Whole Life Insurance A Whole Life Insurance Plan Offers The Advantage Of Providing Permanent Coverage, But It Is A Much More Expensive Type Of Policy Than A Term Life One.

Whole Life Insurance. The Purpose Of Whole Life Insurance Is To Provide Coverage For Your Entire Lifetime.

SELAMAT MEMBACA!

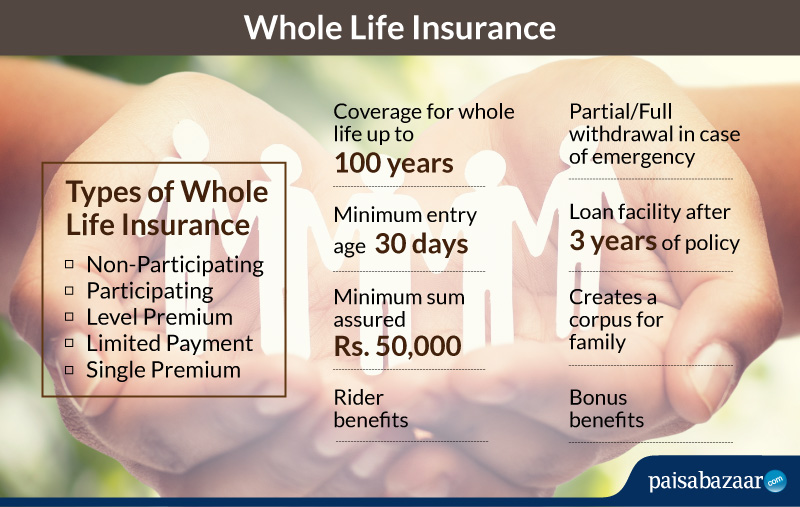

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance is paid out to a beneficiary or beneficiaries upon the policyholder's death, provided that the premium payments were maintained.

Whole life insurance pays a death benefit.

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and consistent premiums.

Whole life insurance is a type of insurance designed to provide coverage throughout your life, with a benefit paid at your death to your family (or the beneficiary of your choosing), as long as you maintain.

Whole life insurance has both a face value and a cash value.

The policy's face value is what your beneficiaries receive when you die.

Whole life insurance is a type of permanent life insurance that helps protect your loved ones in the future and your finances now.

Whole life insurance policies offer two primary benefits.

Whole life insurance is a permanent policy, which gives you guaranteed protection for your loved ones that lasts a lifetime.

Unlike term insurance, whole life does not have a set term;

The insured can keep the insurance whole life insurance differs from term life insurance in its provision of both a death benefit and a.

Whole life insurance is a type of permanent life insurance that never expires, unlike term life whole life stands out from other types of permanent life insurance because it guarantees the exact.

Traditionally, whole life insurance is a consumer demanded product.

Whole life insurance is the original insurance.

When insurance started, all that existed was whole index universal life insurance is another whole life alternative.

Whole life insurance probably should not be the centerpiece of any financial investment plan.

How much life insurance do i need?

That depends on the insured's situation and desired goals.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Their simplified whole life insurance policy is available to clients between the ages of 40 and 80 and offers a death benefit.

Whole life insurance is designed to provide coverage for the life of the insured.

Whole life policies generally offer fixed premiums, guaranteed death benefits and are designed to build tax deferred cash.

Premiums remain at a stable level as long as the.

The purpose of whole life insurance is to provide coverage for the insured, for their entire lifetime.

Traditionally, whole life insurance is a consumer demanded product that offers more than just a.

That means your family and beneficiaries are covered for the duration of your life.

Whole life insurance is a permanent life policy designed to last for the insured's lifetime.

Features include level premiums and guaranteed death benefits.

Discover how much it has to offer you and your family today!

The obvious advantage of whole life.

Whole life insurance provides lifelong protection.

This critical review looks behind the whole life sales hype to reveal complications and issues you must understand.

The average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional term life insurance policies do not.

Whole life insurance is a type of permanent life insurance that is valid throughout the lifetime of the insured.

Apart from providing a death benefit, it also contains a savings.

Whole life insurance is a type of life insurance meant to last for the entire life of the insured person of the policy.

It does not expire as term life insurance does.

