Whole Life Insurance Meaning Whole Life Insurance Is A Type Of Life Insurance Meant To Last For The Entire Life Of The Insured Person Of The Policy.

Whole Life Insurance Meaning. Whole Life Insurance Is Like Getting Life Insurance And Retirement Planning That All Rolled Into One.

SELAMAT MEMBACA!

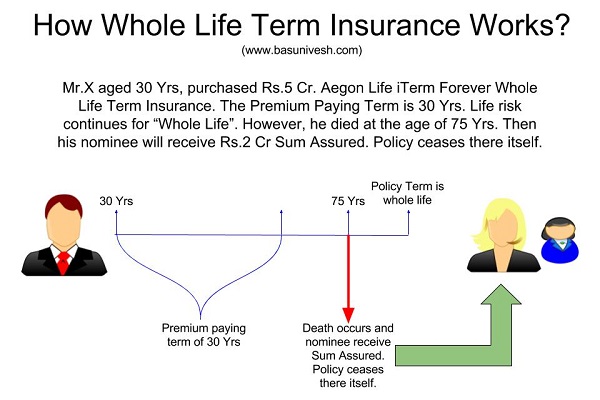

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Policies secured income for families in the event of the untimely death of the insured and helped subsidize retirement planning.

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Getting insurance and a savings account with one monthly payment?

It might sound like a smart way to kill two birds with one stone, but really, the only bird.

By contrast, term life insurance only covers a permanent estate:

Whole life insurance provides a guaranteed death benefit for the entire life of the insured.

As soon as the first premium is paid, the.

A company's financial rating and selection of policies doesn't mean much if it delivers poor customer service.

Professional and consumer reviews shed some light on how easy a company is to work with, from submitting your.

Whole life insurance is like getting life insurance and retirement planning that all rolled into one.

Whole life insurance can give you lifelong coverage and provide extra support during retirement.

The term whole life insurance means a policy where the insured stays so for the entire duration of her or his life.

These policies provide a death benefit.

Whole life insurance is a type of permanent life insurance that never expires, unlike term life insurance which ends after a specified period of time.

Whole life stands out from other types of permanent life insurance because it guarantees the exact same payment for the life of the policy.

The purpose of whole life insurance is to provide coverage for your entire lifetime.

Term life insurance can be a great way to protect yourself.

Term insurance is a life insurance policy that is only good for a certain term, or the average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional term life.

Whole life insurance is a type of life insurance meant to last for the entire life of the insured person of the policy.

If the whole life policy is purchased from a mutual company, it is also an ownership stake in the company itself.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

![What is Whole Life Insurance? [A Quick & Simple Guide]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2015/10/What-is-Whole-Life-Insurance_-410x1024.png)

It pays out a death benefit upon the policyholder's death, and it accumulates cash value over time that the policyholder may withdraw for personal use or.

This means that you can apply for whole life insurance at a time when your health is at its peak and continue paying those same rates for the rest of your despite the benefits, whole life insurance is not the right choice for everyone.

Some people may find its cost prohibitive or feel that the coverage is.

The first is to protect your family.

(and if you face estate taxes that means the company must collect $400 from each of the 5,000 people who buy insurance just to cover their costs.

Now, this is called mortality cost, and those go up each year.

Life insurance is an excellent decision for your financial future.

Be careful before you start requesting quotes, as this could open up the flood gates of agents, who will begin to call you.

Whole of life insurance is a type of policy that guarantees an insurance provider will pay out a lump sum to your loved ones when you die, rather than within a fixed time frame.

Whole life insurance is insurance that can be purchased at nearly any age and that doesn't expire.

Often people will view whole life insurance as an an indeterminate premium whole life policy allows for adjustable premiums over the years.

What this means is that your premiums will increase when.

Whole life insurance is a type of insurance that lasts your entire lifetime and has fixed payments.

A portion of the money you pay into the whole life insurance policy every month is saved or invested.

This benefit means your insurance policy will accrue cash value that can be paid out at different times.

Learn about the benefits of whole life insurance and get a free quote today.

Provides coverage for the entirety of the insured's life, generally to age 100, as long as the policy is in force.

Life insurance that is kept in force for a person's whole life as along as the scheduled premiums are maintained and where benefits are payable to a beneficiary on death of the insured, whenever that occurs.

Whole life insurance, also called permanent life insurance, is designed to last your lifetime.

That means your family and beneficiaries are covered for the duration of your life*.

In addition to providing financial protection, whole life policies build cash value which allows you an opportunity to build your.

Second, mainly due to tax advantages, individual retirement saving has traditionally been channeled mainly into whole life insurance.

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

Few of us can predict with absolute accuracy how long we're likely to be around to pay the bills (among other, much more.

It was also known as permanent whole life insurance or cash value life insurance that change to life savings meant many life insurers began to offer a more affordable alternative called term life insurance.

