Whole Life Insurance Definition The Coverage And Possibility Of Premiums Last For The Policyholder's Entire Life.

Whole Life Insurance Definition. You Can Also Add A Definition Of Whole Life Insurance Yourself.

SELAMAT MEMBACA!

Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries, so long as the contract is up to date at life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies.

A type of insurance with a savings element that is guaranteed to pay out on death.

| whole life insurance is a life insurance policy that continues for the insured's whole life and requires premiums to be paid every year into the policy.

Whole life insurance is a type of insurance designed to provide coverage throughout your life, with a benefit paid at your death to your family (or the beneficiary of your choosing), as long as you maintain the terms of your contract.

A system in which you make regular payments to an insurance company in exchange for a fixed….

Second, mainly due to tax advantages, individual retirement saving has traditionally been channeled mainly into whole life insurance.

Whole life insurance is a kind of permanent life insurance, i.e.

As long as the insured individuals make the premium payments as agreed, their insurance coverage is valid throughout their lives.

Quick summary of whole life insurance.

A life insurance policy that covers the whole of the insured's life or lives and will pay an amount on death whenever it occurs.

There are definitely times when it makes sense, but you need to know what you're getting into.

There are a variety of different life insurance policies available for people who want to provide financial security for their.

Whole life insurance provides a guaranteed death benefit for the entire life of the insured.

The policy pays a fixed amount upon the death of the insured party.

You can also add a definition of whole life insurance yourself.

A contract with both insurance and investment components:

