Whole Life Insurance Meaning Term Life Insurance Can Be A Great Way To Protect Yourself.

Whole Life Insurance Meaning. That Means Your Family And Beneficiaries Are Covered For The Duration Of Your Life*.

SELAMAT MEMBACA!

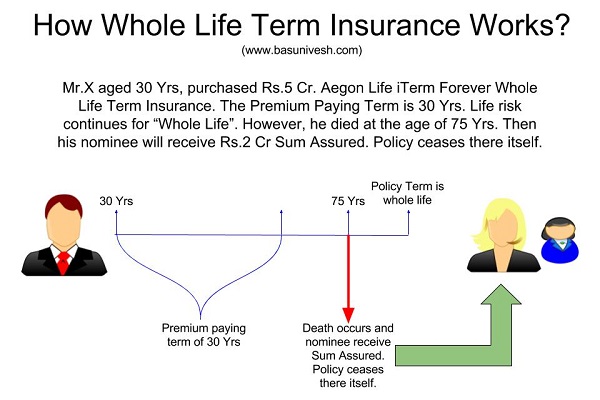

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Policies secured income for families in the event of the untimely death of the insured and helped subsidize retirement planning.

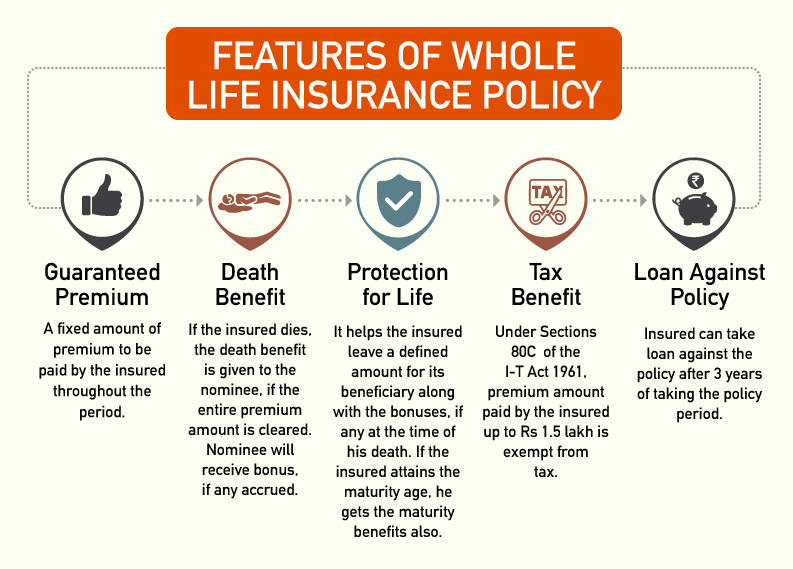

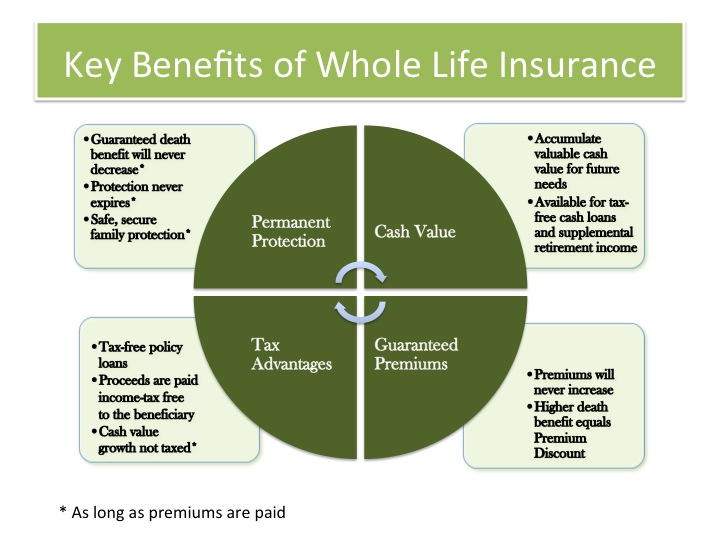

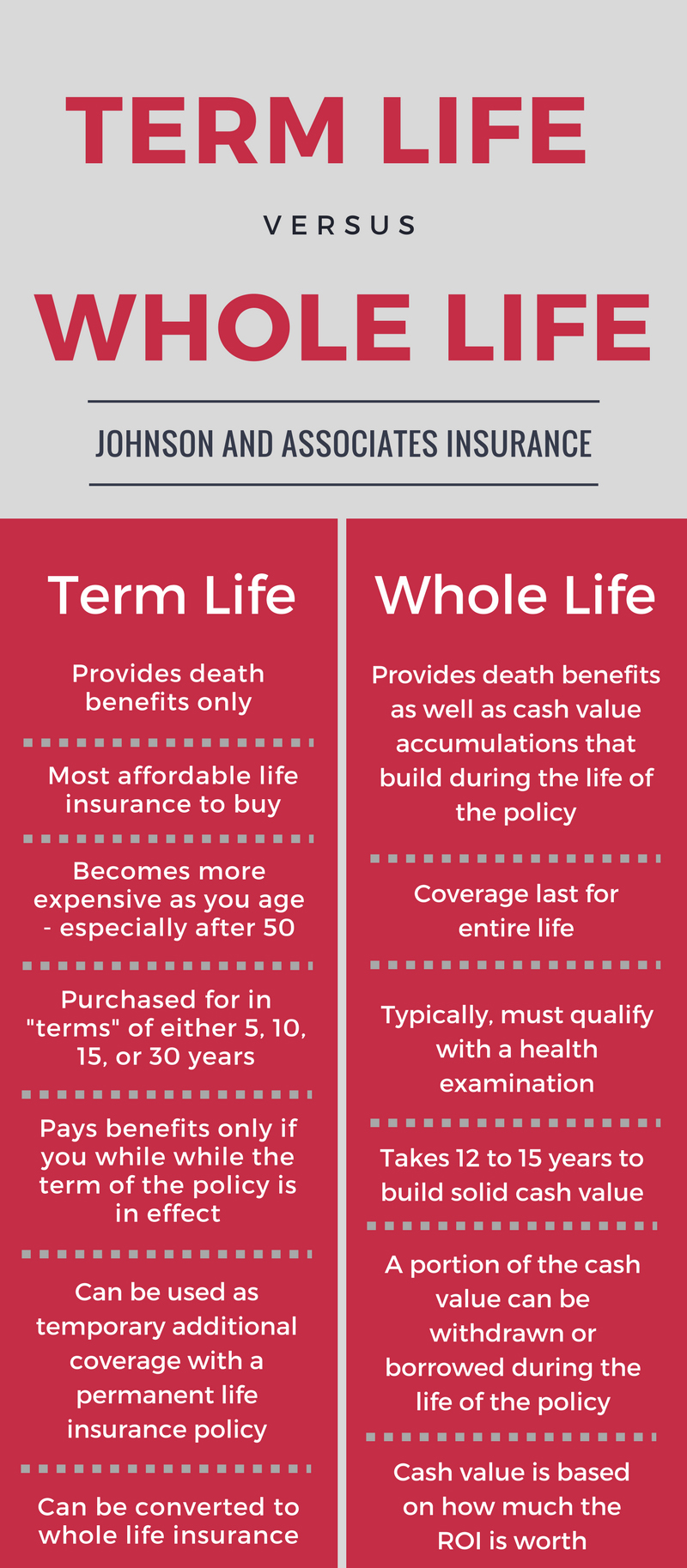

Whole life insurance policies provide permanent life insurance and typically offer fixed premiums, fixed death benefits and a cash value savings component.

