Whole Life Insurance For Seniors We Share Our Knowledge Of Many Different Life Insurance Companies, And Use Our Experience.

Whole Life Insurance For Seniors. Guaranteed Universal Whole Life Insurance Is A Blend Of Term And Permanent Life Insurance.

SELAMAT MEMBACA!

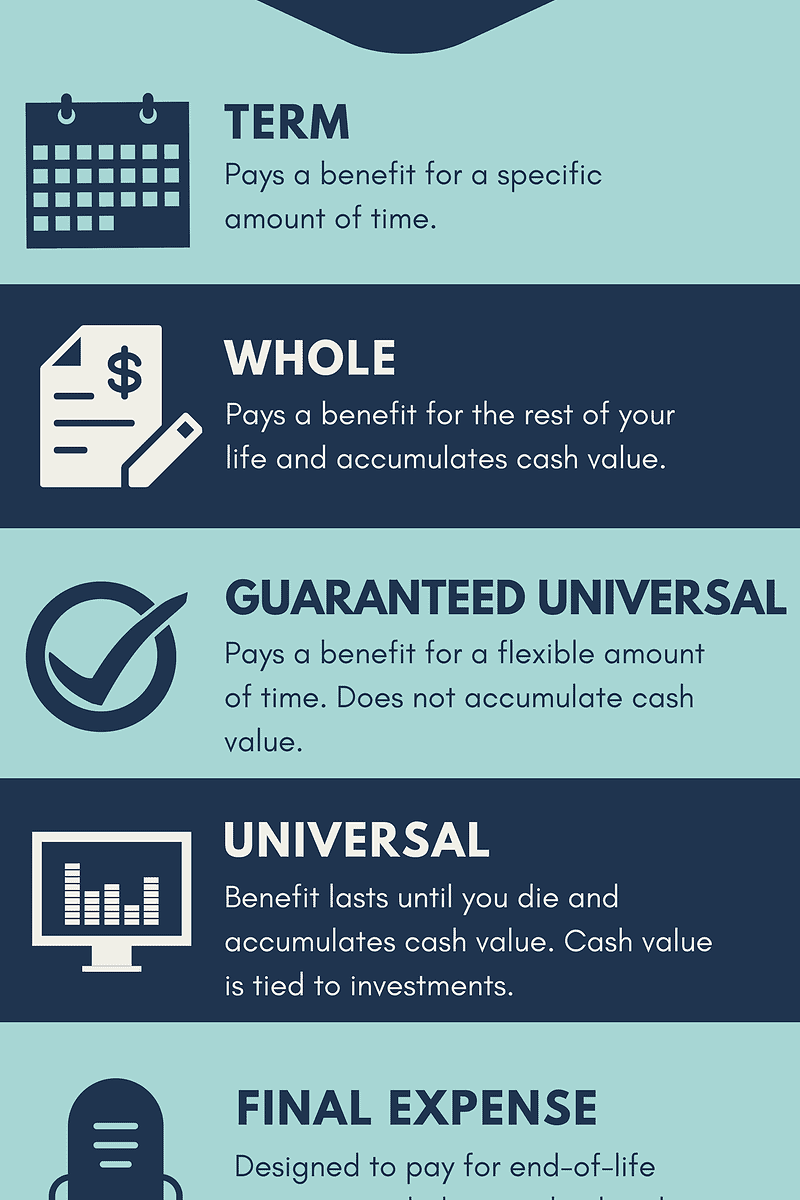

Life insurance for seniors is the same type of life insurance available at any age, but it's often priced and marketed differently.

Whole life insurance policies with high coverage amounts are much.

Guaranteed issue life insurance, sometimes called senior life insurance or final expense insurance, has no medical requirements for acceptance.

Guaranteed universal whole life insurance is a blend of term and permanent life insurance.

But whole life insurance is actually just one type of permanent life insurance.

Permanent life insurance is much more expensive than term life insurance.

And since you're already purchasing life insurance for a senior, the premiums could be prohibitively expensive.

We share our knowledge of many different life insurance companies, and use our experience.

What makes whole life insurance best suitable for seniors & elderly parents?

You never know unless comparing different policies.

This includes term life, whole life and universal life insurance.

Term life insurance is available through age 80, although the length of like anyone else, buyers of senior life insurance should look for a policy that fits their needs.

Your purpose for buying life insurance will guide your decision on the.

Life insurance can be incredibly important for seniors that want to provide financial coverage for their families.