The policy accumulates cash value as the years go by.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatMengusir Komedo MembandelSehat Sekejap Dengan Es BatuTernyata Jangan Sering Mandikan Bayi8 Bahan Alami Detox Ternyata Ini Beda Basil Dan Kemangi!!Mana Yang Lebih Sehat, Teh Hitam VS Teh Hijau?Segala Penyakit, Rebusan Ciplukan ObatnyaCara Benar Memasak SayuranIni Manfaat Seledri Bagi KesehatanThe policy accumulates cash value as the years go by. Whole Life Insurance. Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

Unlike other insurance options, whole life insurance premiums don't increase with your age and includes an investment option that accrues cash when you pay into it.

By soliciting quotes from an online quote service like netquote.com, you'll not only be able to compare rates and coverages in searching out the best value, but you'll also get the opportunity to compare the.

Get instant whole life insurance quotes fast.

Learn everything you need to know about whole life insurance and compare rates.

There are definitely times when it makes sense, but you need to know when most people search for whole life insurance quotes, they use those words because they think this is the only type of policy offering.

Displays instant online whole life insurance quotes from all the best insurance companies.

Get your quote in 15 seconds.

Your quote may differ based on your health rating.

Life insurance policy basics & key features 4.

Whole life insurance quotes 5.

Whole life insurance policy has a cash worth component, like the whole of life assurance, that develops over time and can be.