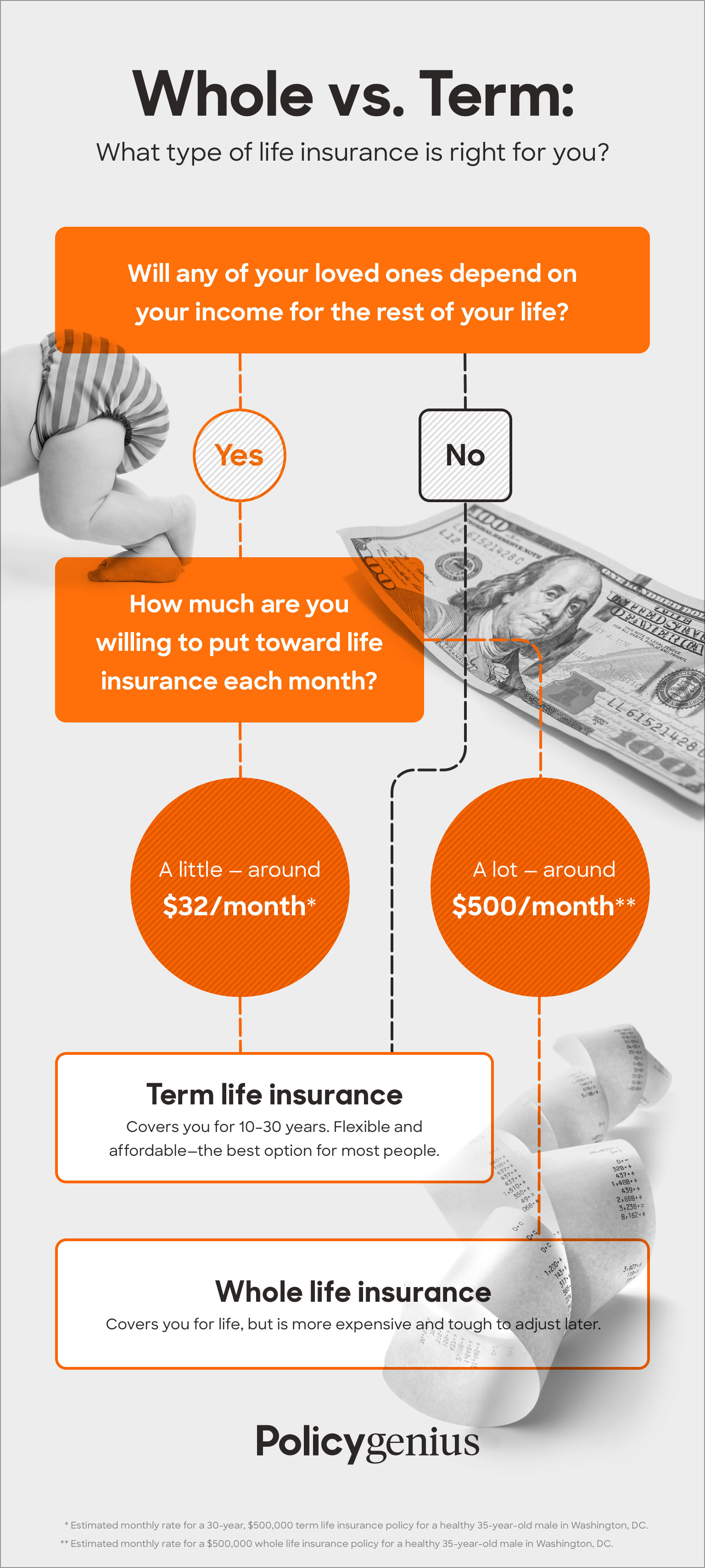

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance is, first and foremost, permanent life insurance protection that lasts your entire life;

By contrast, term life insurance only covers a permanent estate:

Whole life insurance provides a guaranteed death benefit for the entire life of the insured.

What is permanent life insurance?

A company's financial rating and selection of policies doesn't mean much if it delivers poor customer service.

Professional and consumer reviews shed some light on how easy a company is to work with, from submitting your.

That's because having a policy with a mutual life insurance company means you own a part of the company and can share in the mutual's profits in the form of an annual dividend payout.