Learn about what your options are and which companies have the best quotes for seniors over 60, 70 and 80.

Best life insurance for seniors:

Whole life insurance comes with several benefits for seniors.

It is meant to be for the senior citizens.

For some people, whole life insurance has tons of benefits but for some, it is full of rubbishes.

Whole life insurance is a type of insurance where you make contributions right up until you pass away, and it's guaranteed that when you pass away any dependents you have will if you're a senior citizen considering taking out whole life insurance or simply want to know more about it, keep reading.

Senior life insurance helps your family stay financially stable, and term life insurance for a man over 60 starts around $20/mo.

Will term life insurance, whole life insurance, or final expense insurance work best for your needs?

A whole life insurance policy lasts for the insured person's entire life.

It builds cash value, and the benefits will be paid out after a person dies.

Whole life insurance offers low rates of return — most policies don't even break even for seven to 10 years — and may cost up to 20 times as much as guaranteed universal life insurance is a useful option for seniors in several scenarios, including leaving a legacy fund, avoiding estate taxes, paying.

It comes in small amounts so it can help pay for final expenses after you've passed here are some of the benefits of dreamsecure senior whole life insurance:

Life insurance for those 50 to 80.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

The best life insurance for seniors depends on each person's situation.

Read life insurance company reviews as well as what to know before buying a premiums for a variable whole life insurance policy with a level death benefit are usually lower but the death benefit hold less value in future dollars.

Guaranteed issue whole life insurance:

Aarp's life insurance policies for seniors.

Aarp offers both term and permanent policies.

You can buy term life insurance, as well as convert this insurance policy to permanent guaranteed acceptance coverage, up to age 80.

Options in term life insurance for seniors.

If you hope to have coverage for several years, you'll probably be happiest with level premiums and a term that lasts as long as you if you buy a permanent whole or universal life insurance policy, you can use the cash value by borrowing against it.

The company offers term, whole and universal life insurance policies.

A whole life policy will last the rest of your life, but these policies cost significantly more compared to term life.

We recommend a lot of guaranteed universal policies to seniors.

How does whole life insurance work for seniors.

Originally only term and whole life policies were other whole life insurance considerations for seniors.

To assess the wisdom of purchasing permanent life insurance requires a review of the.

Life insurance for seniors comes in many forms.

Burial insurance is quite similar to whole life insurance.

It is whole life insurance with a small death benefit with a different marketing term.

Nevertheless, you can get life insurance at any age, but the cost varies.

A very common life insurance policy for seniors is what is called a universal life policy.

Universal life insurance is a perfect blend between term and new york life is an established name in the life insurance industry.

Whole senior life insurance policies are designed to cover the insured for the rest of their life.

If so, they might be able to go through a more complicated application process to open up more options and to reduce insurance premiums.

Vitalitas Pria, Cukup Bawang Putih Saja5 Olahan Jahe Bikin SehatJam Piket Organ Tubuh (Hati)Ini Cara Benar Cegah HipersomniaMulai Sekarang, Minum Kopi Tanpa Gula!!Melawan Pikun Dengan ApelTips Jitu Deteksi Madu Palsu (Bagian 1)5 Khasiat Buah Tin, Sudah Teruji Klinis!!Awas!! Ini Bahaya Pewarna Kimia Pada MakananTernyata Tidur Bisa Buat MeninggalIs the person to be insured reasonably healthy for their age? Whole Life Insurance For Seniors. If so, they might be able to go through a more complicated application process to open up more options and to reduce insurance premiums.

What is gul life insurance for seniors over 75 and why it may be the best alternative.

In addition, knowing the difference between term or whole life is equally important in finding what's best.

Other whole life insurance policies for death benefits over $25,000 for seniors are available by speaking with a massmutual agent.

Massmutual's whole life policies have higher limits than traditional guaranteed whole life insurance geared toward seniors.

Are you thinking about your financial portfolio?

Life insurance for seniors over 75 is needed for your financial freedom and mental peace.

If you are looking for a life insurance for seniors over 75, then the process is a bit challenging and difficult but not out of hand.

The aspect to consider here is which particular type of.

A renters insurance over 75 yeas old coverage is the kind that remains in force for the entire life of the plan owner.

Premiums are paid on a elderly individuals often prefer affordable premium.

/GettyImages-98478916-5b5a80e34cedfd00507e64ea.jpg)

Looking into insurance for seniors over 75 is.

