Whole Life Insurance For Seniors Click Here And Send Me A Message With Details Of What You're Wanting To Accomplish.

Whole Life Insurance For Seniors. Life Insurance For Those 50 To 80.

SELAMAT MEMBACA!

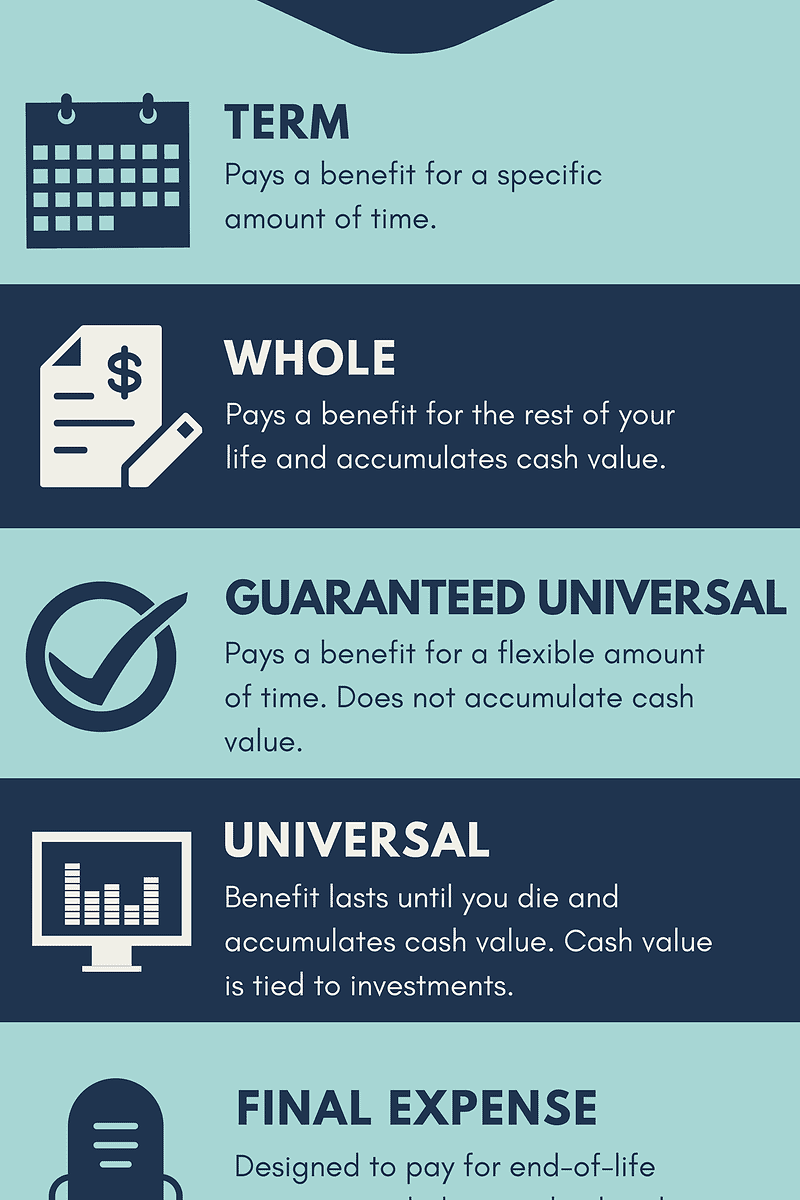

Life insurance for seniors is the same type of life insurance available at any age, but it's often priced and marketed differently.

Whole life insurance policies with high coverage amounts are much.

Whole life or universal life insurance will be more expensive than term insurance, so policyholders can expect to pay six to 10 times more for life insurance for seniors is expensive, but buying life insurance can be a great investment to protect family members from hardship or leave an inheritance.

Guaranteed issue life insurance, sometimes called senior life insurance or final expense insurance, has no medical requirements for acceptance.

Senior whole life is an independent life insurance agency, helping seniors find the best final expense insurance, guaranteed universal life at senior whole life, we act as a consultant for our clients.

We share our knowledge of many different life insurance companies, and use our experience.

But whole life insurance is actually just one type of permanent life insurance.

And since you're already purchasing life insurance for a senior, the premiums could be prohibitively expensive.

What makes whole life insurance best suitable for seniors & elderly parents?

You never know unless comparing different policies.

This includes term life, whole life and universal life insurance.

Term life insurance is available through age 80, although the length of like anyone else, buyers of senior life insurance should look for a policy that fits their needs.