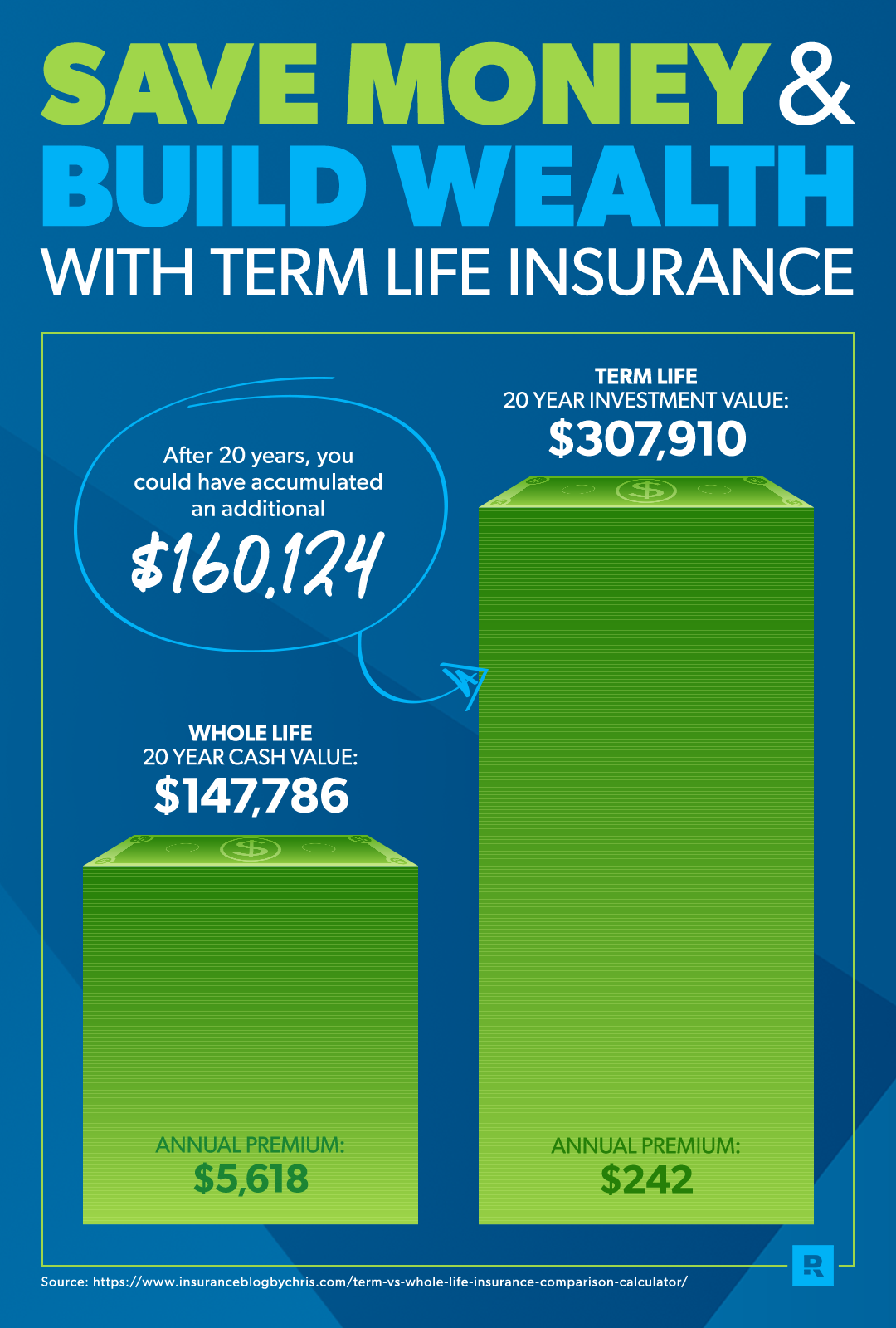

Whole life insurance costs more because it's designed to build cash value, which means it tries to double up as an investment account.

Getting insurance and a savings account with one monthly payment?

Whole life insurance is a type of permanent life insurance that never expires, unlike term life insurance which ends after a specified period of time.

