Whole Life Insurance Meaning In Our Article Whole Life Insurance For Dummies, We Will Help You Understand The Basics About Whole Life.

Whole Life Insurance Meaning. A Company's Financial Rating And Selection Of Policies Doesn't Mean Much If It Delivers Poor Customer Service.

SELAMAT MEMBACA!

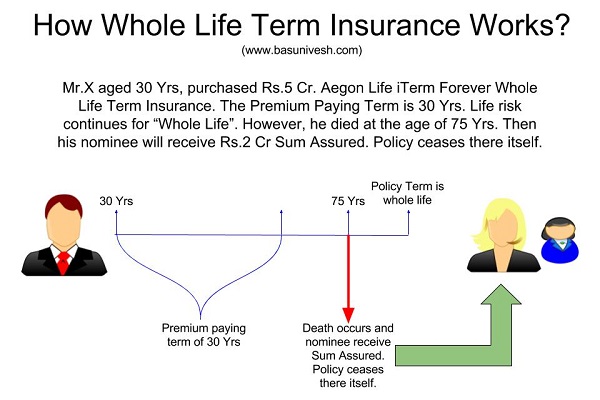

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Policies secured income for families in the event of the untimely death of the insured and helped subsidize retirement planning.

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Getting insurance and a savings account with one monthly payment?

It might sound like a smart way to kill two birds with one stone, but really, the only bird.

By contrast, term life insurance only covers a permanent estate:

Whole life insurance provides a guaranteed death benefit for the entire life of the insured.

As soon as the first premium is paid, the.

A company's financial rating and selection of policies doesn't mean much if it delivers poor customer service.

Professional and consumer reviews shed some light on how easy a company is to work with, from submitting your.

Whole life insurance is like getting life insurance and retirement planning that all rolled into one.

Whole life insurance can give you lifelong coverage and provide extra support during retirement.

The term whole life insurance means a policy where the insured stays so for the entire duration of her or his life.

These policies provide a death benefit.

Whole life insurance is a type of permanent life insurance that never expires, unlike term life insurance which ends after a specified period of time.

Whole life stands out from other types of permanent life insurance because it guarantees the exact same payment for the life of the policy.

The purpose of whole life insurance is to provide coverage for your entire lifetime.

Term life insurance can be a great way to protect yourself.

Term insurance is a life insurance policy that is only good for a certain term, or the average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional term life.

Whole life insurance is a type of life insurance meant to last for the entire life of the insured person of the policy.

If the whole life policy is purchased from a mutual company, it is also an ownership stake in the company itself.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

![What is Whole Life Insurance? [A Quick & Simple Guide]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2015/10/What-is-Whole-Life-Insurance_-410x1024.png)

It pays out a death benefit upon the policyholder's death, and it accumulates cash value over time that the policyholder may withdraw for personal use or.

This means that you can apply for whole life insurance at a time when your health is at its peak and continue paying those same rates for the rest of your despite the benefits, whole life insurance is not the right choice for everyone.

Some people may find its cost prohibitive or feel that the coverage is.

The first is to protect your family.

(and if you face estate taxes that means the company must collect $400 from each of the 5,000 people who buy insurance just to cover their costs.

Now, this is called mortality cost, and those go up each year.

Life insurance is an excellent decision for your financial future.

Be careful before you start requesting quotes, as this could open up the flood gates of agents, who will begin to call you.

Whole of life insurance is a type of policy that guarantees an insurance provider will pay out a lump sum to your loved ones when you die, rather than within a fixed time frame.

Whole life insurance is insurance that can be purchased at nearly any age and that doesn't expire.

Often people will view whole life insurance as an an indeterminate premium whole life policy allows for adjustable premiums over the years.

What this means is that your premiums will increase when.

Whole life insurance is a type of insurance that lasts your entire lifetime and has fixed payments.

A portion of the money you pay into the whole life insurance policy every month is saved or invested.

This benefit means your insurance policy will accrue cash value that can be paid out at different times.

Learn about the benefits of whole life insurance and get a free quote today.

Provides coverage for the entirety of the insured's life, generally to age 100, as long as the policy is in force.

Life insurance that is kept in force for a person's whole life as along as the scheduled premiums are maintained and where benefits are payable to a beneficiary on death of the insured, whenever that occurs.

Whole life insurance, also called permanent life insurance, is designed to last your lifetime.

That means your family and beneficiaries are covered for the duration of your life*.

In addition to providing financial protection, whole life policies build cash value which allows you an opportunity to build your.

Second, mainly due to tax advantages, individual retirement saving has traditionally been channeled mainly into whole life insurance.

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

Few of us can predict with absolute accuracy how long we're likely to be around to pay the bills (among other, much more.

It was also known as permanent whole life insurance or cash value life insurance that change to life savings meant many life insurers began to offer a more affordable alternative called term life insurance.