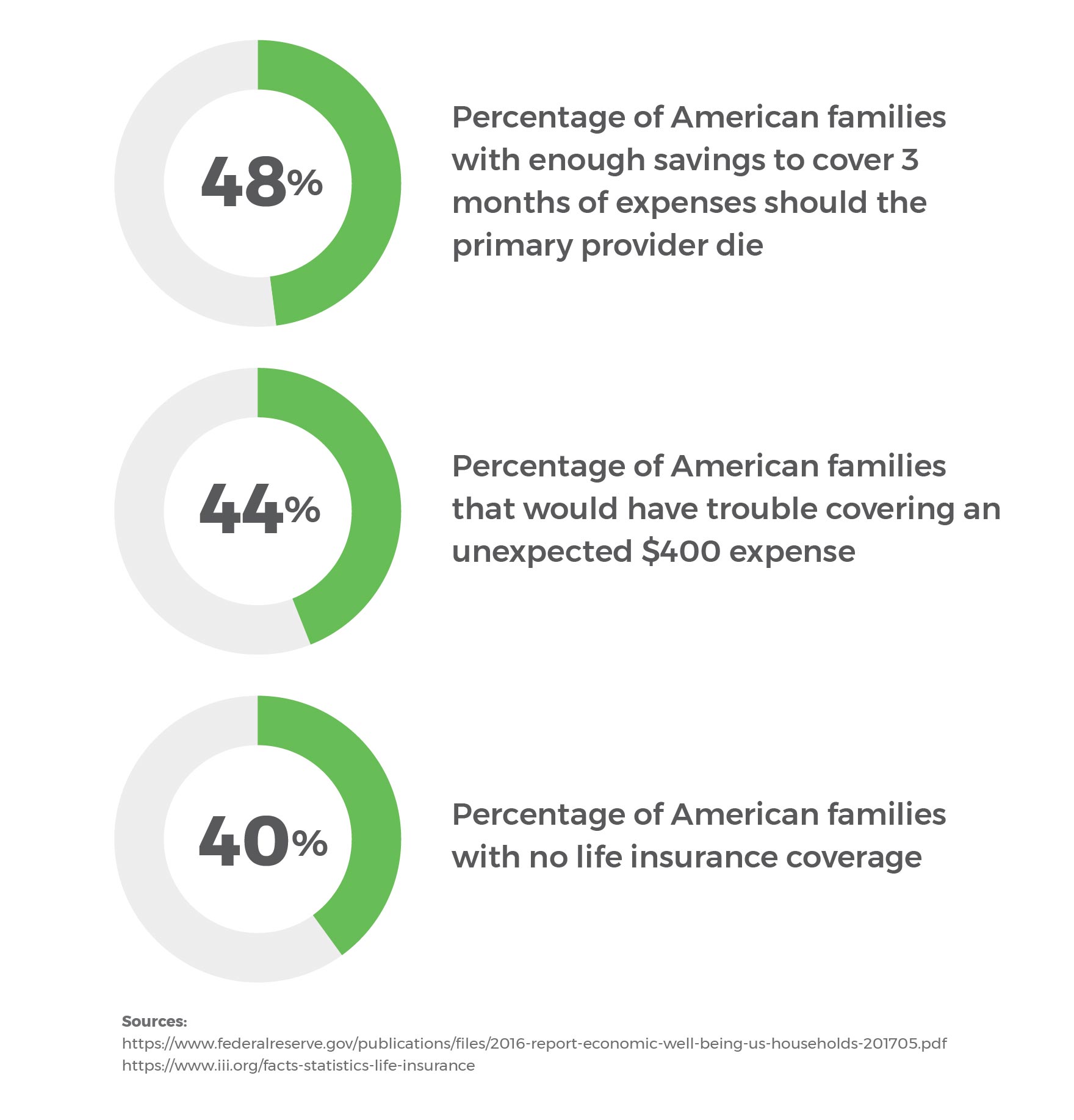

Life insurance pays out after you die and can be an important safety net for your family.

Get free online life insurance quotes today from multiple life insurance companies, all buying life insurance can be quick and easy.

We'll walk you through the whole process, so you can.

Interested in whole life insurance?

Our dedicated life insurance experts can walk you through the process.

Each company is solely responsible for the financial obligations accruing under the products it issues.

Whole life insurance is the most common type of permanent life insurance.

In addition to lifelong coverage, whole life insurance comes with a savings component that accrues cash value.

These include a death benefit and a cash value component.

When seeking whole life insurance quotes, it is typically best to work with a company that has access to more than just one insurance company.

In both cases, the death benefit is the amount the designated beneficiary will receive upon the insured's death, provided the policy is in force.

Whole or universal life insurance typically cover:

Coverage for your lifetime, as long as policy terms are met.

Whole life insurance offers permanent protection for the balance of your life, however long that no quotes online for whole life insurance.

Northwestern mutual offers two whole life insurance policies:

Whole life insurance is the most basic form of permanent life insurance coverage.

The insured person is covered for life.

With whole life insurance, the premium and death benefit are determined at the start and remain the same throughout the life of the policy.

Whole life insurance covers you for the rest of your life.

Give your family permanent financial security and protection today!

We'll help find the right company and the lowest rates!

Find the coverage that is right for you and your family.

Find cheap whole life insurance quotes right here with our free comparison tool below.

Before getting life insurance quotes some consumers don't understand that life insurance comes in several forms.

Whole life insurance also referred to as permanent coverage is by far the most common type of life insurance.

As the name suggests, this type offers protection for the entire life of.

Fun is like life insurance;

The older you get, the more it costs. ― kim hubbard.

The time still goes by and time is expensive.

Whole life insurance is one type of permanent life insurance that can provide lifelong coverage.

Forbes advisor explains costs, guarantees, cash value and more.

Online whole and standard life insurance quotes, co.

We can be your single source for all your.

Some whole life insurance policies are issued by mutual companies.

If they are, the policies are generally considered to be participating or par get the best quotes for whole life insurance.

Well, payments are the same through the life of the policy, so they are more predictable than other forms of permanent life insurance like variable life or universal life.

Get free instant whole life insurance quotes and compare whole life insurance rates, side by side.

Whole life insurance is a type of permanent life insurance whereby the insured will be covered by their policy, no matter when they die, as it's a policy that will last your entire life.

Whole life insurance does not have a policy term — your provider guarantees a death benefit no matter when you die.

Check out your best options for term life insurance, get a quote and see if you're eligible.

Is life insurance worth it?

Borrow against the cash value.

Whole life insurance quotes & policy overview.

Most things in life come with an expiration date — from groceries to coupons and even certain types of life.

A whole life insurance policy offers a range of benefits, and we can help you to find your perfect policy.

Give us a call or why not try out our sister site for instant whole of life insurance quotes, where you can also apply online.

A whole life insurance policy offers a range of benefits, and we can help you to find your perfect policy. Whole Life Insurance. Give us a call or why not try out our sister site for instant whole of life insurance quotes, where you can also apply online.Resep Ayam Kecap Ala CeritaKulinerResep Ramuan Kunyit Lada Hitam Libas Asam Urat & Radang3 Cara Pengawetan CabaiTernyata Bayam Adalah Sahabat WanitaResep Cream Horn PastryIkan Tongkol Bikin Gatal? Ini PenjelasannyaResep Cumi Goreng Tepung MantulBakwan Jamur Tiram Gurih Dan NikmatKuliner Jangkrik Viral Di JepangResep Ayam Suwir Pedas Ala CeritaKuliner

Komentar

Posting Komentar