Whole life stands out from other types of permanent life insurance because it guarantees the exact same payment for the life of the policy.

Whole life insurance is a type of life insurance meant to last for the entire life of the insured person of the policy.

If the whole life policy is purchased from a mutual company, it is also an ownership stake in the company itself.

Whole life insurance can give you lifelong coverage and provide extra support during retirement.

You can borrow money against.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

Whole of life insurance is a type of policy that guarantees an insurance provider will pay out a lump sum to your loved ones when you die, rather than within a fixed time frame.

The term 'assurance' means that the policy guarantees to pay out upon death, and 'whole of life' insurance is typically the.

Rates are generally fixed, and the policy builds cash value over time.

In term life, you buy the policy for a predetermined amount of time.

If the insured does not pass away during the policy term, a new policy must be.

Traditionally, whole life insurance is a consumer demanded product.

That means that a whole life insurance policy, besides providing a death benefit, will also provide potential for cash value build up.

And that benefit can be substantial after 20 or 30 years, even to the point of representing an additional retirement resource.

![What is Whole Life Insurance? [A Quick & Simple Guide]](https://2l27cd2bdspu43ihba1hjyq4-wpengine.netdna-ssl.com/wp-content/uploads/2015/10/What-is-Whole-Life-Insurance_-410x1024.png)

Whole life insurance is insurance that can be purchased at nearly any age and that doesn't expire.

Often people will view whole life insurance as an an indeterminate premium whole life policy allows for adjustable premiums over the years.

What this means is that your premiums will increase when.

The first is to protect your family.

(and if you face estate taxes that means the company must collect $400 from each of the 5,000 people who buy insurance just to cover their costs.

Now, this is called mortality cost, and those go up each year.

Term insurance is a life insurance policy that is only good for a certain term, or the average life insurance rates are greater on whole life insurance policies because they have some type of cash value buildup, and traditional term life.

In our article whole life insurance for dummies, we will help you understand the basics about whole life.

Life insurance is an excellent decision for your financial future.

Learn more about whole life insurance (a type of permanent life insurance), including whether it's the best option for you, from the experts at lifeinsure.com.

The policy will remain in force for the lifetime of the insured as long as the premiums are paid.

This means the insurer cannot cancel your.

The premium payment can happen for a specified number of years or throughout life.

Whole life insurance is a type of life insurance that provides coverage for the entirety of the policyholder's life and has a savings component.

Moreover, the money in the savings component also grows at an agreed upon interest rate.

Whole life insurance means the life insurance policy that:

Whole life insurance, also called permanent life insurance, is designed to last your lifetime.

That means your family and beneficiaries are covered for the duration of your life*.

Whole of life insurance explained.

How easy is it to get life insurance if you're considered high risk?

We work with experts who can get you the cover you need.

Whole life insurance is a permanent insurance policy that is guaranteed to remain active for as long as the insured individual is alive and as long as premiums are paid.

At the point when you initially apply for inclusion, you are consenting to an agreement in which the insurance organization vows to pay.

A contract with both insurance and investment components:

Whole life insurance is actually a type of permanent life insurance.

This insurance doesn't just have a death benefit.

It also includes a savings component.

But it also means that premiums are more expensive, and these policies are more.

4 Manfaat Minum Jus Tomat Sebelum TidurKhasiat Luar Biasa Bawang Putih PanggangIni Manfaat Seledri Bagi KesehatanIni Fakta Ilmiah Dibalik Tudingan Susu Penyebab JerawatCara Benar Memasak SayuranVitalitas Pria, Cukup Bawang Putih SajaTernyata Jangan Sering Mandikan BayiSalah Pilih Sabun, Ini Risikonya!!!10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 1)Pentingnya Makan Setelah OlahragaThis means you can maintain insurance for the rest of your life. Whole Life Insurance Meaning. But it also means that premiums are more expensive, and these policies are more.

Beispielsätze für whole life insurance auf deutsch.

Bab.la ist für diese inhalte nicht verantwortlich.

