Whole Life Insurance Rates It Can Be A Good Idea If You

Whole Life Insurance Rates. When Deciding Whether Term Life Insurance Or Whole Life Insurance Better Fits Your Needs, Consider Where You Are Now And Where You May Be Down The Road.

SELAMAT MEMBACA!

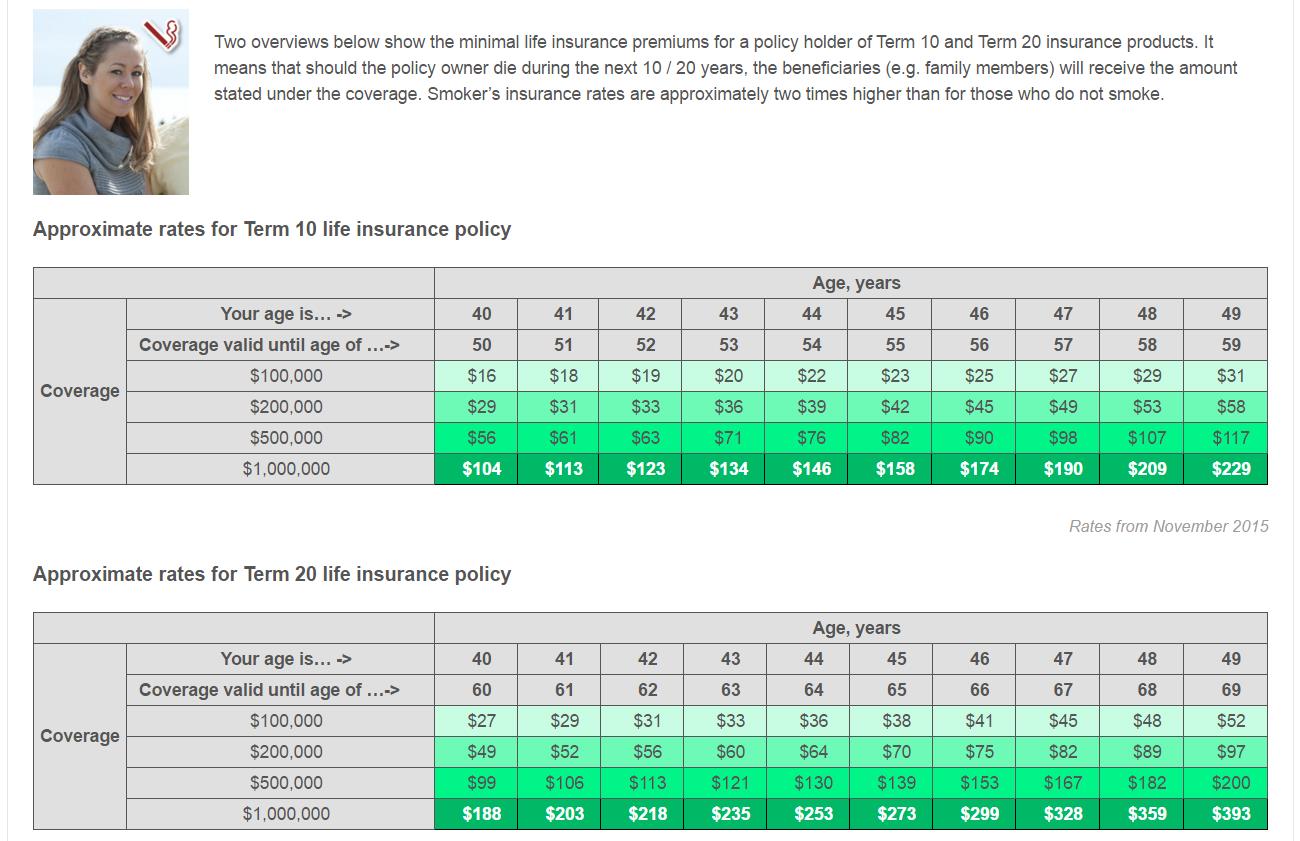

Term life insurance rates are lower initially than whole life insurance rates.

(once again, it is important that the policy is properly.

How much whole life insurance costs you?