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

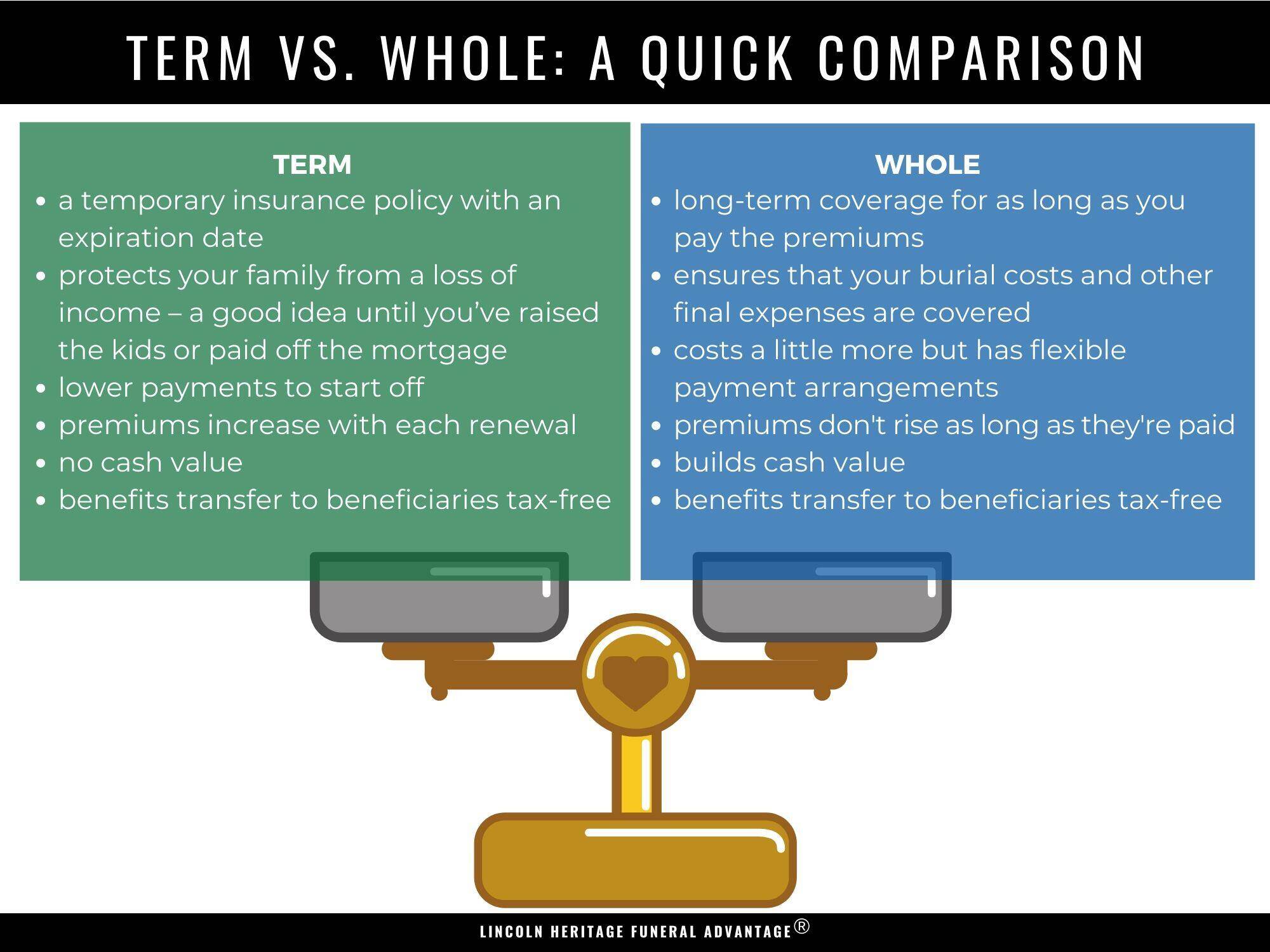

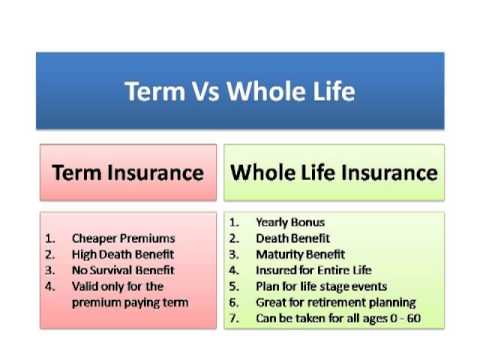

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance is one of the four main types of permanent life insurance.