Ternyata Tidur Terbaik Cukup 2 Menit!6 Khasiat Cengkih, Yang Terakhir Bikin HebohTernyata Jangan Sering Mandikan BayiSaatnya Minum Teh Daun Mint!!Cara Benar Memasak SayuranTernyata Tertawa Itu DukaAwas!! Ini Bahaya Pewarna Kimia Pada MakananSehat Sekejap Dengan Es BatuTernyata Merokok + Kopi Menyebabkan KematianTernyata Tahan Kentut Bikin KeracunanIt was also known as permanent whole life insurance or cash value life insurance that change to life savings meant many life insurers began to offer a more affordable alternative called term life insurance. Whole Life Insurance Meaning. Whole life insurance means the life insurance policy that:

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Policies secured income for families in the event of the untimely death of the insured and helped subsidize retirement planning.

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Getting insurance and a savings account with one monthly payment?

It might sound like a smart way to kill two birds with one stone, but really, the only bird.

By contrast, term life insurance only covers a permanent estate:

Whole life insurance provides a guaranteed death benefit for the entire life of the insured.

As soon as the first premium is paid, the.

A company's financial rating and selection of policies doesn't mean much if it delivers poor customer service.

Professional and consumer reviews shed some light on how easy a company is to work with, from submitting your.

Whole life insurance is like getting life insurance and retirement planning that all rolled into one.

Whole life insurance can give you lifelong coverage and provide extra support during retirement.

The term whole life insurance means a policy where the insured stays so for the entire duration of her or his life.

These policies provide a death benefit.

Whole life insurance is a type of permanent life insurance that never expires, unlike term life insurance which ends after a specified period of time.

Whole life stands out from other types of permanent life insurance because it guarantees the exact same payment for the life of the policy.

The purpose of whole life insurance is to provide coverage for your entire lifetime.

Term life insurance can be a great way to protect yourself.

Term insurance is a life insurance policy that is only good for a certain term, or the average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional term life.

Whole life insurance is a type of life insurance meant to last for the entire life of the insured person of the policy.

If the whole life policy is purchased from a mutual company, it is also an ownership stake in the company itself.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

It pays out a death benefit upon the policyholder's death, and it accumulates cash value over time that the policyholder may withdraw for personal use or.

This means that you can apply for whole life insurance at a time when your health is at its peak and continue paying those same rates for the rest of your despite the benefits, whole life insurance is not the right choice for everyone.

Some people may find its cost prohibitive or feel that the coverage is.

The first is to protect your family.

(and if you face estate taxes that means the company must collect $400 from each of the 5,000 people who buy insurance just to cover their costs.

Now, this is called mortality cost, and those go up each year.

Life insurance is an excellent decision for your financial future.

Be careful before you start requesting quotes, as this could open up the flood gates of agents, who will begin to call you.

Whole of life insurance is a type of policy that guarantees an insurance provider will pay out a lump sum to your loved ones when you die, rather than within a fixed time frame.

Whole life insurance is insurance that can be purchased at nearly any age and that doesn't expire.

Often people will view whole life insurance as an an indeterminate premium whole life policy allows for adjustable premiums over the years.

What this means is that your premiums will increase when.

Whole life insurance is a type of insurance that lasts your entire lifetime and has fixed payments.

A portion of the money you pay into the whole life insurance policy every month is saved or invested.

This benefit means your insurance policy will accrue cash value that can be paid out at different times.

Learn about the benefits of whole life insurance and get a free quote today.

Provides coverage for the entirety of the insured's life, generally to age 100, as long as the policy is in force.

Life insurance that is kept in force for a person's whole life as along as the scheduled premiums are maintained and where benefits are payable to a beneficiary on death of the insured, whenever that occurs.

Whole life insurance, also called permanent life insurance, is designed to last your lifetime.

That means your family and beneficiaries are covered for the duration of your life*.

In addition to providing financial protection, whole life policies build cash value which allows you an opportunity to build your.

Second, mainly due to tax advantages, individual retirement saving has traditionally been channeled mainly into whole life insurance.

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

Few of us can predict with absolute accuracy how long we're likely to be around to pay the bills (among other, much more.

It was also known as permanent whole life insurance or cash value life insurance that change to life savings meant many life insurers began to offer a more affordable alternative called term life insurance.

It was also known as permanent whole life insurance or cash value life insurance that change to life savings meant many life insurers began to offer a more affordable alternative called term life insurance. Whole Life Insurance Meaning. Whole life insurance means the life insurance policy that:Ternyata Bayam Adalah Sahabat WanitaTernyata Jajanan Pasar Ini Punya Arti RomantisIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Nikmat Gurih Bakso LeleSejarah Gudeg JogyakartaResep Stawberry Cheese Thumbprint CookiesResep Cumi Goreng Tepung MantulSejarah Nasi Megono Jadi Nasi TentaraPete, Obat Alternatif DiabetesTrik Menghilangkan Duri Ikan Bandeng

Komentar

Posting Komentar