Read this comprehensive article that compares whole life insurance rates by age and other factors from top companies.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

The average cost of life insurance is $26 a month.

Use our life insurance cost calculator to see how your rate could vary based on your health.

Our life insurance cost calculator can help you estimate how much a term life policy.

Traditional whole life insurance uses a savings account as the managed investment portion of the policy.

This account has a set minimum rate determined at the time of policy inception and can increase as interest rates rise.

Whole life insurance is a great choice for people who want the security of a policy that never expires coupled with an investment vehicle suitable for reaching / managing financial goals.

Whole life rates can vary from provider to provider, so we strongly encourage you to use a service like ours to make.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

Life insurance — term or whole — is designed to help your loved ones recover financially when you pass away.

It can ensure that your spouse upholds the same standard of living or that you can whole life insurance rates are often higher than other types of life insurance.

It can be a good idea if you

Rates quoted are subject to change and are set at the company's sole discretion.

Rates for other underwriting classifications would be higher.

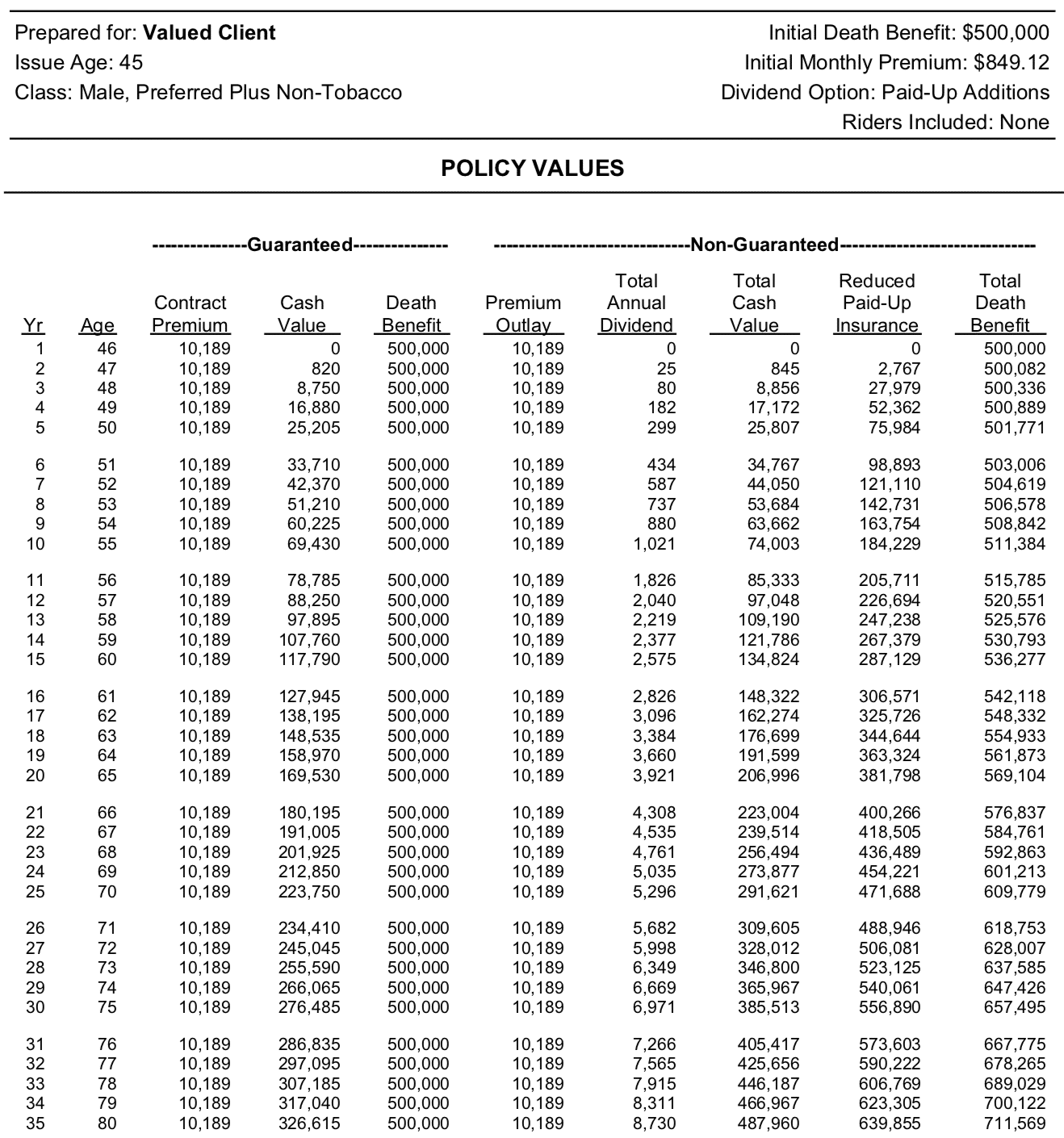

Whole life insurance policies increase in value.

You can tap into the value by making withdrawals, borrowing against the value or even asking your insurer to increase.

Generally, whole life insurance is more expensive than the same amount of term life insurance coverage.

During the underwriting process, a category is assigned based on these factors, and the rate is determined by how desirable the policyholder is considered to be.