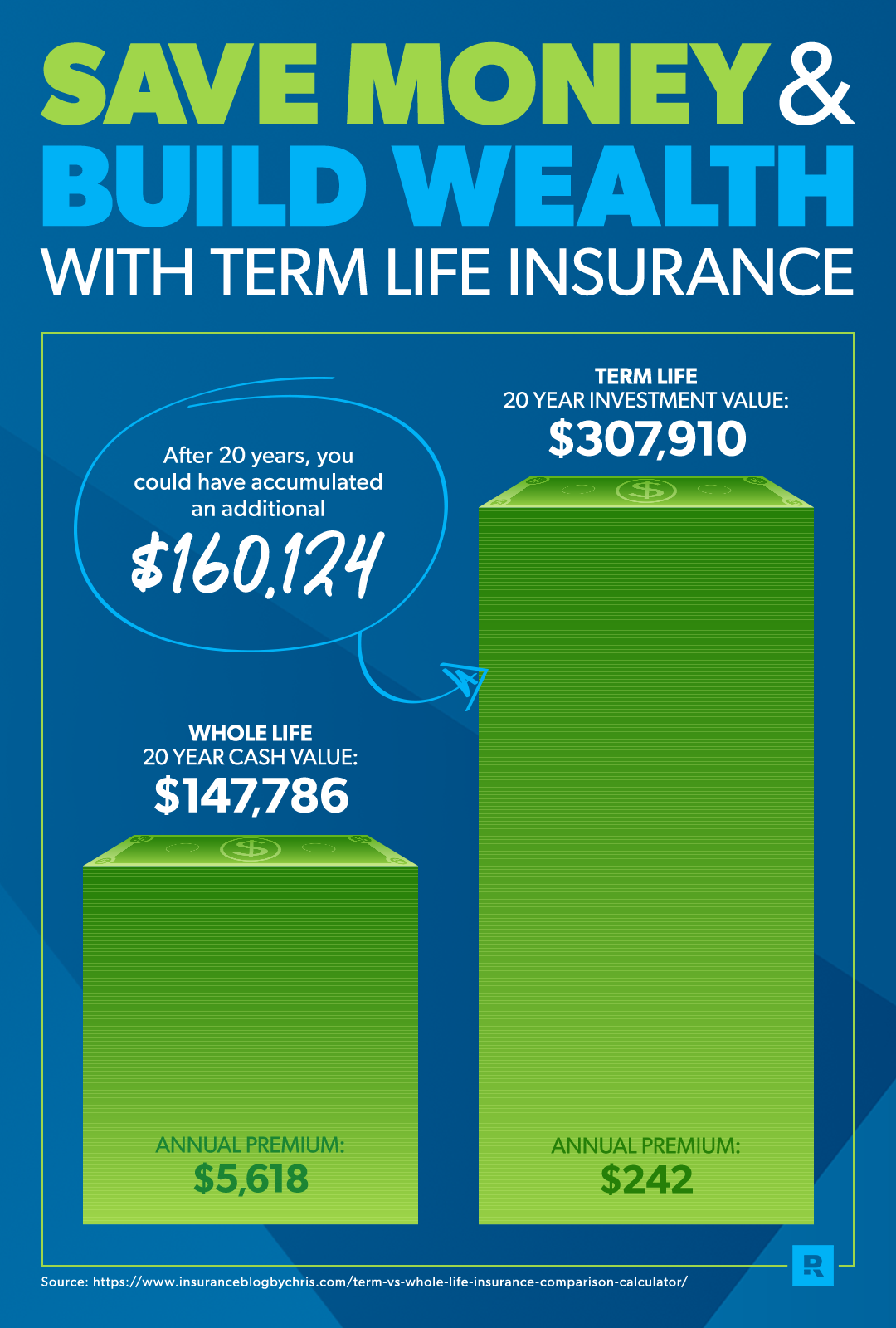

It costs more than term life insurance, but it also accrues cash value.

Definition of whole life insurance in the definitions.net dictionary.

Whole life insurance, or whole of life assurance, is a life insurance policy that remains in force for the insured's whole life and requires premiums to be paid every year into the policy.

Whole life stands out from other types of permanent life insurance because it guarantees the exact same payment for the life of the policy.

The best whole life insurance definition can be found with the following points:

A whole life insurance policy is a permanent form of life insurance that will remain throughout the lifetime of the insured.

Unlike term life insurance, whole life insurance offers an investment component.

Whole life insurance policies offer death protection and will pay a lump sum to your beneficiaries should you pass away.

Return from definition of whole life insurance to debt free financial advice.

Moreover, the money in the savings component also grows at an agreed upon interest rate.

The insured can withdraw money and even cash it in.

A life insurance policy that combines a death benefit payment to the policyholders' beneficiary along with a savings vehicle that accumulates the policy's cash value.

Whole life insurance on the other hand is a form of permanent life insurance, which means that in addition to insurance, the policy also has a savings component.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

A contract with both insurance and investment components:

A whole life insurance plan is basically a term plan with unlimited term.

The basic difference between the two plans is that in whole life plans, the nominee gets the money whenever the life insured dies till the age of 99 years whereas in term plan, the nominee would get the death benefit.

Life insurance that is kept in force for a person's whole life as along as the scheduled premiums are maintained and where benefits are payable to a beneficiary on death of the insured, whenever that occurs.

By definition, whole life insurance provides coverage that lasts your lifetime provided that your premiums remain current.

Rather than discuss the complexities associated with whole life insurance policies, let's get straight to discussing their benefits.

Whole life insurance is a type of a permanent life insurance that covers you as long as you live.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Ternyata Inilah HOAX Terbesar Sepanjang MasaTernyata Merokok Menjaga Kesucian Tubuh Dan Jiwa, Auto Masuk SurgaIni Cara Benar Cegah HipersomniaTernyata Tidur Terbaik Cukup 2 Menit!Jam Piket Organ Tubuh (Ginjal)Gawat! Minum Air Dingin Picu Kanker!Uban, Lawan Dengan Kulit KentangTernyata Menikmati Alam Bebas Ada ManfaatnyaTernyata Banyak Cara Mencegah Kanker Payudara Dengan Buah Dan SayurPD Hancur Gegara Bau Badan, Ini Solusinya!!Typically you will be paying constantly higher premiums. Whole Life Insurance Definition. Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Under the terms of the policy, the excess of premium payments above the current cost of insurance is credited to the cash value of the policy, which is credited each month with interest.

Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries, so long as the contract is up to date at life insurance is a contract in which an insurer, in exchange for a premium, guarantees payment to an insured's beneficiaries when the insured dies.

Whole life insurance, or whole of life assurance (in the commonwealth), is a life insurance policy that remains in force for the insured s whole life there are several types of whole life insurance policies.

Whole life insurance, or whole of life assurance , sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to this page is based on a wikipedia article written by contributors (read/edit).

A system in which you make regular payments to an insurance company in exchange for a fixed….

To simplify the text, we will present problems and relevant approaches in terms of a life insurance and annuity portfolio only.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

Whole life insurance can give you lifelong coverage and provide extra support during retirement.

Term life insurance covers you for a shorter period, but it's cheaper and simpler.

Whole life insurance sentence examples.

I don't know if you've noticed lately, but they're all around you!

Whole life insurance meaning in english, whole life insurance definitions, synonyms of whole life definition of whole life insurance in english ar wikipedia.

Insurance on the life of the insured for a fixed amount at a definite premium that is paid each year in the same amount during the entire lifetime of the insured.

A contract with both insurance and investment components:

(1) it pays off a stated amount upon the death of the insured, and (2) it whole life insurance policies are one type of cash value insurance.

By contrast, term life insurance only covers you for a specific number of years.

While there are other kinds of permanent coverage, whole life is the simplest.

A whole life policy also has a cash.

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

English dictionary | whole life insurance.

A type of insurance with a savings element that is guaranteed to pay out on death.

| whole life insurance is a life insurance policy that continues for the insured's whole life and requires premiums to be paid every year into the policy.

Whole life insurance policy provides death benefits during the entire life of a policy holder.

Let us see this through the definitions first so that you get it in simple terms.

Term insurance is a fixed term contract.

Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholder's life and has a savings component.

The insured can withdraw money and even cash it in.

Subscribe to america's largest dictionary and get thousands more definitions and advanced search—ad free!

Whole life insurance — whole life insurance, or whole of life assurance (in the whole life insurance — see life insurance merriam webster's dictionary of law.

Whole life insurance is more expensive than term life insurance, but there are some advantages, such as cash value you can borrow against.

Whole life insurance is a type of permanent life insurance that never expires, unlike term life insurance which ends after a specified period of time.

Wikipedia, the free encyclopedia [home, info].

Search for whole life insurance on google or wikipedia.

A whole life insurance provides coverage for an individual's whole life.

A savings components which builds overtime and can be used for wealth accumulation.

Life insurance that is kept in force for a person's whole life as along as the scheduled premiums are maintained and where benefits are payable to a beneficiary on death of the insured, whenever that occurs.

The premium payment can happen for a specified number of years or throughout life.

Life insurance policy covering death, builds a cash value, pays fixed benefit for death, has a constant premium.

By definition, whole life insurance provides coverage that lasts your lifetime provided that your premiums remain current.

Additionally, whole life insurance provides tax benefits and a cash value feature that grows over time.

This policy is perfect for those consumers seeking the benefits of life.

Whole life insurance is a life insurance that remains in effect for the insured's entire life and.

Proper citation formating styles of this definition for your bibliography.

Whole life insurance is a life insurance that remains in effect for the insured's entire life and. Whole Life Insurance Definition. Proper citation formating styles of this definition for your bibliography.Resep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangTernyata Bayam Adalah Sahabat Wanita5 Trik Matangkan ManggaTernyata Terang Bulan Berasal Dari BabelResep Pancake Homemade Sangat Mudah Dan EkonomisTernyata Inilah Makanan Indonesia Yang Tertulis Dalam PrasastiTernyata Kamu Baru Tau Ikan Salmon Dan Tenggiri SamaFakta Perbedaan Rasa Daging Kambing Dan Domba Dan Cara Pengolahan Yang BenarCegah Alot, Ini Cara Benar Olah Cumi-CumiResep Yakitori, Sate Ayam Ala Jepang

Komentar

Posting Komentar