Englishwith whole life insurance you can provide financial security for your family or anyone near to you.

'� einer oder mehr forum threads stimmen mit ihrem gesuchten begriff überein.

Whole life insurance, or whole of life assurance (in the commonwealth of nations), sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date.

Whole life insurance is a type of permanent life insurance that offers cash value.

These policies allow you to build up cash that you can tap into while you're alive.

Client and company manage investments.

Traditional whole life insurance uses a savings account as the managed investment portion of the policy.

This account has a set minimum rate determined at the time of policy inception and can increase as interest rates rise.

Permanent life insurance is different than term life insurance, which covers the insured person for a set amount of time (usually between 10.

Whole life insurance is a type of permanent life insurance that offers lifelong coverage and consistent premiums.

These policies include a cash value account, which is the investment component in permanent policies.

Helping your family get through the most difficult time.

Our individual whole life insurance policy helps to provide your family the support they need to pay for your final expenses.

The purpose of whole life insurance is to provide coverage for your entire lifetime.

Whole life insurance is permanent protection that lasts your entire life, at a guaranteed premium rate that will never increase, regardless of your age or health status.

One benefit of whole life insurance is that it accumulates cash value that can be borrowed against during your lifetime.

Whole life insurance is one of the four main types of permanent life insurance.

It costs more than term life insurance, but it also accrues cash value.

Whole life insurance covers you and your entire life, provided you pay your premiums.

Whole life insurance policies never expire, and the amount of they offer whole life , universal life, and variable universal life insurance.

Whole life insurance is a type of permanent life insurance that helps protect your loved ones in the future and your finances now.

A guardian whole life insurance policy covers you for your entire life, rather than a limited term as with term life insurance (which typically covers you for a period of 10.

Whole life insurance can help provide financial protection for your whole life.

Provides coverage for the entirety of the insured's life, generally to age 100, as long as the policy is in force.

Whole life insurance accumulates cash value, too, providing you the option of borrowing against it.1 it's a financially smart way to help protect yourself and your loved ones.

You can even buy a separate policy for children, so they have coverage for their entire lives.

Another benefit to whole life insurance is that the amount paid each month is level, or consistent.

You don't have to worry about premium hikes as you age or as your health declines.

Best whole life insurance companies.

Whole life insurance policies have a level premium, they accumulate a guaranteed amount of cash value each year, and the death benefit is also index universal life insurance is another whole life alternative.

This policy also has an investment component letting you allocate up to 100% of your.

Gerber life whole life insurance provides permanent life insurance protection and financial security for your family.

A part of the premiums paid by the insured person goes towards insurance, while the remainder is invested and builds a cash value.

But you can go live life with peace of mind, knowing that the family security plan® whole life insurance will help your family financially when you're gone.

It's all about choosing to provide tomorrow's protection today.

The policy can build cash.

Whole life insurance is a permanent life policy designed to last for the insured's lifetime.

Features include level premiums and guaranteed death benefits.

Discover how much it has to offer you and your family today!

Bmo whole life insurance offers permanent lifetime insurance protection while allowing you to accumulate wealth.

Plus your premiums don't increase.

Whole life insurance offers lifelong protection, but it is a bit more expensive—there's no such thing as cheap whole life insurance.

The policy accumulates cash value that you can borrow against for any reason.

Whole life insurance offers lifelong protection, but it is a bit more expensive—there's no such thing as cheap whole life insurance. Whole Life Insurance Meaning. The policy accumulates cash value that you can borrow against for any reason.Kuliner Legendaris Yang Mulai Langka Di DaerahnyaResep Segar Nikmat Bihun Tom YamResep Kreasi Potato Wedges Anti GagalResep Ponzu, Cocolan Ala Jepang3 Cara Pengawetan CabaiResep Garlic Bread Ala CeritaKuliner Ternyata Bayam Adalah Sahabat WanitaSejarah Kedelai Menjadi TahuSejarah Nasi Megono Jadi Nasi TentaraIni Beda Asinan Betawi & Asinan Bogor

Komentar

Posting Komentar