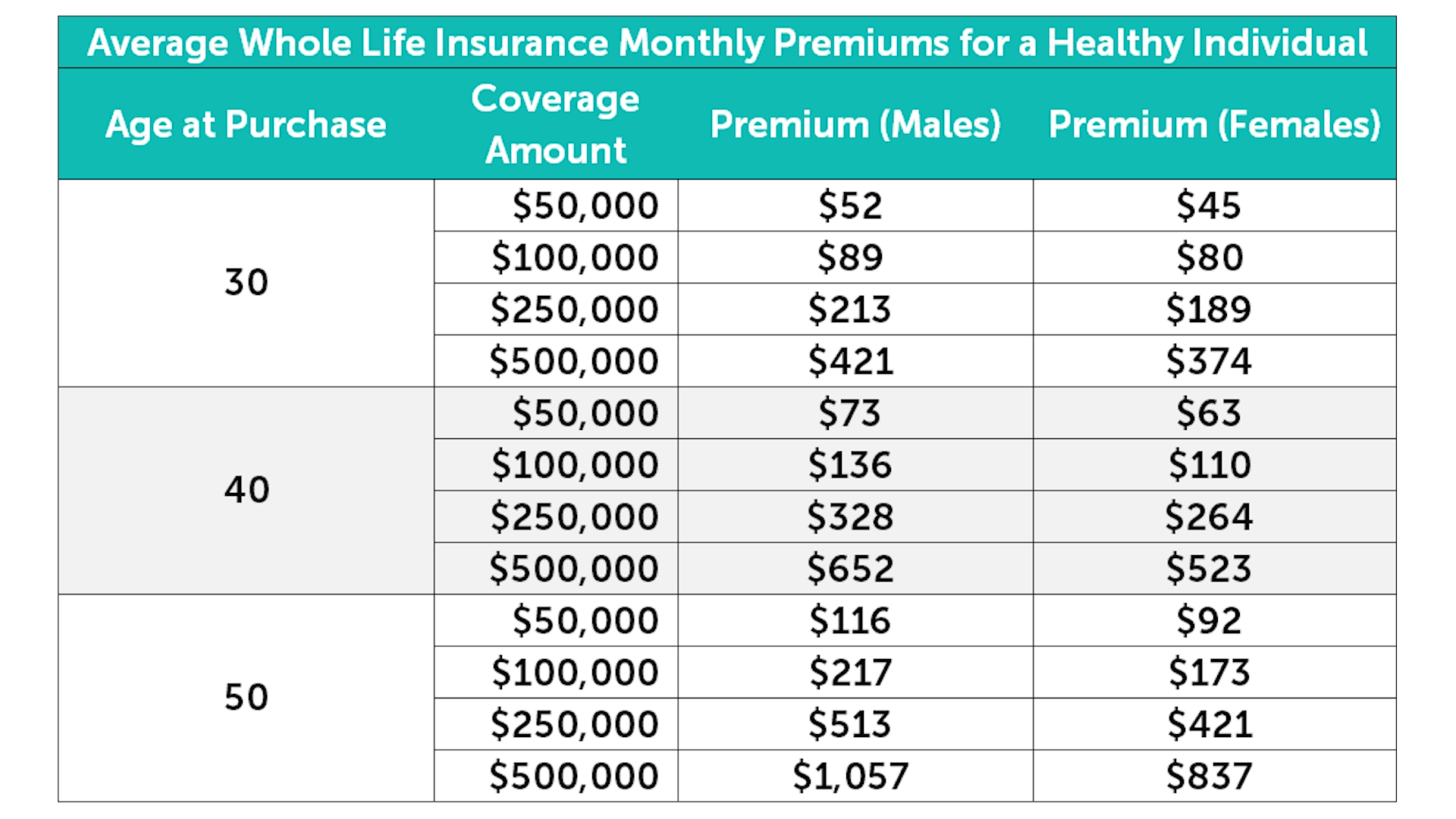

Let us now take a look at the average cost of a whole life policy for men and women at different ages.

This is why experts say that you should never wait for the right time to insure yourself.

The right time to buy life insurance is right now, because the.

Features include level premiums and guaranteed death benefits.

Best whole life insurance companies.

Find the cheapest insurance quotes in your area.

Finding the right life insurance plan can feel like an overwhelming process.

The terminology and amount of plan choices can make it difficult to really narrow down what type of insurance would provide the best financial protection for your loved ones.

Whole life insurance is generally 10 to 15 times higher than term insurance for an equivalent death benefit, according to quotacy.

![How Much Does Whole Life Insurance Cost? [Charts & 2019 Rates]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2019/01/Whole-Life-Insurance-Rates-Chart-Male.jpg)

You can earn a guaranteed rate, although it might be lower than you can get.

Whole life insurance is the gold standard of life insurance policies.

This type of permanent life insurance is one of the most misunderstood.

The way these plans work is very straightforward.

There is no small print that you need to be worried about.

Whole life final expense insurance available through choice mutual insurance agency may be underwritten by any of the following insurance companies.

Whole life insurance may or may not be a good investment.

For those who are looking for a way to lock in coverage at a set premium rate, it may be a good option.

However, if you are seeking a way to obtain a large amount of death benefit at an affordable premium rate, then term life insurance may.

Looking for (cheap) whole life insurance rates?

Life insurance is an incredibly valuable financial asset that can help provide you and your loved ones with the financial protection you deserve.

Table of contents how are whole life insurance rates calculated?

Here are actual whole life insurance rates for a $100,000 policy for a healthy male and female.