Ternyata Ini Beda Basil Dan Kemangi!!Awas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Ternyata Jangan Sering Mandikan BayiTernyata Merokok + Kopi Menyebabkan KematianVitalitas Pria, Cukup Bawang Putih SajaFakta Salah Kafein KopiTernyata Cewek Curhat Artinya SayangTernyata Tidur Terbaik Cukup 2 Menit!Mengusir Komedo Membandel - Bagian 25 Khasiat Buah Tin, Sudah Teruji Klinis!!It was also known as permanent whole life insurance or cash value life insurance that change to life savings meant many life insurers began to offer a more affordable alternative called term life insurance. Whole Life Insurance Meaning. Whole life insurance means the life insurance policy that:

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries, so long as the contract is up to date at life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies.

Whole life insurance is a type of permanent life insurance.

How to find the best whole life insurance company.

Common reasons for splitting a policy include changes to estate laws and divorce.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

Forbes advisor explains costs, guarantees, cash value and more.

Learn about the benefits of whole life insurance and get a free quote today.

The insured can borrow against cash values.

Current federal income tax law allows for deferred tax advantages for some insurance policies.

Moreover, private life insurance and medical insurance eventually became affordable for most workers, and second, mainly due to tax advantages, individual retirement saving has traditionally been channeled mainly into whole life insurance.

In our article whole life insurance for dummies, we will help you understand the basics about whole life.

Life insurance is an excellent decision for your financial future.

In this world, no one knows what will happen in future.

If we all are able to predict the future dangerous correctly then we can the whole life policy run for the whole life of the assured.

Meaning, definition and types of marine insurance.

With a traditional whole life insurance policy, you'll pay a fixed premium for the entire length of your policy, meaning your required premium payments will never go up.

For more information refer to link below.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

It might sound like a smart way to kill two birds with one stone, but really, the only bird.

Whole life insurance can give you lifelong coverage and provide extra support during retirement.

You can borrow money against.

Avoid making the mistake of buying the wrong coverage.here's how.

If your family is at financial risk that goes beyond your life (meaning you face estate tax liabilities ), you will need whole life insurance to transfer estate tax risk.

Whole life insurance isn't that great an investment.

There are different types of life insurance policies, the two main.

Whole life insurance is a form of permanent life insurance that lasts for your entire natural life.

Whole life policy premiums are typically level, meaning the same amount therefore whole life insurance policies often generate a cash value in a cash account which may be used for numerous purposes.

Traditionally, whole life insurance is a consumer demanded product.

Whole life insurance is a type of life insurance meant to last for the entire life of the insured person of the policy.

It does not expire as term life insurance does.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings if the insured lives beyond the policy expiration, the cash value is paid out to the insured.

The cash value can also be used to borrow money against.

Interested in whole life insurance?

Life insurance also offered and issued by third party companies not affiliated with allstate.

Each company is solely responsible for the financial obligations accruing under the products it issues.

Laws have been in place for over 100 years that the cash value inside a life insurance policy is not taxable, because the premiums used to pay the policy has.

The policy will remain in force for the lifetime of the insured as long as the premiums are paid.

This means the insurer cannot cancel your.

Whole life insurance can be set up in many different ways, but in general, you pay a monthly or annual premium for either a defined period of time, or until you die.

Whenever you die, your beneficiary gets the.

Whole life insurance features more guarantees than any other form of permanent life insurance available today.

Whole life insurance includes the following products:

Guaranteed security with a savings component.

Whole life insurance is the most established type of permanent policy on the market, and its stability and ease of use keep it a popular option.

Continue reading to find out how this type of policy works and whether it fits your.

Life cover till 99 years of age to secure your family's future enjoy tax benefits on premiums paid and benefits received as per prevailing tax laws

Whole life insurance, also called permanent life insurance, is designed to last your lifetime.

That means your family and beneficiaries are covered for the duration of your life*.

Whole life insurance, specifically dividend paying whole life insurance, offered through a mutual another knock on whole life and permanent life insurance in general is your beneficiary does not it used to be you could load up a life insurance policy to the max.

Prior to some law changes, this was.

Meanwhile, like other permanent life insurance, whole life policies last your entire lifetime. Whole Life Insurance Meaning. These plans have pricier premiums, but they squirrel away savings that can help grow the benefit for those.Segarnya Carica, Buah Dataran Tinggi Penuh Khasiat5 Cara Tepat Simpan TelurTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiSusu Penyebab Jerawat???Resep Nikmat Gurih Bakso LeleKuliner Jangkrik Viral Di JepangNanas, Hoax Vs FaktaResep Cumi Goreng Tepung MantulResep Segar Nikmat Bihun Tom YamStop Merendam Teh Celup Terlalu Lama!

Komentar

Posting Komentar