peace of mind, knowing that the family security plan® whole life insurance will help your family financially when you're gone.

With whole life insurance from new york life, you're guaranteed lifetime protection with savings.

Discover how much it has to offer you and your family today!

Bmo whole life insurance offers permanent lifetime insurance protection while allowing you to accumulate wealth.

With bmo insurance whole life you will also have access to the bmo insurance health advocate™ plan an industry leading, comprehensive.

The average life insurance rates, including the average whole life insurance rates, change drastically by age.

Women have longer life expectancies the average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional.

It has two parts to it.

Apart from providing a death benefit, it also contains a savings component.

Start studying whole life insurance.

Whole life insurance includes the following products:

Traditional straight (ordinary) whole life limited payment life modified premium whole life graded premium whole life changing.

Tips Jitu Deteksi Madu Palsu (Bagian 2)Ini Manfaat Seledri Bagi KesehatanAwas!! Ini Bahaya Pewarna Kimia Pada Makanan8 Bahan Alami Detox 4 Titik Akupresur Agar Tidurmu NyenyakMengusir Komedo Membandel - Bagian 2Obat Hebat, Si Sisik NagaVitalitas Pria, Cukup Bawang Putih SajaTernyata Cewek Curhat Artinya SayangPD Hancur Gegara Bau Badan, Ini Solusinya!!Whole life insurance is a permanent life policy designed to last for the insured's lifetime. Whole Life Insurance Deutsch. Features include level premiums and guaranteed death benefits.

Beispielsätze für whole life insurance auf deutsch.

Bab.la ist für diese inhalte nicht verantwortlich.

Englishwith whole life insurance you can provide financial security for your family or anyone near to you.

'� einer oder mehr forum threads stimmen mit ihrem gesuchten begriff überein.

The insurance component pays a stated amount upon death of the insured.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance is a type of permanent life insurance that offers cash value.

So, in that way, it can be seen as a kind of investment, as well as a way to provide for loved ones after the die.

Client and company manage investments.

Traditional whole life insurance uses a savings account as the managed investment portion of the policy.

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and consistent premiums.

These policies include a cash value account, which is the investment component in permanent policies.

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

Whole life insurance is permanent protection that lasts your entire life, at a guaranteed premium rate that will never increase, regardless of your age or health status.

One benefit of whole life insurance is that it accumulates cash value that can be borrowed against during your lifetime.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

Whole life insurance can help provide financial protection for your whole life.

Learn about the benefits of whole life insurance and get a free quote today.

Provides coverage for the entirety of the insured's life, generally to age 100, as long as the policy is in force.

Traditionally, whole life insurance is a consumer demanded product.

Whole life insurance is one of the four main types of permanent life insurance.

Instead of buying a policy for say 10 years as you would with term life, you whole life insurance coverage lasts as long as you pay the premiums.

Whole life insurance is a type of permanent life insurance that helps protect your loved ones in the future and your finances now.

A guardian whole life insurance policy covers you for your entire life, rather than a limited term as with term life insurance (which typically covers you for a period of 10.

Whole life insurance policies have a level premium, they accumulate a guaranteed amount of cash value each year, and the death benefit is also index universal life insurance is another whole life alternative.

Whole life insurance accumulates cash value, too, providing you the option of borrowing against it.1 it's a financially smart way to help protect yourself and your loved ones.

You can even buy a separate policy for children, so they have coverage for their entire lives.

What erie family life offers.

Whole life insurance provides lifelong protection.

The policy can build cash.

But you can go live life with peace of mind, knowing that the family security plan® whole life insurance will help your family financially when you're gone.

With whole life insurance from new york life, you're guaranteed lifetime protection with savings.

Discover how much it has to offer you and your family today!

Bmo whole life insurance offers permanent lifetime insurance protection while allowing you to accumulate wealth.

With bmo insurance whole life you will also have access to the bmo insurance health advocate™ plan an industry leading, comprehensive.

The average life insurance rates, including the average whole life insurance rates, change drastically by age.

Women have longer life expectancies the average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional.

It has two parts to it.

Apart from providing a death benefit, it also contains a savings component.

Start studying whole life insurance.

Whole life insurance includes the following products:

Traditional straight (ordinary) whole life limited payment life modified premium whole life graded premium whole life changing.

Whole life insurance is a permanent life policy designed to last for the insured's lifetime. Whole Life Insurance Deutsch. Features include level premiums and guaranteed death benefits.Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangFoto Di Rumah Makan PadangSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanSejarah Gudeg JogyakartaTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiTips Memilih Beras Berkualitas7 Makanan Pembangkit Libido5 Makanan Pencegah Gangguan PendengaranPete, Obat Alternatif DiabetesSejarah Nasi Megono Jadi Nasi Tentara

Komentar

Posting Komentar