This article covers whole life insurance rates chart.

When deciding whether term life insurance or whole life insurance better fits your needs, consider where you are now and where you may be down the road.

Regardless of the kind of coverage.

Some whole life insurance policies offer a limited payment option in which premiums end at age 65.

Some offer an interest sensitive variation, where the cash value of the policy fluctuates according to prevailing interest rates.

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Getting insurance and a savings account with one monthly payment?

It might sound like a smart way to kill two birds with one stone, but really, the only bird.

Get instant whole life insurance quotes fast.

Learn everything you need to know about whole life insurance and compare rates.

PD Hancur Gegara Bau Badan, Ini Solusinya!!7 Makanan Sebabkan Sembelit4 Titik Akupresur Agar Tidurmu NyenyakSaatnya Bersih-Bersih UsusAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Mana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Ini Manfaat Seledri Bagi KesehatanTernyata Mudah Kaget Tanda Gangguan MentalTernyata Merokok + Kopi Menyebabkan KematianTernyata Pengguna IPhone = Pengguna NarkobaLearn everything you need to know about whole life insurance and compare rates. Whole Life Insurance Rates. Compare rates view and compare the best whole life insurance rates from top companies.

Find out everything you need to know about whole life insurance in canada including rates and get free whole life insurance quotes from 25+ insurers.

Plus your premiums don't increase.

Whole life insurance can be ideal, if you're considering planning your estate and need a source of funds that will help your heirs to

Life insurance doesn't need to be complicated or intimidating.

Get the best of both worlds.

How would you feel if you had insurance protection for your whole life?

A couple stands together, the woman is pregnant.

Licensed across canada and working with over 100 experienced insurance brokers.

Whole life insurance is insurance that covers the insured for their entire lifetime.