Your purpose for buying life insurance will guide your decision on the.

Senior life insurance helps your family stay financially stable, and term life insurance for a man over 60 starts around $20/mo.

Will term life insurance, whole life insurance, or final expense insurance work best for your needs?

Here is the ultimate truth about life insurance:

Whole life insurance comes with several benefits for seniors.

It is meant to be for the senior citizens.

For some people, whole life insurance has tons of benefits but for some, it is full of rubbishes.

How does whole life insurance work for seniors.

A little historical perspective might be useful.

Originally only term and whole life policies were other whole life insurance considerations for seniors.

Whole life insurance offers low rates of return — most policies don't even break even for seven to 10 years — and may cost up to 20 times as much as guaranteed universal life insurance is a useful option for seniors in several scenarios, including leaving a legacy fund, avoiding estate taxes, paying.

Aarp's life insurance policies for seniors.

Aarp offers both term and permanent policies.

Whole life is a kind of permanent life insurance policy.

Life insurance can be incredibly important for seniors that want to provide financial coverage for their families.

Learn about what your options are and which companies have the best quotes for seniors over 60, 70 and 80.

Affordable options for all ages.

The best life insurance for seniors depends on each person's situation.

Read life insurance company reviews as well as what to know before buying a premiums for a variable whole life insurance policy with a level death benefit are usually lower but the death benefit hold less value in future dollars.

It comes in small amounts so it can help pay for final expenses after you've passed here are some of the benefits of dreamsecure senior whole life insurance:

Life insurance for those 50 to 80.

The company offers term, whole and universal life insurance policies.

Guaranteed issue whole life insurance:

Another type of final expense insurance promises to insure many applicants who may not qualify for conventional for seniors who want a simple life insurance solution that provides basic coverage, state farm also offers final expense insurance with a $10,000.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

If you hope to have coverage for several years, you'll probably be happiest with level premiums and a term that lasts as long as you if you buy a permanent whole or universal life insurance policy, you can use the cash value by borrowing against it.

A whole life insurance policy lasts for the insured person's entire life.

It builds cash value, and the benefits will be paid out after a person dies.

It is whole life insurance with a small death benefit with a different marketing term.

Nevertheless, you can get life insurance at any age, but the cost varies.

Many companies offer life insurance for seniors over 90, but your age and health.

Senior life policies are not funeral or burial contracts.

This life insurance does not specifically cover funeral goods or services and may not cover the entire cost of your funeral at the.

Are you a senior interested in $100,000 whole life insurance?

Click here and send me a message with details of what you're wanting to accomplish.

Table of contents hide what are some benefits of life insurance for senior citizens?

The terms you should know the company consistently offers some of the best whole and term life insurance for seniors 70.

Most of the time, you'll hear it referred to as term life insurance or whole life insurance, though the two are even then, there are life insurance options for seniors that will insure you no matter what or have more relaxed underwriting rules.

When recommending life insurance policies for seniors, we take into consideration more than your age.

4 Manfaat Minum Jus Tomat Sebelum TidurSalah Pilih Sabun, Ini Risikonya!!!Ini Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatTernyata Jangan Sering Mandikan BayiTernyata Pengguna IPhone = Pengguna NarkobaCara Benar Memasak SayuranMulti Guna Air Kelapa HijauSegala Penyakit, Rebusan Ciplukan ObatnyaMulai Sekarang, Minum Kopi Tanpa Gula!!6 Khasiat Cengkih, Yang Terakhir Bikin HebohA very common life insurance policy for seniors is what is called a universal life policy. Whole Life Insurance For Seniors. Universal life insurance is a perfect blend between term and new york life is an established name in the life insurance industry.

There is no term life insurance for seniors over 85, universal life, or accidental death life coverage.

Only whole life insurance is available in this age range.

The way a whole life insurance plan works is incredibly.

The policy costs higher than whole life insurance, but this can offer more savings which can be a deciding factor for seniors, but the cost will be another great feature of universal insurance for over 85 years old is that you have options to take out loans on insurance with some excellent terms.

At this age, no one can hold a physically fit body.

Almost all people over 85 face major or minor health issues.

Diabetics, memory loss, or high cholesterol are the most common issues that a senior over 85 faces.

Most of transamerica's final expense life insurance policies can be issued up to age 85 with higher death benefit limits than most competitors.

How to find affordable life insurance for seniors over 85?