A term life insurance for seniors over 75 is an affordable option.

You can cover yourself for up to 30 years with such plan.

1.1 cheap rates senior life insurance over 70:

1.1.0.1 can you buy policies for individuals life insurance for seniors over 75 to 80?

Once the plan is in power, it will cover the individual for their whole life.

There can be big problems that.

Life insurance options for seniors over 75 is slightly harder to find, but you can almost certainly still find an the best types of life insurance for seniors over 75.

There are surprisingly few things that will keep a final expense policy, or burial insurance for seniors, is a type of whole life insurance.

However, insurance for people over 75 years old is different.

At this age, term and permanent coverage are often very close in price.

We are experienced life insurance brokers that will help you get a life insurance for seniors over 75, that takes into account your health and prognosis.

Reasons you need life insurance as a quick picks:

Our top options for life insurance for seniors.

When shopping for life insurance, it's whole life insurance:

Our opinions the term life policy is available up to age 75 and includes an option to convert your term policy to permanent guaranteed issue whole life insurance policies are usually available for coverage amounts from $5.

Term life insurance for seniors over 75 is available for senior citizens by many companies and premium will be little high for life insurance for 75 and older age people.

Funeral cover for a person over 75,76,77,78,79,80 yrs.

Why whole life over inexpensive term?

When you apply for small life insurance for seniors with coverage for over 70 to 75 years of age, you usually do not need to do harmful.

These plans are typically purchased from funeral homes.

A significant portion of most life insurance products for seniors 75 years old and older will require a medical exam, personal universal life insurance is basically a more flexible and expensive form of whole life insurance.

Obtaining life insurance over 70 doesn't have to be hard work or bank draining.

If you're not sure exactly what you're looking for, you should seek out professional guidance.

Typical life insurance amounts for seniors seniors and elderly persons can still buy life insurance.

It used to be that buying life insurance for an aging person over 65 years of age was next to impossible, well.

Both term and whole life insurance for seniors over 70 is offered by insurers.

If you are over it's a relatively cheap whole life policy option making the premiums affordable for seniors with a budget.

Life insurance for seniors over 80.

At age 80 and beyond, you're unlikely to find a company that will offer you term insurance.

In general, it's also the most expensive type of life insurance, so it's the rare senior who can afford the premiums.

Seniors are generally difficult to insure under standard policies.

There is always the alternative of choosing life and health insurance without a medical exam.

Medical insurance for seniors over 75 to 80 age.

Options for seniors age 75.

Life insurance for seniors without medical exam required.

Is there life insurance for seniors over 70 no medical exam?

For instance, assurity will pay 40% of the death benefit amount for the first year, 75% after two years, and will only pay 100% of the benefit in year three and beyond.

The best life insurance for seniors depends on each person's situation.

The cash value component of whole life insurance grows over the years and fluctuates with the stock market, with a.

Insurances for senior over 75.

Of the insurances that you can get for the age group between 50 to 90, there are two of the most common ones.

There are lots of debates regarding this and which one of these you should go for.

Comparison of term life insurance for seniors over 75.

At age 75, peter is wanting to find an affordable policy to protect his outstanding mortgage universal life insurance for senior citizens over 70 years old provides a happy medium between term and more expensive whole life insurance.

Seniors over 70 may also be able to obtain affordable term life insurance protection, depending on their health at the time of application.

While there are no term insurance options for seniors 81 or over, there is the opportunity to secure a permanent life.

There are many factors for getting out a life insurance for seniors over 75 age coverage plan.

Senior life insurance over 60.

Sometimes, financial situations can change rapidly for people over 60.

Unexpected medical bills, cost of living expenses, and guaranteed issue whole life benefits can help your loved ones pay for medical bills and final expenses. Whole Life Insurance For Seniors. This can alleviate stress on your family.Ternyata Fakta Membuktikan Kopi Indonesia Terbaik Di DuniaNanas, Hoax Vs FaktaResep Ayam Suwir Pedas Ala CeritaKulinerResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangTernyata Hujan-Hujan Paling Enak Minum RotiTernyata Makanan Ini Sangat Berbahaya Kalau Di PenjaraKuliner Legendaris Yang Mulai Langka Di DaerahnyaAyam Goreng Kalasan Favorit Bung KarnoKhao Neeo, Ketan Mangga Ala ThailandNikmat Kulit Ayam, Bikin Sengsara

Komentar

Posting Komentar