Plus, it comes into effect when the individual enters into a whole also, it takes place with the insurance company the individual chooses.

Get free life insurance quotes from canada's top providers.

Insurdinary provides you with quotes from the leading providers in canada.

Permanent life insurance, otherwise known as whole life insurance, as it covers you for your whole life.

Idc insurance direct canada inc.

National service centre 4400 dominion st., suite 260 burnaby, bc v5g 4g3.

Term life insurance options for couples.

Your premiums won't change as you get older.

Whole life insurance policies also have a savings or investment component.

A part of the premiums you pay are invested by the insurance company and the investment returns are available for you to use as cash value.

Compare life insurance quotes from canada's top providers.

Find a great rate and protect your family's future.

There are several types of life insurance policies in canada, but they generally fall into two categories:

Whole life insurance canadian whole life insurance policies promise a guaranteed return for your cash value.

The insurance company tells you how much when you compare different life insurance companies in canada, pay careful attention to their credit rating.

This rating shows how likely the.

Level premiums for your entire life and a cash surrender value available if you cancel the life insurance canada.com advises consumers interested in purchasing whole life insurance to only consider fully guaranteed life insurance.

Unlike term insurance where premiums increase over time, premiums for whole life insurance are permanent for life.

This is regarded as performance credit or dividend for whole.

Protect the financial security of your loved ones today.

The various kinds of permanent life insurance are whole life insurance, universal life insurance and term to 100.

Policyme offers one of the lowest life insurance rates in canada.

Whole life insurance is able to provide protection for the entire life of the insured, rather than just for limited period of time.

This policy usually has a growing cash surrender value, which you can access in the future.

The death benefit, premiums, cash values are guaranteed under this policy.

Our dedicated life insurance experts can walk you through the process.

Rates quoted are subject to change and are set at the company's sole discretion.

Rates for other underwriting classifications would be higher.

How much whole life insurance costs you?

Read this comprehensive article that compares whole life insurance rates by age and other factors from top if you want to get the best whole life insurance rates, you will have to do the research.

The good news is we have done all the research for you.

If you're still unsure about what to.

As opposed to term life insurance, whole life insurance combines permanent life insurance protection with a savings component, but at a higher a:

Each insurance company in canada has its own eligibility requirements and risk assessment guidelines when determining whether an applicant.

![Life Insurance For Children [the Best Policy for Your Kids]](https://www.insuranceandestates.com/wp-content/uploads/childrens-whole-life-insurance-rates.jpg)

Whole life policies guarantee a minimum growth rate on the cash value.

Some policies have the potential to earn dividends, which are portions of the insurer's financial surplus.

There are a whole host of life insurance products.

What you could be doing is evaluating the insurance companies.

Check them out with the insurance bureau of canada or with the credit rating agencies.

Looking for a term or whole life insurance quote?

Helpful information about obtaining life insurance in canada from our partners.

The first step to securing life insurance is to obtain a quote by filling out our simple online form.

While many insurance companies are competing to gain market share, we collaborate within to find you the best deal.

Permanent life insurance, with or without a medical exam, to protect your family throughout your lifetime.

Coverage adapted to your needs.

Term life insurance can provide coverage for 10 years, 20 years or for life depending on your needs.

Whole life policies establish the premium rate when the policy is purchased, and the rate is usually guaranteed not to increase for the life of the contract.

We are a broker company offering plans / insurance products from companies like manulife financial,rbc insurance,sun life,industrial.

We are a broker company offering plans / insurance products from companies like manulife financial,rbc insurance,sun life,industrial. Whole Life Insurance Rates. Ready to get started but still not sure yet?Sejarah Kedelai Menjadi TahuKuliner Legendaris Yang Mulai Langka Di DaerahnyaResep Yakitori, Sate Ayam Ala JepangResep Kreasi Potato Wedges Anti GagalTernyata Bayam Adalah Sahabat WanitaResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangTernyata Inilah Makanan Indonesia Yang Tertulis Dalam Prasasti5 Trik Matangkan ManggaTrik Menghilangkan Duri Ikan BandengResep Beef Teriyaki Ala CeritaKuliner

Komentar

Posting Komentar