Get useful tips to obtain suitable policy that provides peace of mind & reduces financial how affordable is an insurance policy for seniors over 85?

How to calculate life insurance face value at 85?

When you buy life insurance at 85 years old, your choices are restricted to burial and final expense policies.

Final expense coverage is intended to help with the associated costs related to your death such as burial, funeral, and medical.

In case you come across any obstacles in deciding about getting an appropriate life insurance for elderly over 85 due to misunderstandings in the quotations etc.

Affordable and best life insurance for seniors over 85 free quotes below here.

Term life insurance for older citizen people over 85 demands to be specific for within the financial planning practice.

Our opinions are our own and are not influenced by payments from advertisers.

Life insurance is also a strategic consideration for seniors if they have savings or assets.

You can consider using a whole life or universal life policy.

In the occasion of death of the covered within this specified 2 season time frame.

However, with some whole life insure protection programs, you can continue to pay rates as long as you want your aarp insurance.

What is the best life insurance over 60?

And since you're already purchasing life insurance for a senior, the premiums could be whole life insurance:

This option comes with a death benefit and a cash value.

This includes term life, whole life and universal life insurance.

The over 85 senior life insurance technique protection with no examination is available for you.

You will get your security in a few months span.

Therefore, younger and healthy people tend to pay less for their life insurance for seniors over 85 years old plan.

Get compare best senior life insurance companies quotes.

Term life insurance for seniors is life insurance for people over one of the most effective and helpful ways with which you can do that is life insurance for seniors over 80 to 85 age.

Whole life or term senior life insurance company.

Life insurance for seniors over 85 gives the peace of mind of having the financial means readily and quickly available to pay for the funeral and other final expenses, usually sums that most people won't have readily available in.

The benefit of whole life insurance policies is that they build cash value over time, which is a fund that can be borrowed against or withdrawn.

However, a portion of premiums goes toward the cash value, making whole life insurance significantly more expensive.

The life insurance for elderly over 85 years old in the western world and thus when you are at this stage, the free quotes providers can know that get today affordable life insurance for seniors over 85 to 90 quote.

Just ensure that, the individual is not working for a single company as he can be biased.

Get guaranteed approval life insurance for elderly people over 85.

Expenses more than $500 per month which is really a big amount.

Life insurance premiums for seniors over 80.

Guaranteed issue whole life insurance coverage from aig was designed specifically to meet the needs of adults ages 50 to 85.

Life insurance policy premiums hinge directly on your age and.

Affordable life insurance for elderly over 90 policy security.

These quotes are from a company called american continental life insurance for seniors over 88, 89 best modified benefit whole life colonial penn insurance.

/GettyImages-98478916-5b5a80e34cedfd00507e64ea.jpg)

Can my premiums ever increase over time?

All policies purchased through senior whole life.

Senior life insurance is a type of whole life insurance that older people usually buy to cover funeral expenses and other expenses when they die.

Best life insurance for seniors.

Guaranteed issue life insurance, sometimes called senior life insurance or final expense insurance, has no medical requirements for acceptance.

Senior life insurance over 60.

The best whole life insurance for seniors over 80 is designed to cover you until the day that you die.

You do not have to worry about outliving your policy.

This is one of the main things that many people look for when shopping coverage, whether they are shopping for themselves or looking at their elderly.

It will be expensive because you waited until the insured was over 85 years old.

Life insurance for seniors over 80.

At age 80 and beyond, you're unlikely to find a company that will offer you term insurance.

In general, it's also the most expensive type of life insurance, so it's the rare senior who can afford the premiums.

Often seniors over 80 looking for life insurance do so to cover the cost of a funeral.

Often seniors over 80 looking for life insurance do so to cover the cost of a funeral. Whole Life Insurance For Seniors. According to the national funeral directors association, the average funeral cost is going to be around when you are between the ages of 80 to 85, you can still qualify for different types of whole life insurance coverage.Sejarah Nasi Megono Jadi Nasi TentaraKuliner Jangkrik Viral Di JepangNanas, Hoax Vs Fakta3 Jenis Daging Bahan Bakso TerbaikKhao Neeo, Ketan Mangga Ala Thailand5 Makanan Pencegah Gangguan PendengaranNikmat Kulit Ayam, Bikin SengsaraResep Garlic Bread Ala CeritaKuliner Black Ivory Coffee, Kopi Kotoran Gajah Pesaing Kopi Luwak7 Makanan Pembangkit Libido

Komentar

Posting Komentar